From automated background checks to cryptocurrency banks, Y Combinator’s second demo day for its latest batch presented a dozen new enterprises to look out for.

Just like the seed accelerator’s first demo day, this one offered a plethora of startups that piqued our interest.

Business Score kicks off the list. This startup enables businesses to automate background checks on other enterprises by tapping into data sources from across the internet. Business Score’s solution empowers companies to quickly find out if the people signing up to use their service is who they say they are or work for the company they say they work for. In other words, it helps prevent fraud.

PayMongo is the second FinTech enterprise to look out for. It has set out to change the Philippines’ payment market. It creates tools enabling businesses to more easily collect payments. The FinTech startup also gives clients access to real-time data and insights to payments.

Multis is marketing itself as a cryptobank for companies. It offers its clients the ability to use cryptocurrencies to trade, transfer funds, earn interest on saving and set recurring payments.

Proof Trading is an institutional equities broker aiming to launch in 2020. The stated goal of the company is to disrupt and transform the “opaque and old-fashioned” finance industry, starting by giving institutional trading investor better prices.

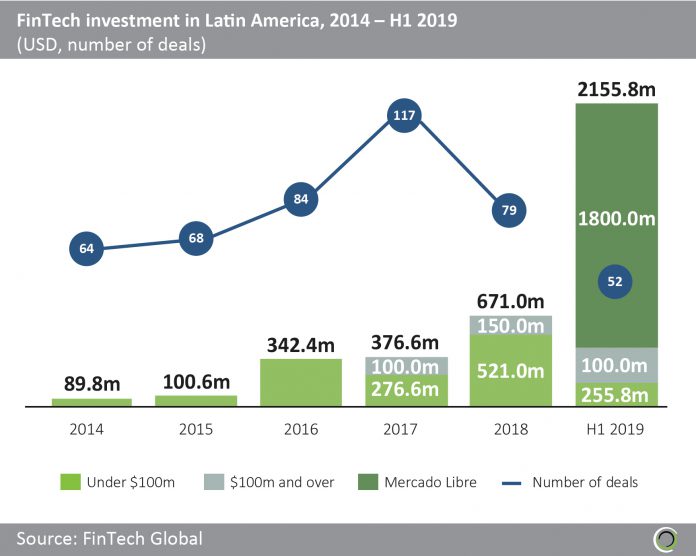

It is hardly surprising then that Y Combinator offered a smattering of startups trying to leverage the rising market. FinTech investments in Latin America has jumped massively over the past five years. FinTech Global’s own research reveals it has jumped from $89.8m in 2014 to $2.15bn in the first half of 2019 alone.

So let’s take a closer look at the FinTech companies coming out of Y Combinator.

First out of these ones we have the small loans provider Apurata. The founders claim banks in Latin America only approved nine per cent of loans whereas this solution approved roughly 26 per cent of loan seekers.

Mudafy is a PropTech startup trying to improve the process of buying and selling properties in the region. The company promises to deliver a faster, more efficient and professional service. This would include making appraisals, marketing and helping out from the beginning of the sales process to the very end.

A third Latin America-focused FinTech startup coming out of Y Combinator is Flux. It is an enterprise enabling merchants in the region to accept payments with mobile wallets without using intermediaries like Visa or MasterCard.

Covela is an InsurTech company coming out of Latin America. This online insurance broker for Latin American SMEs was founded in 2018 and is headquartered in Mexico City.

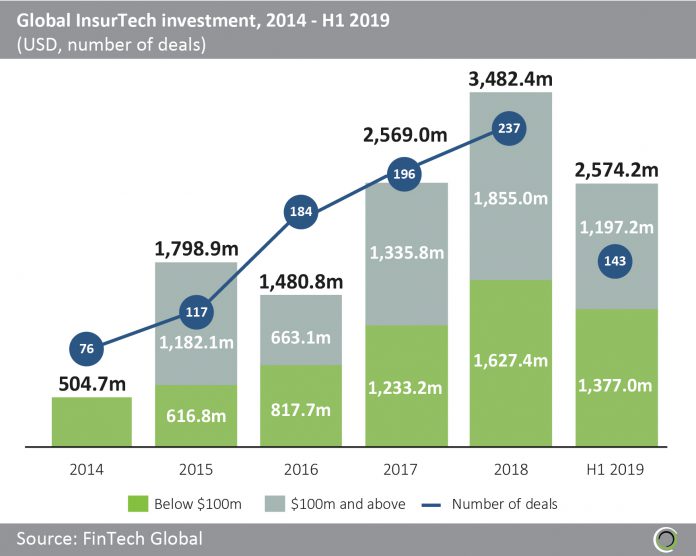

Speaking of InsurTech, the North American InsurTech sector is thriving. FinTech Global’s own research shows that over half of the investment in the sector have gone to North American companies since 2014. The investment in the sector has jumped over the past five years from $504.7m in 2014 to $3.48bn in 2018.

And it is set to rise. InsurTech funding reached $2.57bn in the first six months of 2019 alone.

Y Combinator’s latest bunch showcased two new entrants into this market. The mentioned Covela was one and the second was Vouch. This InsurTech business provides business insurance to startups. The enterprise claims to offer both fairer prices and risk management tools.

TradeID has set out to change the way people can trade with US blue-chip stocks in Indonesia. Just like GreenTiger, the Y Combinator-backed Indian startup from the first day of the seed accelerator’s demo days, TradeID enables traders commission-free abilities to trade.

Hutsy is another PropTech startup coming out of Y Combinator this year. This online real estate brokerage has set out to make buying houses easier through automation. through an online experience.

Beacons AI is a payment platform that lets influencers get even more cash out of their fans. It does this by making users pay to ask influencers questions. YouTubers, Instagram stars and the like can then answer these questions with a short video.

Copyright © 2019 FinTech Global