Our weekly roundup of the big FinTech trends from the past seven days is all you need to keep yourself updated on what’s happening in the industry.

The past week has given FinTech, InsurTech, challenger bank, cybersecurity and cryptocurrency aficionados reason to perk up their ears.

Frequent readers of these hallow pages are undoubtedly familiar with the many ways FinTech startups have changed banking. But while the ubiquity of digital banking may suggest there is little room for budding entrepreneurs to make a splash in the sector, a new Italian project has demonstrated that there’s still ample room for a few new players to squeeze in.

The Banca Idea Project bagged the biggest round in the FinTech scene that we reported on in the last week. The Italian project is a testament to the strength of the digital banking sector.

The round comes on the back of several other neobanks having enjoyed fresh capital injections in recent months. For instance, Revolut, Monzo, Starling Bank and Chime all raised rounds in the first half of 2020 and Penta bagged €4m ($4.53m) just this last week, adding to the €18.5m ($20.94m) Series B round it raised back in March.

That being said, the global pandemic has clearly affected the neobank sector too. For instance, Monzo had to downgrade its valuation by 40% in its recent round, seeing it drop from $2bn to $1.24bn. The challenger bank has seemingly struggled because of the coronavirus. In June FinTech Global reported that it had to fire 120 members of its staff following the closure of its Las Vegas office and 165-strong team positioned there.

Of course, Monzo is not the only digital bank to have been forced to roll back some of its expansion plans because of Covid-19. Revolut has also made several members of its workforce redundant in recent months. The challenger bank subsequently faced allegations that it had coerced employees in Poland and Portugal to leave the company in ways failing to live up to the employment laws in the country. Revolut denied any wrongdoing.

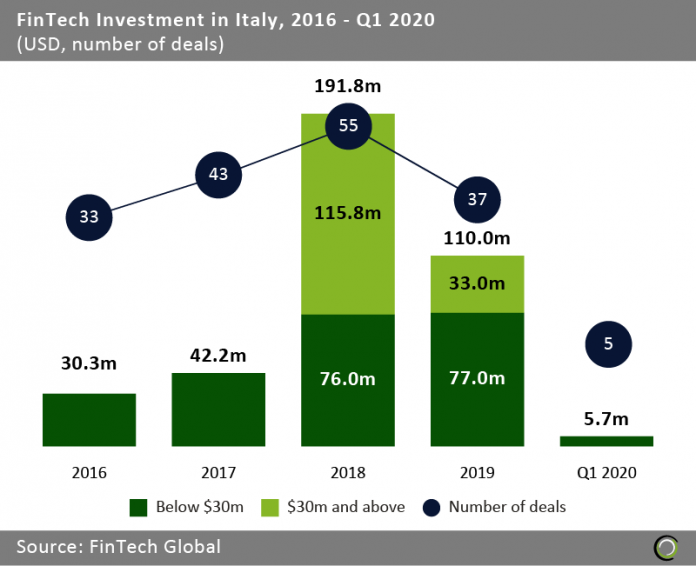

The Banca Idea Project could also be a good sign for the Italian FinTech landscape as a whole. The nation has suffered particularly from the pandemic. This was evident in the investment rounds raised by the FinTech industry at the beginning of the year. The country recorded only five deals in the first three months of 2020, according to FinTech Global’s research.

To make matters worse, the collapse of the capital stream into Italy came after investment slowed significantly in 2019 compared to the previous three years. Between 2016 and 2018 Italian companies raised $264.3m across 131 deals. However, the sector experienced a pullback last year when funding declined by 42.6% to $110m from the record high of $191.8 reached in 2018.

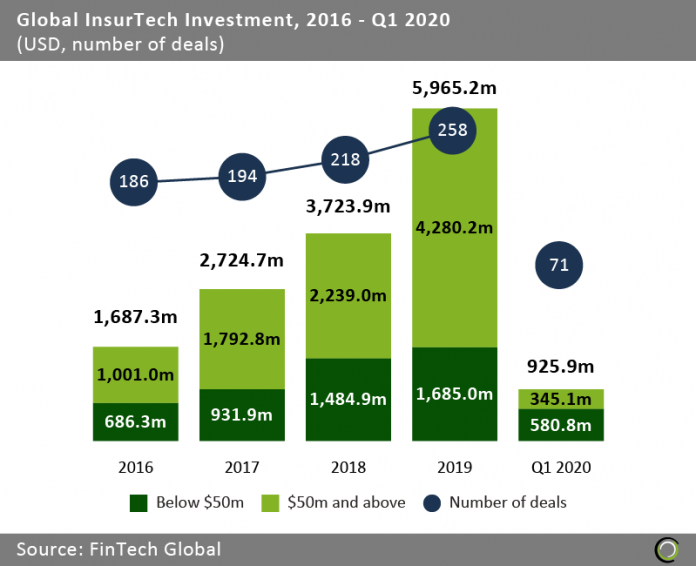

These rounds and Lemonade’s IPO could arguably demonstrate that there might be something to the notion that Covid-19 could ignite insurers’ desire to swap their legacy systems for new technological ones. In other words, while many InsurTech companies may struggle as a result of the pandemic, the industry as a whole could benefit from the coronavirus.

