Amidst the coronavirus crisis, many FinTech companies have still been able to raise big rounds. Here are 35 of the successful investment stories that we paid special attention to in the past week.

There’s no question that the coronavirus has caused major upheaval in the FinTech sector, with UK companies alone being projected to lose out on £1.4bn of fresh capital because of the pandemic.

Of course, a lot of FinTech ventures are making their utmost to help struggling companies navigate these chaotic times. For instance, British challenger banks have stepped up to bat in a big way with Revolut opening up its charity services to support the medical fight against COVID-19 and Starling Bank having lent over £258m to SMEs through the government’s Bounce Back Loan scheme in the past week alone.

Moreover, as FinTech Global reported last week, the crisis could provide several opportunities for flexible FinTech firms that can adjust to the new environment. The market is definitely set to transform considerably with the coronavirus having already changed how people work and exposed limitations in current cybersecurity infrastructures and legacy systems.

Indeed, while many of the 35 rounds reported in the past week have undoubtedly been in the works for some time, it’s hardly surprising to see six cybersecurity startups among the ventures who successfully raised fresh capital in the last week, given COVID-19 has emboldened bad actors to launch new fraud and hack attacks across the globe.

However, to do reap the benefits of the crisis, FinTech companies must be able to ride out the storm, which won’t be easy with several reports suggesting that funding will be hard to get by with investors being more reluctant to back new risky startups.

With that in mind, let’s take a look at the companies that caught our eye over the past seven days through their funding rounds.

Homeward has taken home $105m in new investment

This week’s biggest round has undoubtedly been collected by Homeward, which managed to bolster its accounts with a $105m funding round. The PropTech’s new capital injection was a mixture of $85m in debt financing and $20m in equity.

Adams Street Partners, Javelin Venture Partners and LiveOak Venture Partners supported the equity raise. Homeward plans to use the money to purchase more homes for its customers and to expand its agent partnerships.

The investment came less than a year after Homeward raised $25m in a round in July 2019.

Ant Financial has injected $73.5m into Wave Money

Digital remittance service Wave Money has formed a strategic partnership with Ant Financial Services, which includes a $73.5m investment.

With the support of Ant Financial, Wave Pay will be able to deepen its technological capabilities and boost the access of mobile financial services in Myanmar.

The deal will see Ant Financial become a minority stakeholder in Wave Money.

Expel has secured $50m in a Series D round

Expel, a security operations centre service, has seen its treasure trove grow by $50m at the closure of its new Series D round, as it looks to expand internationally.

Capital from the round will be used to grow its sales and marketing operations, increase investment into its cloud security offering and seek international growth opportunities.

The capital injection was led by CapitalG, the growth investment fund of Alphabet. Additional commitments came from Battery Ventures, Greycroft, Index Ventures, Paladin Capital Group and Scale Venture Partners.

Anyfin netted $30m in Series B round

Swedish FinTech platform Anyfin has reportedly secured $30m in a Series B round. EQT Ventures led the round that also saw support from previous Anyfin backers Accel, Northzone and Rocket Internet’s Global Founders Capital (GFC).

With the close of the round, Anyfin is hoping to deepen its product development, release additional services and move into new markets.

Semperis netted $40m Series B round

Cybersecurity solution provider Semperis has closed its Series B round on $40m. Private equity firm Insight Partners led the round with additional support coming from unnamed previous backers.

Featurespace expands its financial crime fighting efforts on the back of new £30m fund

Cambridge-based Featurespace has bagged £30m to expand its offerings, which include providing adaptive behavioural analytics software for enterprise financial crime prevention. This offering has arguably become particularly important in the days of the coronavirus when bad actors have launched cyber attacks, infected companies with ransomware and instigated other forms of fraud. The international Financial Action Task Force (FATF) is just one of the many organisations to have warned about the growing threat in recent months.

“During these challenging times, our machine learning models have automatically adapted to the shift in consumer, business and criminal behaviour,” said Martina King, CEO of Featurespace. “It is our continued focus to deliver industry-leading, fraud and anti-money laundering solutions to our customers and partners.”

Verteva has raised $21m in new investment

Australia-based lending platform Verteva has reportedly collected roughly $21m in a Series A investment. The capital injection was supplied by Bolton Equities and has emboldened Verteva to exit stealth mode. With the support of the fresh funding, the FinTech will look to boost market entry, product development and business expansion.

