With unicorn alumni like Monzo, Improbable, Bulb and Bloom & Wild, Tech Nation’s Upscale accelerator programme has an impressive track record.

So it is hardly surprising that interest to join the British programme’s latest cohort has been at an all-time, with 131 companies applying for a spot in the Upscale 5.0 batch. Even more impressively, Tech Nation picked 30 startups out of the roughly 5,000 tech scaleups in the UK. The selected ventures include two FinTech, one RegTech and one PropTech startup.

“The UK has a fantastic track record of producing globally successful tech companies and this is another strong group of firms that will benefit from Tech Nation’s Upscale programme,” said Matt Warman, digital minister. “It highlights the strength and diversity of our digital economy with startups in FinTech, retail and recruitment. We are doing all we can to ensure the tech sector gets the support it needs to thrive.”

The startups picked have on average raised funds of £7.2m, have revenues of £1.8m, been active for four and a half years, consist of 63% first-time founders and have collectively raised £217m.

The Upscale programme gives the founders guidance in how to become better leaders and how to expand internationally. The programme’s goal is to establish a peer-to-peer network of companies on their scaleup journey.

“The network has a wealth of experience to share with the cohort, reflected in our judging panel and programme sessions,” said Mike Jackson, entrepreneur success director at Tech Nation. “I’m excited to welcome this year’s companies onto the programme which helps to tackle key challenges founders face, wherever they are based in the UK.”

So let’s take a closer look at the startups in the sectors that can boost the financial services industry.

London-based Plum is the first FinTech firm on the list. The company, launched in 2016, has developed solutions to help over 500,000 people in the UK grow their savings. Its AI assistant is set up to boost users’ bank balance and uses automation to save, switch bills and invest in a personalised way. It has integrated with challenger banks such as Monzo and Starling Bank in the past.

“We’re delighted to be selected for Tech Nation’s Upscale programme,” said Victor Trokoudes, co-founder and CEO at Plum. “At Plum, we’re harnessing technology and behavioural insights to help people across the UK boost their bank balance and improve their financial wellbeing. Together with the support of Tech Nation, we’re looking forward to developing this further in 2020 and bringing Plum to more people across Europe.”

2019 was a big year for the firm. Among other things, it announced in May that it had raised $4.5m after experiencing a 433% increase in its user numbers and then scored another $3m in November.

The second FinTech to join the Upscale 5.0 cohort is SeedLegals, a London-based startup set up to help make it easier for startups to raise money without having to rely on paper, law firms or accountants. Instead, SeedLegals has digitalised the process through its platform.

LandTech is the only PropTech company in the new Tech Nation accelerator batch. It is described as a startup with the goal to revamp how property development works. LandTech is set up up to make it easier to find land, get through planning and raise funding in a more streamlined and convenient way. With over 1,500 clients, of which 80% are SME property developers, LandTech boasts of having added an additional 10,000 homes to the UK housing market.

“After you’ve cleared the first hurdle by proving that there’s a market need for your product, scaleup life brings a host of new challenges,” said Jonny Britton, co-founder and CEO of LandTech. “Getting support and guidance through the next phase is key to staying ahead and maximising your potential. Being able to get this advice from some of the UK’s best companies is a fantastic opportunity.”

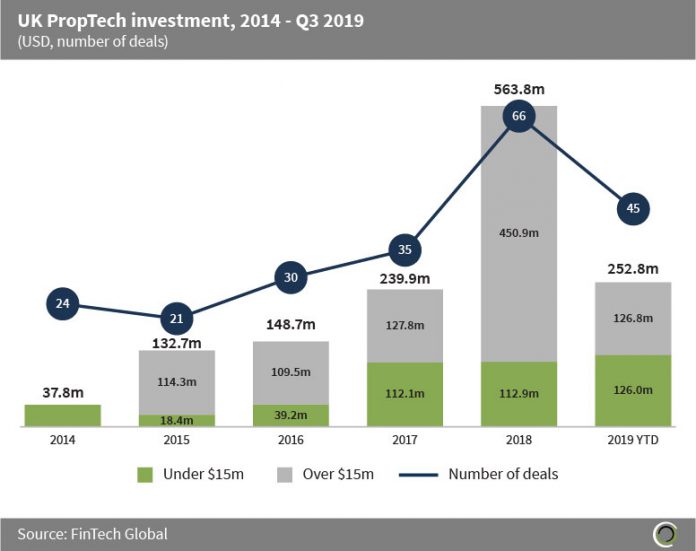

LandTech made the Upscale 5.0 list at an interesting time for UK PropTech. Between 2014 and 2018, annual investment in the industry jumped from $37.8m to $563.8m, according to FinTech Global’s research. Although, industry investment seemed to slow down a little in 2019. The sector had only attracted $252.8m in funding by the end of the third quarter last year.

The only startup operating in the RegTech space in the Upscale 5.0 cohort is ThoughtRiver, the Cambridge-based LegalTech company. The company helps businesses with their compliance issues with its technology that empowers business owners to screen contracts automatically. The program then automatically reviews the legal document, answers key legal questions and produces detailed advice and guided remediation within Microsoft Word.

The UK has been the official European FinTech leader for years. However, with Britain leaving the EU on Friday January 31, many have wondered what will happen after the UK’s exodus from the trading bloc, if it will be able to retain the crown. As the negotiations between the EU and the UK and what a trading deal between the two might look like is set to play out over the next year, the industry is set to deal with some uncertainty for some time still.

Copyright © 2020 FinTech Global