From stocktrading to teenage finances, last week’s funding rounds provide plenty of things to consider for the future of the industry.

Another week has passed with 27 more FinTech deals closed. As usual, we take this opportunity to look into the trends, insights and patterns presented to us from the investment rounds from the past seven days. And boy, oh boy, do we have a lot to go through. So strap in, because it’s going to get intense from here on out.

Robinhood caught a lot of the spotlight last week and for good reason. The stocktrading platform extended its already massive Series F round with another $320m, bringing the grand total raised by the FinTech unicorn in this round alone to $600m. That means it may be one of the biggest rounds recorded in recent years, seemingly dwarfing challenger bank Revolut’s $500m round from earlier this year.

Impressive as this round is, Robinhood is not without its problems. Over the last year alone, it has recorded a series of service outages, cybersecurity issues related to how it stored data and the now infamous “infinite money cheat code” bug.

The glitch enabled people to access unlimited investment money by borrowing cash through the Robinhood Gold service that was then added to their capital and, in turn, meant that they could borrow more money. To make things worse, the cheat was shared on Reddit, making it public knowledge.

The last week also saw two whooping $120m rounds being raised by two very different FinTech companies: the RegTech venture Auth0 and the student financing platform CampusLogic. Both rounds raise interesting issues to discuss about the industry as a whole.

Given the RegTech sector is still quite new, we don’t often hear about huge rounds of more than $100m. So it was exciting to hear that RegTech unicorn Auth0 secured $120m in its Series F round last week. And it was not the only company in the segment to raise money: Ravelin also announced the closure of another capital injection this week.

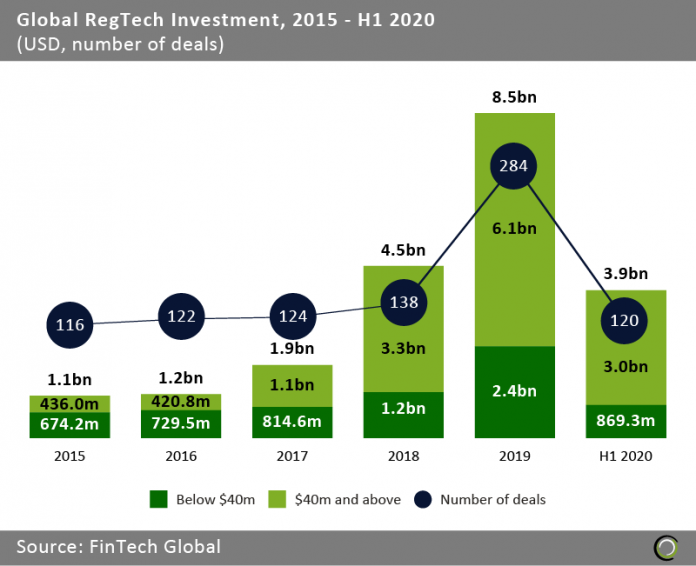

While no industry has been able to avoid the fallout of Covid-19, there’s reason to be bullish about the RegTech sector’s prospects. After all, it did have a strong start of the year. In the first six months alone, it raised $3.9bn of investment, almost half of the $8.5bn injected into the industry in 2019, according to FinTech Global’s research.

Moreover, that’s already about four times as much raised by the RegTech industry in total in 2015. That year, investors poured $1.1bn into the industry.

Add to that the regular seasoning of cybersecurity and fraud-prevention startups raising money last week, and it seems as if the industry is definitely cooking up something good for the future.

Add to that the regular seasoning of cybersecurity and fraud-prevention startups raising money last week, and it seems as if the industry is definitely cooking up something good for the future.

But, as mentioned at the top, Auth0 wasn’t the only company to raise a $120m round last week. And just like its raise, the money collected by CamusLogic offer opportunities to look into a different trend within the industry.

CampusLogic’s raise may have been bolstered by the need for students to have better access to money to afford their studies, but it also highlights how important it is for FinTechs to consider young people. Even more so since another FinTech startup to raise money last week, the Indian neobank Walrus, also specifically targets teenagers.

