From bigger investment rounds to more insurers adopting the latest tech, many things are rapidly changing in the InsurTech space.

To better understand some of these challenges, FinTech Global caught up with Sabine VanderLinden, managing director of Startupbootcamp InsurTech, the accelerator, at the Global InsurTech Summit.

“I think one of the big challenges InsurTech startups face, like any startup, is actually to make enough money before [they] die,†VanderLinden said. “What you find is, there’s still a lot of new startups coming to the market. InsurTech represent approximately 6.5% of [the] overall FinTech startups out there. So there is around 57,000 startups out there, and InsurTechs are probably 3,500 [of those and] of those only 1,500 are invested startups.â€

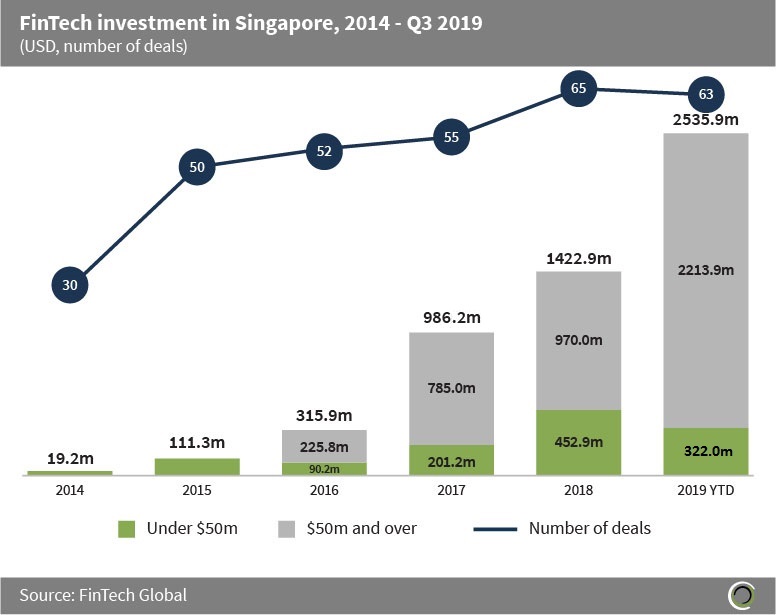

In short, while the industry raised over $5.96bn in 2019 alone, getting their hands on that money is far from easy for InsurTech founders. “What you find is [that] if you wait for insurers to work with you it can take a long time,†VanderLinden said. “So first is not burning enough money, too much money until you know they have actually proven their product fit and then finding the right clients which are able to work with them much faster than the others.â€

“[Accelerators] help them reduce the time [it takes] to go to market to months rather than years,†she said. “[They provide] a great platform to get started. The other part is to attend conferences like this one where they can actually start mingling with the industrym, start asking questions around covenants that needs to be so to validate their minimum viable products.â€

When asked about what the biggest trends in the industry were, she pointed out three things: catering to the underbanked, risk prevention and climate change.

Starting with the underbanked, VanderLinden had noticed that a lot of insurers have begun to see how they can begin to provide better services for SMEs, micro businesses, freelancers and gig workers. “8.6% of people do not have a bank account in Europe and those guys still need protection,†she said, adding that these underserved businesses and individuals could be better taken care of if insurers turn to tech startups in the industry.

“What we also see is that – and some of these [topics] have been mentioned during the conference – [is] protection and prevention, how [you can] combine protecting customers and preventing risk to happen and combining those two components with digital capabilities to develop completely frictionless and seamless experiences,†VanderLinden said.

The past few years have also seen increased focus on green initiatives. A few examples include the European Securities and Markets Authority releasing its strategy on sustainable finance, RegTech companies have launched solutions to help businesses stay sustainably compliant and FinTechs have developed technology to empower sustainable finance.

VanderLinden believed that this trend is also going to affect the InsurTech industry in the years to come. “I do think that insurers are also looking at climate change and sustainability issues right now,” she said. “And whilst we are not going to solve that overnight, I think the next five years we’ll see a lot of development and evolution in the way insurers address sustainability and enable their customer to be greener.”

Copyright © 2020 FinTech Global