From Stash’s $113m round to Okra collecting $1m in new investment, the last week has seen a smattering of FinTech companies raise money.

Let’s take a closer look at some of the rounds, shall we.

Stash stashed $113m in cash through new funding round

Investing and banking platform Stash has collected $113m in its Series F funding round.

The round’s backers included LendingTree, funds and accounts advised by T. Rowe Price Associates, Breyer Capital, Goodwater Capital, Greenspring Associates, Union Square Ventures, Entree Capital and other investors.

Stash is planning on using the money to grow its customer base, brand awareness and boost its efforts in improving financial stability, it claims.

The FinTech venture’s service is set up to empower consumers with their personal finance by offering a single solution which combines investing, banking, advice and education.

The news came a year after Stash raised $65m in a funding round from backers including Union Square Ventures and Breyer Capital.

Cross River Bank netted $100m in new funding

Cross River Bank is set up to provide banking solutions to FinTech companies. It has now collected $100m of fresh capital in a new funding round in preparation of an initial public offering in 2021.

V Capital and Shefa Capital supplied the capital for the Series C.

Nexar switched it up a gear by raising $52m in new investment round

Nexar, the dash cam system provider, has secured $52m in a funding round alongside a new partnership with Japanese insurance firm Mitsui Sumitomo Insurance.

Corner Ventures led the round, with additional support coming from Samsung NEXT Ventures, La Maison, Micron Ventures, Sompo, Atreides Management. Former Nexar investors Aleph, Mosaic Ventures, Ibex Venture and Nationwide, also contributed.

The company will use the money to develop new data services and to expand globally.

Nexar’s vehicle dash cam leverages artificial intelligence to provide drivers with real-time road alerts and to warn about nearby hazards and incidents. It automatically detects and captures incidents and can easily be replayed from a mobile device.

Its platform is used by insurers to help improve the claims process, enabling a policyholder to easily send the footage.

Oriente is looking to expand into new markets following a $50m Series B round

Vietnam might be next up for Hong Kong-based Oriente after the FinTech collected $50m in a Series B to expand across more markets.

The lead investor was Dr. Peter Lee, the co-chairman of Hong Kong property developer Henderson Land. Cloud-based website development platform Wix.com also contributed to the round.

PhonePE collected $28m in new funding round

India-based digital payments company PhonePe has reportedly collected $28m in a new funding round from e-commerce giant Flipkart.

Templafy collected $28m in a Series C round

Document creation and automation platform Templafy has secured $25m in its Series C round. Private equity firm Insight Partners led the raise that also saw contribution from

Dawn Capital, Seed Capital and Damgaard Company.

The money will be used to support Templafy’s expansion and its merger and acquisition efforts.

Secret Double Octopus secured $15m Series B round

Passwordless authentication platform Secret Double Octopus $15m bagged in its Series B round last week.

Funding from the round came from Sony Financial Ventures, KDDI and Global Brain. Previous Secret Double Octopus backer Jerusalem Venture Partners also contributed to the round.

Taurus Group has netted an eight-digit Series A round

Taurus Group, which builds technology for digital assets, has closed a CHF eight-digit Series A round led by Arab Bank Switzerland, with additional commitments coming from Investis Group, Lombard Odier and Tezos Foundation.

The company was founded in 2018. It was set up to merge traditional assets and digital assets. Its technology helps investment banks, private banks, crypto-banks, commercial banks, exchanges and tech companies to access an end-to-end infrastructure to store and manage cryptocurrency and digital securities.

“We believe we have built one of the most powerful platforms in the world to do so, from issuance to custody to transfer, leveraging distributed ledger and smart contracts technologies,” said Sebastien Dessimoz, co-founder of Taurus Group. “We look forward to accelerating our innovation pipeline that will further open new business opportunities to our clients and partners in Switzerland and abroad.”

BlackRock Private Equity Partners puts more money into Cofense

BlackRock Private Equity Partners has injected additional capital into its portfolio company Cofense, an intelligent phishing defence developer.

The fresh burst of funds will help the company meet growth strategies, which include deepening research and development and global expansion.

Marknum Technology bagged $14m in a new Series B investment raise

Marknum Technology has made a name for itself by leveraging AI to protect businesses from online threats. It has now tapped into its investors’ pockets to add $14m to its war chest.

The China-based cybersecurity company’s Series B round was led by Aurora Private Equity and GSR Ventures.

Marknum Technology will reportedly use the money to enhance its AI technology and bolster its marketing efforts. Its platform can be used for data protection, virtual identity capture, remote management, face detection, anti-fraud, voiceprint comparison, identity authentication and more.

Qoala netted $13m in a Series A round

Indonesia-based InsurTech platform Qoala has secured $13.5m of fresh capital in a Series A round led by Centauri Fund, a joint vehicle from Kookmin Bank and Telkom Indonesia.

Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment and Mirae Asset Sekuritas also backed the round.

Previous Qoala backers MassMutual Ventures Southeast Asia, MDI Ventures, SeedPlus and Central Capital Ventura also contributed to the round.

Ontic raised $12m in a Series A round

Ontic, a software developer of security solutions, has netted $12m in its Series A funding round. Felicis Ventures led the round, which also enjoyed participation from previous Ontic backers Silverton Partners, Floodgate and Village Global.

With the funds, the cybersecurity company plans to expand its footprint across enterprise businesses and family offices while accelerating product development. It will also look to expand sales and enter new markets.

