Insurello has secured $8.04m in a new investment round led by Inventure and Schibsted with the participation of existing investor Luminar Ventures.

Swedish FinTech is going from strength to strength, being the key engine behind the sector’s growth in the Nordics. In 2019, the nation accounted for 54.4% of the total investment going into the region’s FinTech industry.

Now, Insurello has given the momentum a boost by securing $8.04m in a new funding round. The round was co-led by Inventure and Schibsted and saw Luminar Ventures return to inject more capital into the startup.

Insurello was founded in 2016 with the aim to help consumers get the right payouts from insurers. Since the launch, it has helped out in more than 85,000 cases, grown its staff to over 70 employees and paid out over $8.04m in compensation to customers. Now, Marcus Janback, founder and CEO of Insurello, plans to use the new money to take the company to another level and is eyeing further expansion into the rest of Europe.

“There has been a massive interest in Insurello and we now have the perfect opportunity to gear up and expand to new markets,” he said. “We will also continue to automate our product and to simplify it for the consumers. Our goal is to scale up and claim fair compensation for our customers, no matter who you are or what background you might have.”

The investors was impressed by the startup’s ability to grow despite Covid-19. “Insurello is one of the few startups that keeps growing even during uncertain times,” said Linus Dahg, partner at Inventure. “We are now investing not only in a product that solves a major problem for consumers but also in a great team that has all the right qualities required for an expansion to new European markets. We genuinely believe in Insurello’s mission and want to be a part of the success going forward.”

The investment comes as roughly 600,000 people across Sweden are wounded in some way but rarely get the compensation they deserve, according to Insurello. This, the startup claimed, is because most cases are complex to iron out and covered by insurance policies the investor is rarely aware off.

This was one of the reasons why Schibsted decided to invest in the company. “Insurello strengthens people’s ability to get help in an often vulnerable situation,” said Dan Ouchterlony, investment manager at Schibsted. “With clear synergies with Schibsted’s ecosystem, our investment will be able to help more people at the same time as it will boost the company going forward.”

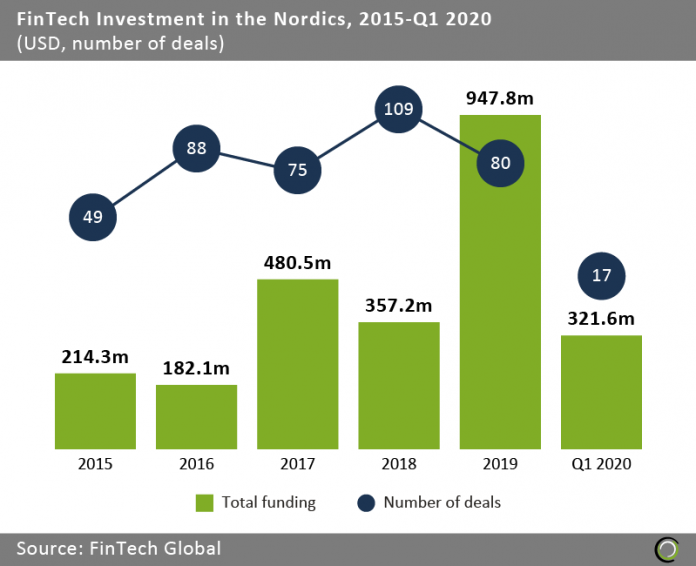

Investment into the Nordic FinTech sector has skyrocketed over the past five years. Back in 2015, the region’s FinTech companies raised a total of $214.3m, according to FinTech Global’s research. That number jumped to $947.8m in 2019. The first quarter of the 2020 also looked promising, with $321.6m being invested into the region’s companies. That being said, it is still too early to tell how the coronavirus will affect investment into the region going forward.

Luminar has previously invested in InsurTech company omocom and helped back Swedish Open Payments’s €1.2m seed round back in May 2019.

Copyright © 2020 FinTech Global