The InsurTech sector has grown tremendously in the past five years. Total funding grew at a compound annual growth rate of 52.3% from $1.7bn to nearly $6bn between 2016 and 2019, according to FinTech Global’s research. The sector seemed to be maturing further at the beginning of this year. InsurTech companies around the world bagged $925.9m in funding across 71 deals in the first three months of 2020. The funding raised in deals under $50m showed increased promise and was at 34.4% of the record levels reached in 2019.

Facebook has also recruited 50 people to its Dublin office to reportedly work on its digital wallet initative to process Libra payments. In May, the social media platform announced that it had renamed the wallet to Novi, having previously called it Calibra.

It is against this background that cryptocurrency compliance startup Chainalysis added another $13m to its Series B round last week. The company had previously top up its Series B round in April 2019 with a $6m after originally raising $30m in February that year.

It is the second cryptocurrency company funding round of note in the past two weeks, with Starling Bank founder Mark Hipperson’s new venture Ziglu baggin £5.25m in seed capital in late June.

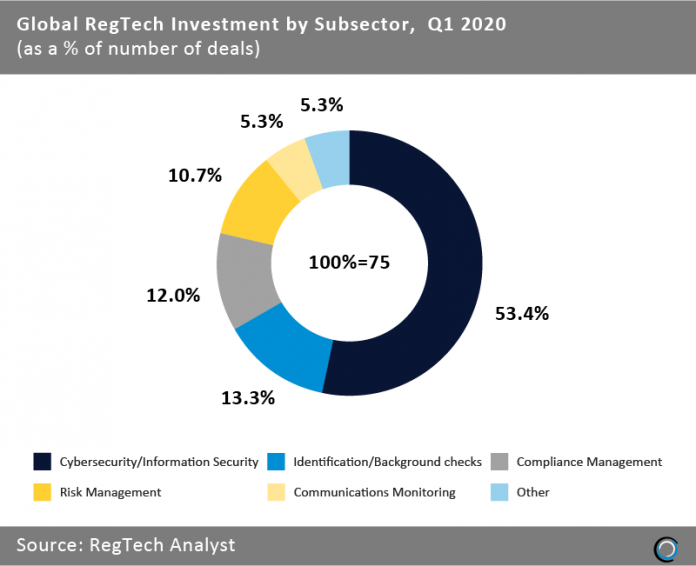

The week also saw the continuing trend of cybersecurity companies raising money with XM Cyber, SOC.OS and xorlab all adding additional capital to their coffers. The news comes after RegTech Analyst reported that cybersecurity companies collected 53.4% of all the money being injected into the RegTech sector in the first quarter of 2020.

Banca Idea Project raises €45m

The Banca Idea Project is the name of a new Italian banking project. But while it may be brand new, it has already raised €45m ($50.9m), making it the biggest round we reported on in the past week. Two Unicredit heavyweights, Roberto Nicastro and Federico Sforza, have raised the money from Generali Group, Sella Group, IFIS Group and ISA among others. The round for the project, which is reportedly called the Banca Idea Project, could be the biggest first round for an Italian FinTech.

Indonesia’s PAYFAZZ raises $53m in its Series B

Indonesia-based PAYFAZZ raised the second biggest round we reported on last week, bagging $53m in its Series B round. B Capital Group and Insignia Venture Partners led the round. Additional contributions to the round came from Tiger Global Management, Y Combinator, ACE & Company, BRI Ventures and Quiet Capital.

PAYFAZZ is said to be planning to use the new money to enhance its financial services tools and seek new opportunities across Southeast Asia. Its mobile app is developed to help Indonesian consumers – especially those without access to traditional bank accounts – access a variety of financial services such as payments and bill paying.

Growers Edge Financial raises a $40m Series B round

Growers Edge Financial raked in $40m for its Series B round to fund its US expansion, the growth of its data science team and the continuous development of its AI technology.

