Stripe’s whooping $600m Series G expansion wasn’t the only investment round completed by a FinTech company over the last week.

Despite coronavirus fears, FinTech companies around the world keep raising money. For proof, you need to look no further than Stripe’s massive $600m round from last week. The round is probably one of the biggest FinTech cash injection to ever been made.

Yet, it wasn’t the only good news for the FinTech industry over the past week. For instance, the last seven days proved fruitful for for several RegTech enterprises. For instance, FinTech Global reported that two biometrics-powered RegTech ventures Onfido and BioCatch both closed massive rounds exceeding $100m.

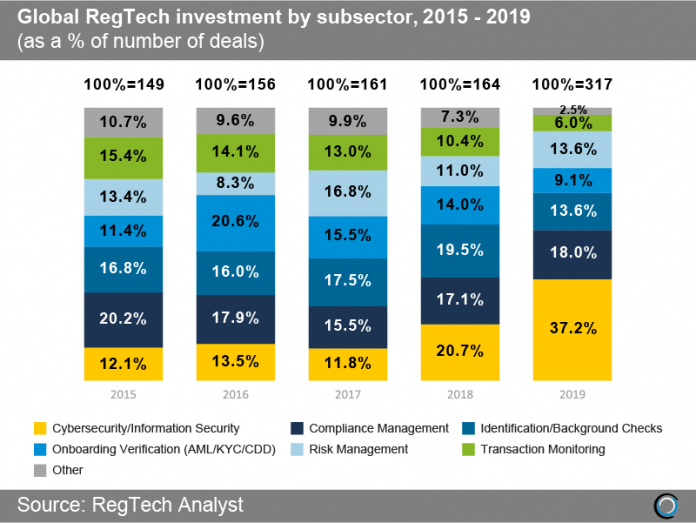

Speaking of RegTech, cybersecurity has been one of the strongest RegTech sectors in the world for years. In 2019 it represented 37.2% of the global investment going into the RegTech industry, according to RegTech Analyst’s research. And the good times seem to keep on rolling.

Last week saw several cybersecurity startups including Awake Security, SafeBreach and Beyond Identity strengthening their finances with new rounds, showing that the sector is still going strong.?

With this wealth of good news sweeping across the industry, why won’t we take a closer look at 23 rounds to make the headlines over the past seven days?

Stripe expanded its Series G round to add another $600m to its coffers

Let’s stat with the big one, shall we? Payments giant Stripe announced over the end of last week that it had extended its Series G round, raising an additional $600m. The new round was backed by Andreessen Horowitz, General Catalyst, GV, and Sequoia.

Stripe said it aimed to use the money to fund the continuous development of its platform, hire more staff around the world and to deepen its stack of software functionality to simplify online business.

Having announced its official launch in Mexico in October 2019, Stripe announced that it would use the new money to keep expanding across the world. Stripe revealed it was planning to launch in Bulgaria, Cyprus, the Czech Republic, Hungary, Malta and Romania.

?People who never dreamt of using the internet to see the doctor or buy groceries are now doing so out of necessity,said John Collison (pictured right), president and co-founder of Stripe. “And businesses that deferred moving online or had no reason to operate online have made the leap practically overnight. We believe now is not the time to pull back, but to invest even more heavily in Stripe platform.p>

Airwallex bulks up its financial muscles with $160m Series D round

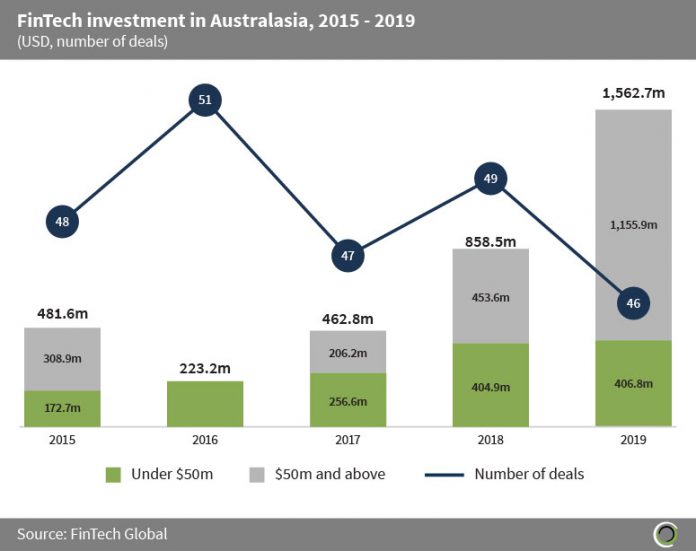

The Australian FinTech sector is on the rise. Over the past five years FinTech companies in Australasia have collected $3.6bn across 241 transactions, with Australian companies capturing 91.1% of the investment on the continent, according to FinTech Global’s research.

