Companies in India more than doubled their share of global deal activity in less than two years.

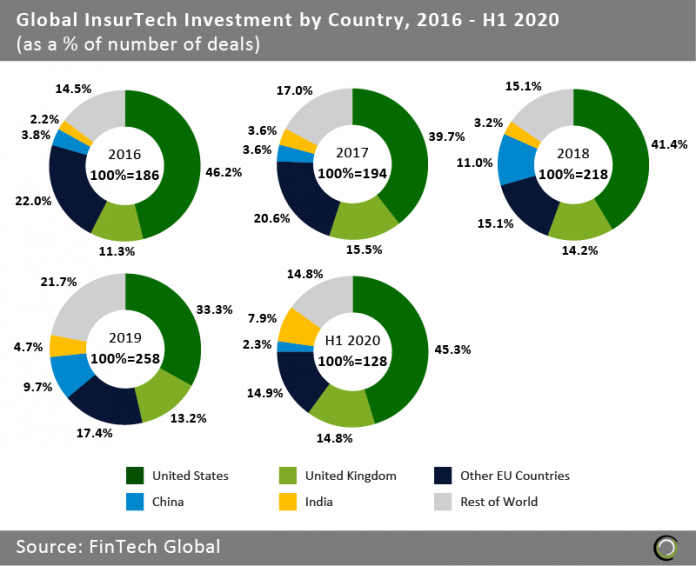

- US InsurTech companies have seen a sharp decline in their global deal share since 2015, dropping 20.1 percentage points (pp) to 33.3% in 2019. However, in H1 2020, the United States was home to nearly a half of all deals closed, demonstrating renewed appetite in the country from investors.

- While the United States surged, China’s share of deal activity fell by more than 4x to an all-time low of 2.3%. The fall in investment followed when the country locked down in January to prevent the coronavirus from spreading to other nations. Despite ending the lockdown in March there has been little recovery since then as foreign investors withdrew from the country due to ongoing concerns about future trade relationships between China and Western economies.

- India, on the other hand, saw a resurgence in deal activity, increasing 3.2% pp to total 8% of deal activity during H1 2020. This comes as India is attempting to redefine their insurance industry using new technology, capable of reducing costs and increasing efficiency. The charge is fuelled by insurance companies’ efforts to reach the vast underserved population in the country. InsurTech companies are entering the space with new distribution platforms and technology to both speed up the insurance process and make it more accessible for consumers.

India claims the largest deal in H1 2020 as it regains foothold in the InsurTech sector

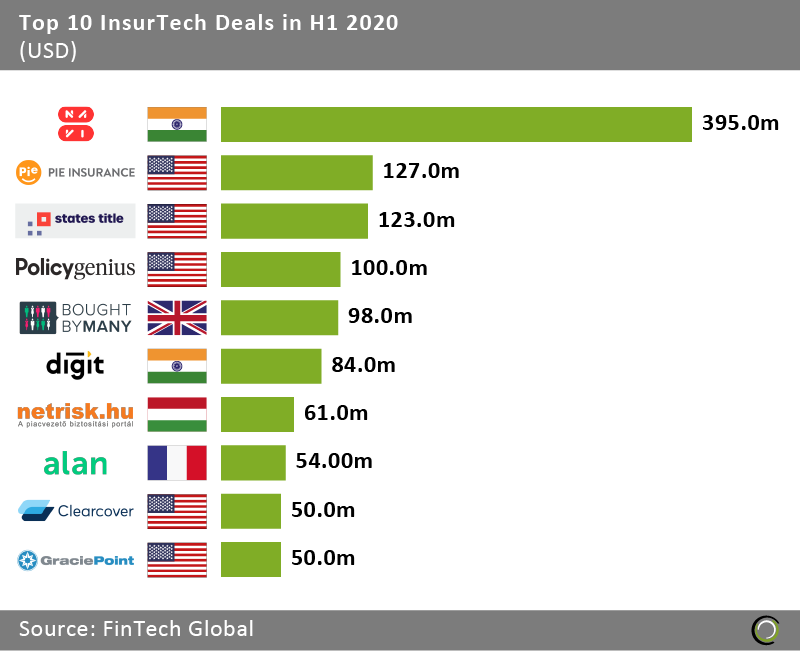

- The top ten InsurTech deals in H1 2020 raised in aggregate $1.4bn, making up 56.7% of the total funding for the period. For comparison in H1 last year, the top ten deals totalled $1.5bn but made up 65.8% of the total capital invested in that timeframe, signalling that investors are increasingly looking across the investment spectrum rather than backing established scaleups.

- The United States captured half of the top ten deals in H1 2020, continuing to play a major role in the sector. The news comes after the United States dropped 8.1% percentage points (pp) in deal share from 2018 to 2019. Despite that decline, the market is signalling maturity as companies move to advanced funding rounds and higher valuations.

- Navi Technologies, a Bengaluru-based firm helping build consumer-centric businesses in the insurance space, announced a $395m deal – the largest in H1 2020 – with backing from Anand Rao and seven other investors. The company plans to expand the BFSI (banking, financial services & insurance) space in India as it becomes the front runner.

- Netrisk.hu, the French-based online insurance broker, announced a $54m investment from TA Associates. The investment comes three years after the company secured $67m in a private equity round by Mezzanine Management and MCI Capital SA.