S2G Ventures, Cox Enterprises and Skyline Global Partners led the round. Other contributions came from Bunge Ventures, the investment division of food company Bunge, and Finistere Ventures, a food-focused investment firm.

Wagestream secures £20m in Series B round

Last wee Wagestream secured £20m in Series B round led by Northzone, the early-stage venture capital firm. Wagestream is essentially set up to empower employees by giving them early access to earned wages. QED Investors, Latitude Ventures and Balderton Capital as well as existing Wagestream backers such as the Joseph Rowntree Foundation through the Fair By Design Fund, the London Co-investment Fund (LCIF) and Village Global also backed the round.

Apiture has raised $20m in a new funding round

Digital banking experience company Apiture bagged $20m in a new round of investment last week. The capital injection was funded through accounts and funds advised by T. Rowe Price Associates and Pinnacle Bank.

XM Cyber secures $17m in its Series B round

XM Cyber, a breach and attack simulation (SA) platform, has closed a Series B round on $17m to fund the growth of its global sales and marketing efforts. The capital was supplied by Macquarie Capital, Nasdaq Ventures, Our Innovation Fund, and Swarth Group.

Flinks closes Series A round on $16m

Canada-based Flinks, a financial data platform, closed a Series A round worth $16m. NAventures led the round.The company raised the capital to support its next expansion efforts. Part of the new capital injection will be used to integrate wealth data into Flinks services. This will enable Flinks to connect data sources in the wealth management space through an aggregation services.

New company CloudSphere secures $15m to support the new venture

Last week we reported that xcloud management and governance platform HyperGrid and agentless discovery and application mapping company iQuate have joined together to create CloudSphere. The new venture, which will offer enterprise and cloud services, has already raised $15m from an investment round led by Atlantic Bridge Capital. As part of the deal, Atlantic Bridge Capital managing partner Kevin Dillion has become the executive board chair at CloudSphere.

Chainalysis added $13m to its Series B round

Cryptocurrency compliance startup Chainalysis has added $13m to its Series B round more than a year after expanding the raise the last time. With the new capital injection, the blockchain analysis company has raised $49m in its Series B round so far.

Chainalysis will use the money to fuel its the growth of its government relationships and further unite the public and private sectors to fuel the cryptocurrency industry’s growth through the addition of software engineers, government sales, and other business roles

Concirrus bags a $6m investment just months after closing its Series B

Concirrus, an insurance software developer, has raised $6m in funding, coming hot off the heels of its $20m Series B round. The fresh capital injection was supplied by FinTech-focused venture capital firm CommerzVentures. Royal Park Partners served as the exclusive financial advisors to Concirrus for the deal.

Verikai pulls in $6m for its Series A round led by ManchesterStory

Verikai, which leverages data and machine learning to change how insurers perceive risk, has collected $6m in its Series A round. The round was led by venture capital firm ManchesterStory. Additional contributions to the round came from early-stage venture firm ValueStream Ventures and startup accelerator Plug N Play. With the close of the investment, the company will build out its corporate structure, with a key focus on expanding their sales and marketing efforts.

Saudi Arabia-based Lean said to raise $4.5m in a seed round

Saudi Arabia-based Lean has reportedly raised $4.5m in a seed funding round, which was led by RAED Venture. Capital was also supplied by Shorooq Partners, Outliers VC, Global Founders Capital and Global Ventures, according to a report from Wamda. Several unnamed angel investors also joined the round.

Radix DLT raises $4.1m

Decentralised finance protocol Radix DLT has reportedly raised $4.1m in a new funding round. The capital injection was supplied by seed-focused investment firm LocalGlobe and TransferWise co-founder Taavet Hinrikus. Radix previously raised $1.9m in an equity round, the article states.

Digital business bank Penta adds €4m to its Series B round

Digital business bank Penta has collected €4m in a new funding round, adding to the €18.5m it raised in March for its Series B. The capital infusion was supplied by S7V, Presight Capital and two unnamed family offices.

Penta closed its initial €18.5m Series B round in March, with contributions coming from RTP Global, ABN Amro Ventures and VR-Ventures. Previous Penta backers HV Holtzbrinck Ventures and finleap also joined the round.

With the Series B funds, the company is looking to increase its product development, including the improvement of its technology, product, customer service and marketing. Funds are also being put towards expansion into other European countries.

Brazil-based Swap said to raise $3.3m in funding

Swap, a Brazilian FinTech helping companies access payments, has reportedly raised $3.3m in a funding round. The capital injection was led by ONEVC. GFC, SOMA Capital, ABSeed, Flourish Ventures and Hustle Fund also participated in the raise alongside a number of angel investors. With the equity burst, the FinTech will look to improve its product infrastructure and onboard new clients.