Validus netted $20m in Series B+ round co-led by Vertex Growth fund and Orion Fund

In another testament to Singapore’s position as an emerging FinTech hotbed, Validus has successfully closed a $20m Series B+ round.

The new capital injection has seen the Southeast Asian venture add $20m to its coffers, bringing the total raised by Validus to $40m. It announced a $15.2m in 2019 and picked up $2.9m in 2017.

Vertex Growth fund and Kuok Group’s Orion Fund co-led the round that also saw participation from previous investors FMO, the international development bank of the Netherlands; Vertex Ventures Southeast Asia and India; Openspace Ventures; AddVentures; and VinaCapital Ventures.

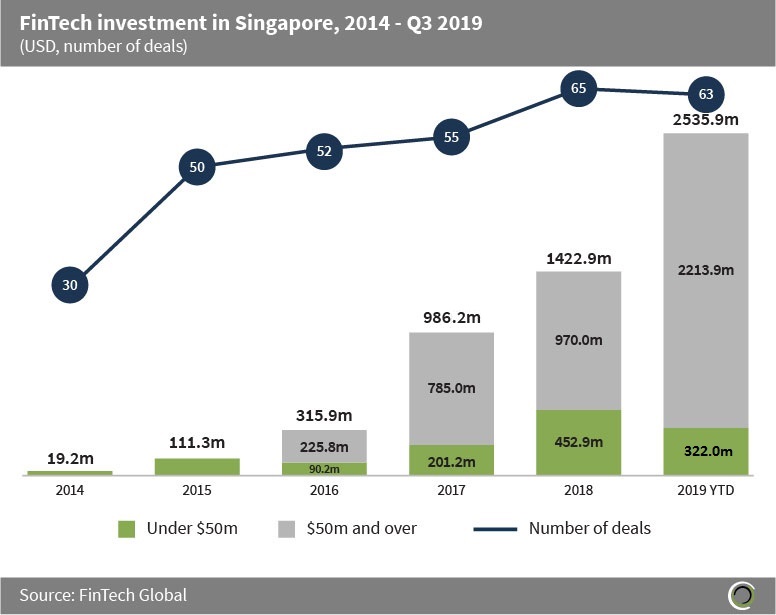

The news comes on the back of research published by FinTech Global in November 2019 that revealed that FinTech companies had successfully raised more capital in the years gone by. Back in 2014, FinTech companies in the country only attracted $19.2m in investment. Fast-forward to 2018 when that figure had jumped to $1.42bn. That record was thoroughly beaten in 2019 when the industry raised $2.53bn in the first three quarters alone.

ANNA has raised £17.5m

ANNA, a small business banking account provider, has closed a funding round on £17.5m.

The investment came from Luxembourg-based multinational banking group ABH Holdings, which has picked up a majority stake within the FinTech.

Following the close of the investment, the FinTech is planning on releasing new products to support small businesses.

Liongard pounces on opportunity to bolster its team after $17m round

FinTech Liongard has picked up $17m in a new investment round led by Updata Partners to strengthen its team and the development of its services. Other investors included TDF Ventures, Intergr8d Capital and number of private investors.

Over the past three years, Liongard has attracted a total of $23m in investment, including this latest Series B round. That’s definitely something you can’t fault Liongard for feeling a sense of pride about.

Deep Labs netted $16m in new round

Mastercard partner Deep Labs has bagged $16m to boost the development of its transaction authentication and authorisation technology.

Gunnar Overstrom, partner at Corsair Capital, Serendipity Capital and Gramercy Ventures, led the raise, which will see him and Robert Jesudason, founding partner of Serendipity Capital, join the board of directors.

“We are pleased to welcome such a high-calibre group of investors as we expand Deep Labs, add new customers and partners around the world, and continue to hire the best and brightest engineers and professionals,” said Chris Edington, CEO and founder of Deep Labs. “Our new investors have a true understanding of our business, our goals and our long-term strategy, and we look forward to benefiting from their unique expertise and experience.”

Vise has scored $14.5m in its Series A round

AI-backed investment management platform Vise is looking to double down on its development efforts after collecting $14.5m in its Series A round. Sequoia Capital led the round that also saw support by Founders Fund, Bling Capital, Human Capital, Lachy Groom, YouTube co-founder Steve Chen and FutureAdvisor co-founder Jon Xu.