Helicap bagged $10m in a Series A round

Alternative lending platform Helicap has reportedly raised $10m in Series A round to fund the improvements of its credit scoring technology. Saison Capital led the round, which also saw participation of previous Helicap backers including East Ventures and Access Ventures.

Paytronix Systems secured $10m

Customer experience management company Paytronix Systems netted $10m last week to ensure is on sound financial footing through the COVID-19 crisis.

Private equity firm Great Hill Partners and Paytronix Systems’ co-founders led the investment, which is aimed at enabling Paytronix Systems to provide its restaurant, convenience-store, grocery and retail clients with the communications tools necessary during the coronavirus pandemic.

TransFICC has secured £5.75m in a Series A round

E-trading tech company TransFICC has announced the close of a £5.75m Series A round which led by AlbionVC. ING Ventures, HSBC, Citi, Illuminate Financial, Main Incubator (the R&D unit of Commerzbank Group) and The FinLab also participated in the round. TransFICC will use the money to extend the product and market coverage of its platform.

Wise scored $5.7m in seed funding round

Banking an payments platform Wise has netted $5.7m in a seed funding round led by Base10 Partners principal Rexhi Dollaku.

Abstract Ventures, Backend Capital, The Fund and Two Culture Capital as well as several angel backers also participated in the round.

Wise will use the money to create new tools.

“We are excited to embed our banking functionality directly into digital platforms or ecosystems that create or service businesses, like Shopify,” said Arjun Thyagarajan, co-founder and CEO of Wise.

Tinvio bagged $5.5m

Merchant and supplier-connecting platform Tinvio is said to have bagged $5.5m in a seed funding round.

The equity was supplied by Sequoia Capital India’s accelerator platform Surge. Additionally contributions to the round came from Global Founders Capital and Partech Capital.

Cryptocurrency startup skew. has raised $5m in new round

London-based FinTech startup skew. has set out to create the gateway to a cryptocurrency markets. Last week it raised $5m to make its ambitions a reality.

Octopus Ventures, a London-based £1.2bn venture fund, led the round, which also saw participation from Digital Currency Group, Firstminute Capital and Seedcamp.

The startup will use the money to grow its engineering team and its distribution capabilities.

Resistant AI has netted $2.75m in a seed round

Automated anti-fraud platform Resistant AI has secured $2.75m in a seed round to bolster its product development efforts.

The investment was co-led by Index Ventures and Credo Ventures, with additional contributions coming from UiPath CEO Daniel Dines, Avast CTO Michal Pechoucek and other angel backers.

Benepass closed $2.2m seed round

Benefit card provider Benepass has closed a $2.2m seed round backed by Y Combinator, Gradient Ventures and Elysium Venture Capital.

Nira netted $2.1m in pre-Series A round

India-based online credit platform Nira has reportedly secured $2.1m in a pre-Series A round. The capital injection was supplied by several existing and new angel investors from the UK, India and a number of European countries. Nira is planning to use the money to make more hires, increase development of its platform and scale its lending services.

CyberOwl raised £1.8m

Cybersecurity platform CyberOwl has reportedly raised £1.8m in a funding round as it looks to move into the maritime industry 24 Haymarket and Merica Asset Management supported the raise.

Okra collected $1m in pre-seed funding.

Open banking solutions provider Okra has raised $1m in a pre-seed round to fund expansion into new markets. TLcom Capital, an investor focused on technology companies in Sub Saharan Africa, supplied the capital to the round.

The Nigeria-based company is creating a secure portal and process for the exchanging of information between customers, applications and banks.

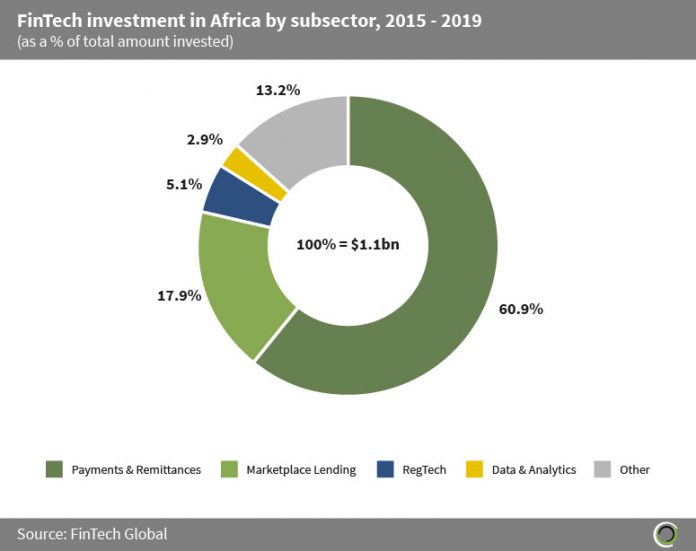

The raise is also a testament to the growth seen in African FinTech over the past few years. Between 2015 and 2019, Africa-based FinTech companies raised more than $1.1bn across 122 transactions, according to data from FinTech Global. The payments and remittances subsector received the most attention, with it being responsible for 60.9% of the funding.

Flueid Software Corporation

Flueid Software Corporation, which automates services within title insurance, real estate and mortgage lending, has received a strategic investment from Aquiline Technology Growth. The amount raised in the round was not disclosed.

Copyright © 2020 FinTech Global