Foxquilt closes $3.5m seed round

Canada-based InsurTech platform Foxquilt has closed a $3.5m seed round. It will use the money to enhance its technology and data science. The InsurTech company helps small businesses and B2B networks to save business insurance. Its underwriting platform leverages smart data and machine intelligence to better understand a business so it can efficiently underwrite risks and give it the best coverage.

Icon Savings Plan said to raise $3.2m in its funding round

US-based retirement savings platform Icon Savings Plan has reportedly collected $3.2m in its seed round. The investment was led by DCM Ventures general partner Tom Blaisdell, with contributions also coming from Rethink Impact, TASC Ventures, Kelly Innovation Fund, Portland Seed Fund and Alumni Ventures Group.

This round marks the first investment to be raised by Icon Savings, which was created back in 2018. With the capital, the company is hoping to grow its team of ten by another five before the year is out.

Senso bags $3m in its pre-Series A round

Senso, an AI platform helping financial institutions improve client retention, has reportedly bagged $3m in its pre-Series A round to fund its expansion in the US. Mendoza Ventures and BreakawayGrowth led the round, with additional support coming from Luge Capital, Rising Tide, Inovia Capital and BDC. With the funds in the bank, the company hopes to accelerate the expansion of its operations and product offerings in the US.

Cybersecurity platform SOC.OS said to raise £2m in funding round

SOC.OS, a cybersecurity platform, has reportedly raised £2m in a funding round to support the growth of its platform. The capital was supplied by Hoxton Ventures and SpeedInvest. SOC.OS is an alert correlation and triage automation tool, which enriches, correlates and prioritises alerts to improve cyber defences. The company aims to help teams reduce response times to critical cyber threats.

Koala scores €1.6m in funding round led by Insurtech Gateway

France-based InsurTech Koala has scored €1.6m in a funding round led by UK-based incubator and fund Insurtech Gateway. Playfair Capital, Techstars Ventures and several unnamed private investors also contributed to the funding round.

This equity infusion will empower Koala to pursue its rapid growth plans, expand its team and increase product development. The InsurTech plans to become the “ultimate travel companion” and will extend its services beyond insurance.

xorlab $1.2m in pre-Series A round

Switzerland-based cybersecurity company xorlab has bagged $1.2m from its pre-Series A round. Spicehaus Partners AG served as the lead investors and will be an active partner to xorlab, it claims. Several other existing and new backers joined the round. With the equity boost, the company plans to hire more staff to help with its growth plans.

SwipeSum bags $1.1m in its funding round

SwipeSum, which is designed to help businesses find the best payments solution, has nabbed $1.1m in its funding round. Cequel III chairman and CEO Jerry Kent led the investment, with several other angel investors joining the round. Missouri-based SwipeSum will use the capital to improve the software of its AI-powered credit card processing statement analysis tool. Funds will also be put towards the expansion of sales and marketing.

Dutch payments company Payaut said to raise €1m in a funding round

Netherlands-based automated payments company Payaut has reportedly bagged €1m in a funding round. The investment was supported by LocalGlobe, Finch Capital and several unnamed angel investors. Despite having just closed this round, the FinTech is already in discussions about raising a seed round in a couple months’ time.

Lupiya bags $1m to fund the rollout of its financial inclusion tools in Zambia

Seven out of ten people in Zambia do not have access to formal financial services, but Lupiya hopes to change that on the back of a new $1m investment from Enygma Ventures.

The Zambian micro-finance startup has developed a platform to make the process of borrowing simpler and easier for people and businesses to access financial services.

If successful, Lupiya hopes to make a big a difference for the roughly 70% of Zambians who have no access to this type of service because they lack any collateral to secure their loans. The startup is particularly focused on helping women participate in the economy through its platform.

InsurTech platform Felix secures $800,000 in its seed funding round

Dubai-based InsurTech platform Felix has reportedly collected $800,000 in its seed funding round, which was led by the Oman Technology Fund. With the close of the capital infusion, Felix will increase the product developments and the growth of its platform in Saudi Arabia.

Docoh closes a $345,000 seed round

Canada-based Docoh, which offers research on public companies and stocks, has closed a £345,000 seed round. Capital will be used to support its position in the market and develop new tools to better help users.

Franc has raised $300,000 so far in its seed funding round

South African FinTech Franc has so far raised $300,000 in an ongoing seed funding round to fund its efforts to simplify the world of investment. Essentially, Franc’s service is developed to provide an easier way of accessing the money market exchanging traded funds.

Copyright © 2020 FinTech Global