Clyde’s looking to grow on the back of $14m investment

Clyde, which offers extended warranties and accident protection, has secured $14m in its Series A round to support its growth in the market.

The equity injection was led by Spark Capital, with participation also coming from Crosslink, RRE, Red Sea Ventures, Abstract Ventures, Starting Line Capital, Correlation Ventures, Jackson Gates, Brian Sugar and more.

Briq reportedly nets $10m in its Series A led by Blackhorn

Briq, which offers financial forecasting for the construction industry, has reportedly netted $10m in a Series A round. The capital was led by Blackhorn Ventures and also saw additional backing from Eniac Ventures, MetaProp NYC, and Darling Ventures. Following the close of the round, the FinTech is looking to build on its success by expanding its platform.

Ermetic closed $10m funding round

Cloud access risk security company Ermetic has emerged from stealth mode in conjunction with the close of a $10m funding round. Glilot Capital Partners, Norwest Venture Partners and Target Global all supported the raise.

As it revealed itself to the world, Ermetic also presented its analytics-based solution, which is set up to prevent cloud data breached by automating the detection and remediation of identity and access risks within infrastructure as a service (IaaS) and platform as a service (PaaS) offerings from Amazon, Google and Microsoft.

The platform automatically discovers all human and machine identities in the cloud and analyses their entitlements, roles and policies through a continuous lifecycle approach, it claims.

LoanSnap collected $10m in new raise

Smart loan provider LoanSnap has raised $10m in new funding round co-led by True Ventures and MANTIS. True Ventures has previously backed businesses like Peloton, Blue Bottle and Fitbit. MANTIS is the tech investment firm created by the Grammy Award–winning band, The Chainsmokers.

Stilt has collected $7.5m in new round

Stilt, which helps immigrants and underserved consumers access loans, has reportedly collected $7.5m for its seed round. The equity infusion was reportedly supplied by Hillsven Capital and Streamlined Ventures.

Smarterly has collected £7m in a new funding round

WealthTech company Smarterly has bagged £7m in a new funding round to strengthen the development of its platform. The platform is developed to enable people to save and invest directly through payroll. Major Oak, the family office, led the Series A round and invested £5m. The other £2m was injected into Smarterly from existing angel and crowdfunding investors.

Freetrade has so far raised £6.45m in a crowdfunding campaign

Freetrade has crushed its £1m target in a new crowdfunding round for 4.41% of equity at a £140m pre-money valuation. So far over 5,200 people has filled the company’s coffers with £6.45m.

Limepay has avoided feeling the squeeze with new $6m capital injection

Limepay, which provides buy now, pay later technology, has closed its funding round on $6m. The capital injection was supplied by a series of private investors including Accor Asia Pacific regional chief Michael Issenberg, Telstra group executive Michael Ebeid and others.

Envelop Risk collected $6m

Envelop Risk has raised $6m and plans to use the money to grow its cyber and speciality (re)insurance business propelled by proprietary machine-learning and data-driven underwriting.

Hub Security raised a $5m Series A round

The Tel Aviv-based Hub Security has collected $5m in an new funding round led by AXA Venture Partners. The investment also saw participation from Jerusalem-based OurCrowd.

Hub Security will use cash from its Series A round to strengthen its team, expand its technology and offer enhanced products to FinTech companies. Particularly, it will focus on enabling access to credit, corporate banking solutions, cross-border payments and providing ultra-secure banking solutions.

