Down payment protection platform ValueInsured has closed a $6.5m funding round led by Everest Re Group affiliate and Houston International Insurance Group.

Texas-based ValueInsured is a down payment protection platform for homebuyers and giving them greater control and flexibility to sell property even when the market is low. The system is easily integrated with a mortgage and then will reimburse a homeowner their entire down payment if they sell when market goes down.

The company is attracting more lenders to offer the solution and is available across the US, with a network of retail loan officers, correspondent lenders and wholesalers.

This capital injection will be used to further its distribution partnership plans, expand its market presence and developing its current features.

ValueInsured CEO Joe Melendez said, “This added support will allow us to deliver down payment protection to more mortgage originators and, most importantly, more homebuyers, providing them peace of mind amid unpredictable, negative changes in the housing market.”

This new wave of capital brings the company’s total funding to around $12.5m, with the company initially receiving a $6m seed round in 2014.

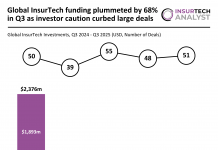

The North America InsurTech sector saw an increase in funding during Q2 2017, following a four-quarter decline, reaching $480m. The sector had dropped down from $572m deployed to $54m across this period.

Copyright © 2017 FinTech Global