InsurTech investment declines in H1 2020 in the face of Covid-19 and its economic effects

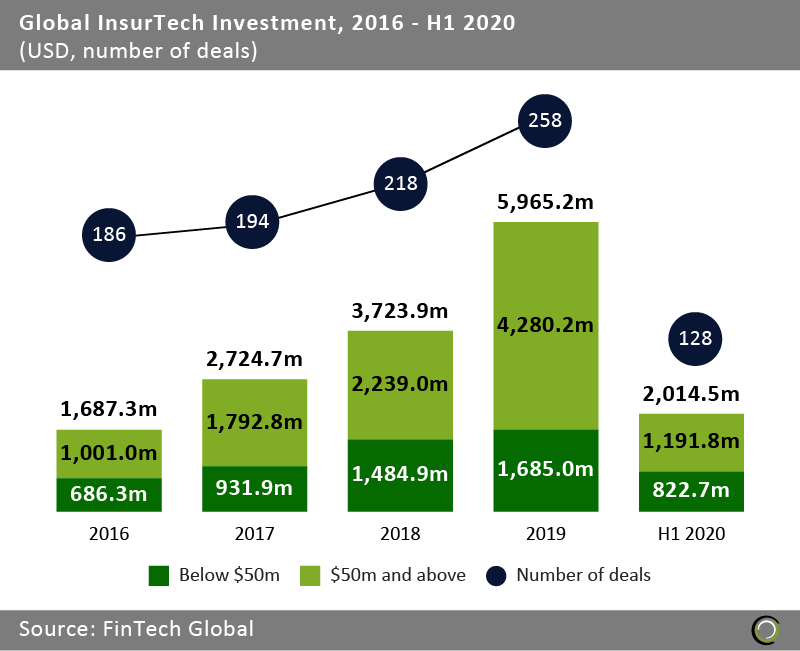

- Total investment in the InsurTech sector has grown exponentially from 2016 to 2019, growing at a compound annual growth rate (CAGR) of 52.3%. The rise in total funding was driven by large deals over $50m which made up 71.8% of the total funding recorded last year. The sector’s record level of investment was driven by an 18.3% increase in the number of deals and a 60.18% increase in total funding.

- Total InsurTech funding in the first half of this year saw a 13.3% drop compared to H1 2019, a slight decline in the face of economic uncertainty. Despite the drop, there was a 5.4% increase in the number of deals compared to the same period last year.

- Should the rate of investment continue for the remainder of the year, 2020 will see a down year on total funding with deal activity remaining steady as a larger percentage of deals happened in the second half of 2019. Investor optimism and the confidence of consumers have fallen with insurance businesses being thrown to the side in the face of the new world economy and lifestyle. With cities across the world on lockdown and facing uncertainty, the insurance sector faces a tough road ahead to move their operations digitally in 2020. Even with economic uncertainty and events from Covid-19, deal activity and investment only saw a slight decline when businesses had to move remotely. The slight drop signals the continued interest in InsurTech and its resilience to the economic cycle.

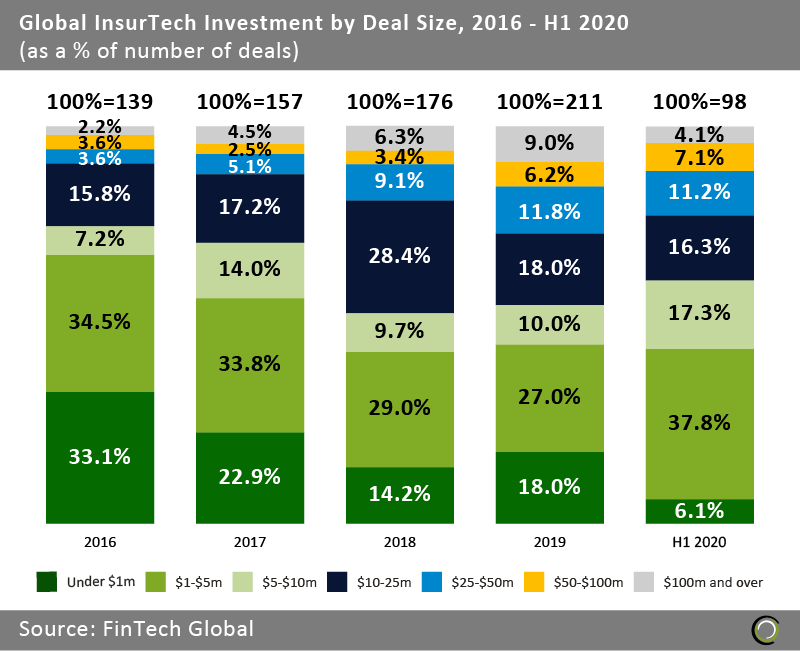

InsurTech sees maturity as the share of deals sized between $1m and $50m sees enormous increase while deals under $1m decline

- In H1 2020, the share of deals under $1m fell by nearly 12% percentage points (pp) to an overall 6.1%, the lowest share to date for the sector. In just under five years, deals under $1m have dropped 27% pp. The massive drop signals sector maturity following InsurTech’s hottest year as well as investors withdrawal from riskier early-stage transactions given the downbeat economic outlook.

- Along with the drop follows a monstrous increase in deals between $1m and 5m and $5 and 10m. Deals between $1m and $5m rose an incredible 10.8pp while deals in the range between $5m and 10m rose 7.3pp. The increase further supports the trend of sector maturity and investor interest as successful companies will go further in funding rounds and require more capital.

- Deals of $100m and above saw a decline, breaking the five-year trend of a rising number of deals of that size. The drop can certainly be attributed to the barriers Covid-19 has placed on deal transactions as well as the uncertainty it places on investors. Deals above $100m dropped 4.9% pp. Comparatively, deals sized between $50m and 100m saw a small increase of 0.9pp, indicating that investors may have dialed back funding in the face of the pandemic.

If you want to find out about the latest trends and innovation in InsurTech join the Virtual InsurTech Forum, taking place on 21 & 22 July. It’s a free to attend digital event hosting over 1,000 senior-level industry leaders and innovators.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.