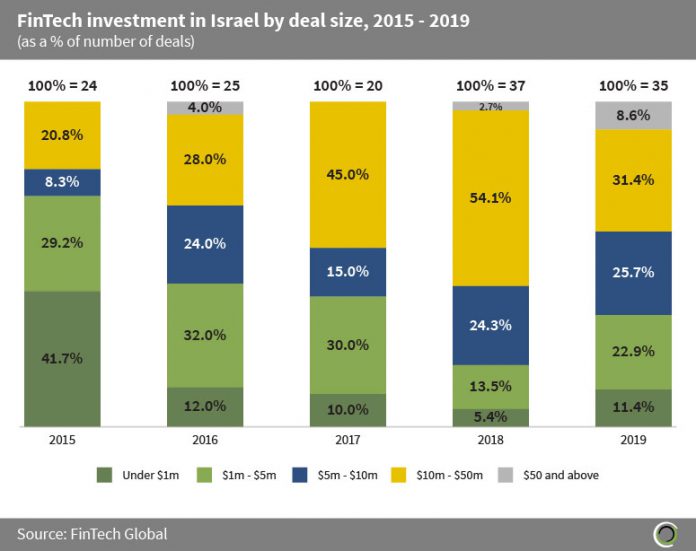

The round is another testament to Israel’s reputation for nurturing cybersecurity startups. Overall, Israeli FinTech companies raised more than $1.7bn across 142 transactions between 2015 and 2019, according to FinTech Global’s research. The same period saw the money raked in from backers jump from $118m in 2015 to $555.5m in 2019. The growth in the Isreali FinTech ecosystem is most noticeable in the increased share of deals valued at $5m and higher which jumped by 36.6pp between 2015 and 2019.

Primer bagged £3.2m in seed round

Payment stack consolidation startup Primer has netted £3.2m in a seed round led by Balderton Capital, the investor behind companies like GoCardless, Revolut and Darktrace.

Startup omocom has collected €3.7m in new round

Swedish InsurTech startup omocom has netted €3.7m in funding to help it grow into new verticals outside of the Nordics.

The investment was co-led by Mustard Seed MAZE and Inventure, with additional support coming from Alma Mundi Insurtech Fund and Luminar.

Cryptocurrency company Lolli has raised $3m in its seed round

Lolli, which offers Bitcoin rewards for online shopping, has collected $3m in its oversubscribed Seed funding round. The round was led by Pathfinder, the early-stage investment vehicle of Founders Fund. Other contributions to the round came from beauty entrepreneur Michelle Phan, Sound Ventures, Craft Ventures, Company Ventures, Adam Leber and Chapter One Ventures.

Minka collected $3m

Latin American FinTech Minka has enjoyed a $3m capital boost in a seed round led by The FinTech Collective. The news about the round comes after the region has enjoyed considerable growth in recent years.

Fenris bagged new capital

Fenris has collected new money from the Center for Innovative Technology (CIT). The InsurTech company enables insurers to streamline and modernise the process of quoting insurance products. Having already expanded its sales operations and enhanced its data delivery and analytics platform, Fenris will use the money to deepen its product suite to meet demand from clients.

BlackCloak collected $1.8m in new round

Cybersecurity company BlackCloak has filled its war chest with $1.8m in an investment from cybersecurity startup-focused investor DataTribe. BlackCloak is set up to offer a cybersecurity and privacy protection platform. As part of the deal, DataTribe will provide BlackCloak with various resources and help protect high-profile individuals and their companies.

Clim8 Invest bagged £1.35m in crowdfunding campaign

Clim8 Invest, which enables consumers to back companies having a positive impact on climate change, has stormed past its initial crowdfunding target, to raise £1.35m.

The pre-launch crowdfunding campaign was backed by 1,200 investors and closed on more than 300% higher than the initial target.

Doorr has closed a $1.26m seed round

Canada-based PropTech startup Doorr has raised $1.26m in a new seed round co-led by Celtic House Venture Partners and MaRS Investment Accelerator Fund. The company will use the cash to pay for the development of its mortgage platform for brokers and financial institutions, focusing particularly on boosting deal velocity, accuracy, compliance and the user experience.

Vennifi filled coffers with $1.1m round

Vennfi, a solution supporting tax-exempt payments, has bagged $1.1m in its funding round to help it build new capabilities.

Figopara bagged $1m in new funding round

SME finance platform Figopara has reportedly raised $1m in its second funding round. World Bank’s International Finance Corporation (IFC) and Revo Capital as well as several angel investors contributed to the raise. Figopara is set up to enable businesses to get loans for their invoices.

Home Lending gets more money

AI mortgage advisor Home Lending is one of the six startups to share $300,000 in funding from NC IDEA, a private foundation supporting North Carolinian companies.

Nium has raised a new round

Nium, which helps businesses send, spend and receive money across borders, has secured an investment to support international expansion. The capital injection was supplied by previous Nium backer Visa, and new investor BRI Ventures, the corporate venture arm of Bank BRI of Indonesia.

White Ops adds more money to its coffers

White Ops, a developer of bot mitigation and fraud protection technology, has collected an investment from Goldman Sachs Merchant Banking Division and ClearSky Security.

The funds will support White Ops next phase of growth which includes global expansion. Capital will also be used to support product development and move into new verticals.

Copyright © 2020 FinTech Global