BioCatch closed a Series C round to the tune of $145m

BioCatch is the RegTech company behind a behavioural biometrics platform that?helps financial institutions protect their clients from fraud. The technology monitors behaviour of consumers on each of their online sessions, learning their specific habits. BioCatch now aims to broaden its product offerings on the back of the closure of a $145m in its Series C round led by growth investor Bain Capital Tech Opportunities.

Onfido filled its coffers with $100m in fresh capital

Biometrics specialist Onfido has netted $100m in a new round led by TPG Growth. The new money puts the total funding raised by the scaleup to $200m. It will use the money to invest in machine-learning technology, consolidate existing markets and keep up with demand in new areas. It is also looking to strengthen its grip of the US, European and Southeast Asian markets.

Taxfix netted $65m in a Series C round

Digital tax app developer Taxfix has collected $65m in its Series C round, which will help it increase its team by 100 people. Index Ventures led the round with participation from the firm partner Neil Rimer joining the Taxfix board of directors. Other contributions came from existing backers Valar Ventures, Creandum and Redalpine.

Digital defence venture Awake Security completed $36m round

Awake Security’s new Series C round has seen the cybersecurity scaleup strengthen its war chest with $36m in fresh capital. Evolution Equity Partners led the round. Energize Ventures and Liberty Global Ventures also participated. Existing investors Bain Capital Ventures and Greylock Partners also added funding.

Bugcrowd closed $30m Series D

Bugcrowd, a crowdsourced cybersecurity platform, has closed a $30m Series D round after it witnessed a 100% year-over-year growth in booking numbers. Rally Ventures served as the lead investor of the round, with additional contributions coming from unnamed new and existing backers. The round puts the company total equity raised to more than $80m.

Beyond Identity launched by Silicon Valley veterans after closing $30m Series A round

Silicon Valley veterans Jim Clark, who founded Netscape, and Tom Jermoluk, the founder of @Home Network, has launched Beyond Identity to deliver a password-free identity management service. To fuel the growth of the new venture, the entrepreneurs have raised $30m in a new Series A round co-led by Koch Disruptive Technologies and New Enterprise Associates.

KoinWorks collected $20m in new round

Indonesian lending platform KoinWorks has reportedly raised $20m in a funding round comprised of debt and equity. The round also included a debt line from Netherlands-based Triodos Bank, which will be used to underwrite loans, according to several reports in the media.

SafeBreach closed $19m in a new Series C round

The cybersecurity venture SafeBreach has made a name for itself through its a breach-and-attack simulation (BAS) platform. Now it aims to continue its successful streak after bagging $19m in its Series C. The round was led by OCV Partners, with contributions also coming from previous backers Sequoia Capital, Deutsche Telekom Capital Partners, DNX Ventures, Hewlett Packard Pathfinder and PayPal.

Parsyl has netted $15m in a Series A round

Supply chain data platform Parsyl has has collected $15m in a Series A funding round at the same time as it launched its new insurance product.

Crypto Finance AG raised a $14.4m Series B

The crypto asset technology developer?Crypto Finance AG has netted CHF 14m ($14.4m) in a Series B round. Swiss investor Rainer-Marc Frey and Asia-based private equity fund Lingfeng Capital co-led the round. Commitments also came from investors spanning Europe and Asia, including QBN Capital.

Push Technology closed ?10m Series A

Push Technology is a company behind a application programming interface (API) management solution. ON the back of its new ?10m Series A round, it is now planning to aggressively expand its sales and marketing efforts. Maven Capital Partners, the investor that has previously backed ventures like UK InsurTech startup honcho, led Push Technology new cash injection.

Railsbank bagged $10m in investment

Railsbank, an open banking and RegTech startup, has reportedly bagged a $10m investment from payments giant Visa. The FinTech has also received funds from Japan-based venture investor Global Brain, according to a number of reports in the media.

