Concirrus, an insurance software developer, has raised $6m in funding, coming hot off the heels of its $20m Series B.

The fresh capital injection was supplied by FinTech-focused venture capital firm CommerzVentures.

Royal Park Partners served as the exclusive financial advisors to Concirrus for the deal.

This investment comes just months after Concirrus close a $20m Series B, which was led by AlbionVC and supported by IQ Capital, Eos Venture Partners and angel investors. The round, which closed in February, was raised to support the InsurTech with its global expansion and product diversification.

It is not clear what the specific purposes of the capital raised from CommerzVentures will be put towards.

Concirrus claims that having added a number of new customers to its platform in the last quarter, it is continuing to grow despite the tough nature of the current market.

CommerzVentures partner Heiko Schwender said, “Our passion lies in helping fintech and insurtech companies to succeed. We believe Concirrus has the best solution to manage risk in the marine insurance industry. Ultimately, it will serve insurance carriers in a variety of supply chain industries. The team combines deep industry experience and technology expertise. We believe that Concirrus is on a very exciting growth journey and we’re very much looking forward to being part of it.”

The InsurTech platform leverages AI and machine learning technology to provide the marine and auto insurance industry with behavioural-based underwriting. The Quest solution offers differentiated pricing, portfolio management and predictive analytics.

Concirrus CEO Andrew Yeoman said, “We are really excited to have CommerzVentures join the business. The last few months have been really busy for Concirrus as we’ve continued to sign new customers during what are clearly unprecedented times. This investment is a clear vote of confidence in our vision and the value that we’re bringing to the insurance market.”

Earlier in the year, Concirrus signed a new multi-year deal with Hiscox London Market to help the insurer improve its analytics-based underwriting for marine insurance.

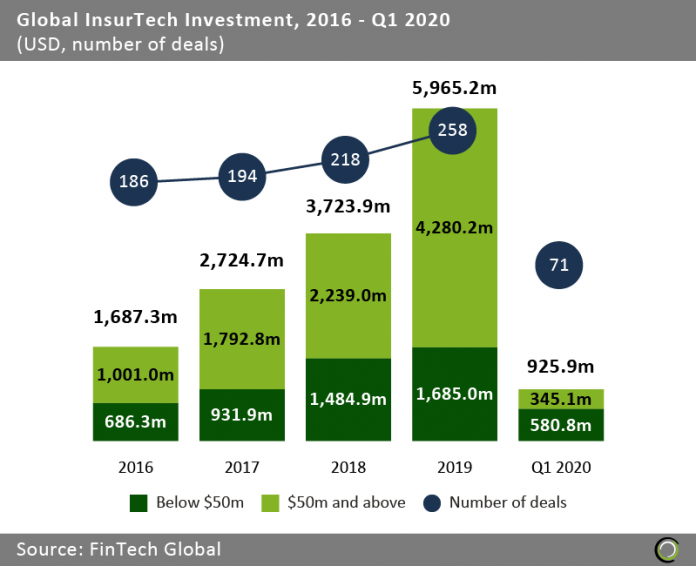

The global InsurTech sector has witnessed a total of $14.8bn in investment capital deployed since 2015, FinTech Global data shows. A new record was reached last year, when $5.9bn was invested through 258 deals.

While the coronavirus is putting uncertainty on the financial market, InsurTech startups still managed to raise a combined total of $925m in the first quarter.