Sila secured $7.7m in seed funding

Sila, the banking and payments API platform, has strengthened its financial with a $7.7m seed funding round. It will use the money to fund the development of new products. Madrona Venture Group and Oregon Venture Fund co-led the raise. Additional support came from Mucker Capital, 99 Tartans, Transferwise co-founder Taavet Kinrikus and angel investor Jerry Neumann.

Savi Solutions PBC netted $6m Series A round

Savi Solutions PBC, a startup helping students improve their loan repayments, has reportedly collected $6m in its Series A round. Nyca Partners led the round. AlleyCorp, Temerity Capital and 9Yards Capital as well as a handful of angel investors also participated in the raise.

Credit Kudos closed ?5m Series A round

A number of angel investors joined AlbionVC TriplePoint, Plug & Play Ventures, Ascension Ventures’ Fair by Design fund and Entrepreneur First? to support Credit Kudos new ?5m Series A round.

Cadence Group closed $4m round

Cadence Group, a FinTech securitisation platform, has closed a $4m round in conjunction with the launch of a new Dutch auction for new investments.

Sprout.ai closed $2.5m seed round

InsurTech BlockClaim is no more. The venture has rebranded to Sprout.ai following the close of its second seed round. The investment, which closed on $2.5m, was led by Amadeus Capital Partners and also received support from Playfair Capital and Techstars.

Jupiter collected $2m in funding

The Indiab challenger bank Jupiter has reportedly secured $2m in funding as it prepares to launch its services in July. Hummingbird Ventures and Bedrock Capital reportedly led the round.

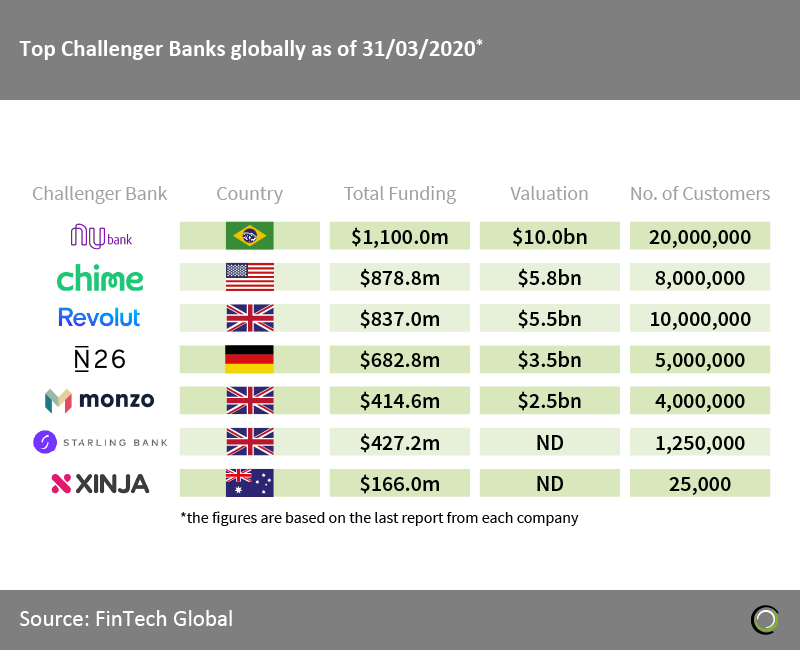

The news comes as challenger banks have proven to be the fastest growing segment of the WealthTech industry in recent years. For instance, Brazilian digital bank Nubank has raised $1.1bn in funding, more than any other neobank. It is currently the most valuable challenger bank in the world.

BlockFi, a cryptocurrency wealth management platform, has collected an investment from Three Arrows Capital, just months after it closed a Series B round.

Stamus Networks netted $1.5m in seed round

Stamus Networks, the cybersecurity startup, has closed a reportedly oversubscribed seed round on $1.5m. The capital injection was co-led by VisionTech Angels and Elevate Ventures. A number of unnamed angel investors also contributed to the round.

VibePay has closed a ?1.25m round

Having styled itself as a social payments app, VibePay has closed a ?1.25m funding round to support the launch of its new open banking-powered service. The company has now raised a total of ?6.36m in funding. But we can expect to hear more from the venture as the company is planning to raise a Series A later in the year.

Copyright ? 2020 FinTech Global