The focus on younger people from FinTech ventures is hardly surprising, given that catching the interest of Gen Z could provide the opportunity to tap in to this age group’s spending power, which is estimated to be worth $143bn. Yet, as we warned in another piece last week, attracting these consumers also comes with challenges aplenty. For instance, many of them do not have a credit account and they are prone to follow the advice of their parents when it comes to managing their money.

Two other rounds raised last week to pay attention to were Warren Brasil and Finnu. The rounds give us opportunity to discuss the rise of the Latin American FinTech scene.

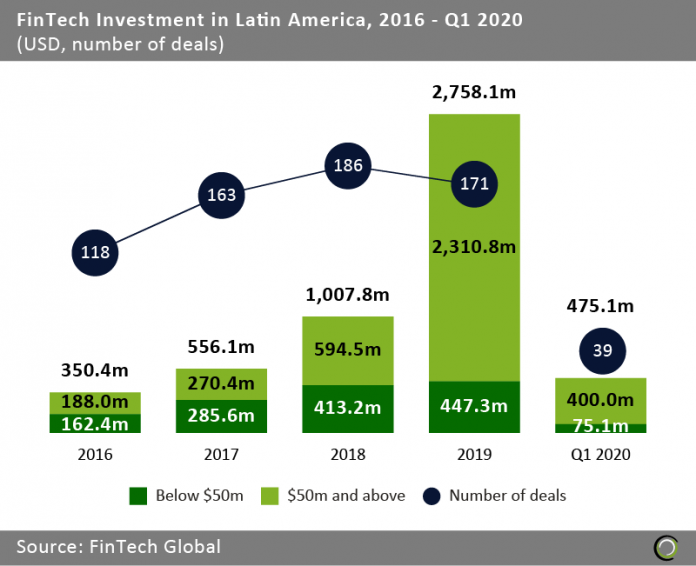

The region has enjoyed a considerable upswing in FinTech investment in the past five years. In 2016, the Latin American industry raised $350.4m in total, according to FinTech Global’s research. That number increased to $2.75bn in 2019. The companies in the region enjoyed a strong start of 2020, with the industry bagging $475.1m in the first three months of the year

Ten deals worth over $100m drove the major jump last year. Those ten rounds included the $400m Series F round raised by Nubank, a Brazilian challenger bank that boasts of having over 20 million customers on its books.

Robinhood extends its already massive Series F round with another $320m

Robinhood raised a massive $280m in its Series F in May this year. However, that didn’t stop the stocktrading app from expanded the round considerably last week by adding an additional $320m to the raise. The expansion pushed the grand total raised by Robinhood in this round to $600m.

The new cash injection saw the company’s valuation jump from $8.3bn from its original Series F close in May to $8.6bn.

The original round announced in May was led by existing investor Sequoia Capital. It also saw participation from existing and new investors including NEA, Ribbit Capital, 9Yards Capital and Unusual Ventures.

Auth0 close new $120m round

RegTech unicorn Auth0 saw its valuation skyrocket to $1.92bn last week after closing its Series F round on $120m.

Salesforce Ventures led the round, which also saw participation from previous backers Bessemer Venture Partners, Sapphire Ventures, Meritech Capital, World Innovation Lab, Trinity Ventures, Telstra Ventures and K9 Ventures. DTCP also joined the round as a new backer.

Auth0 will us the new capital to increase its innovation and go-to-market expansion, in hopes of meeting global demand. Since the secure access company was founded in 2013, it has raised more than $330m in equity.

CampusLogic collects $120m in a minority investment from Dragoneer

Student finance support platform CampusLogic bagged $120m in a minority investment from Dragoneer Investment Group last week. With the funding boost, the company plans to increase product development and make strategic acquisitions to increase the breadth of its platform.

CampusLogic aims to remove the barriers students face when seeking higher education. It claims that nearly 60% of students who don’t complete college state it was due to financial barriers. It also said that three million students drop out of higher education because of financial constraints.

BlueVoyant said to raise $68m in its Series C round

Cybersecurity company BlueVoyant has raised $68m in its new funding round, which was led by Temasek. With the capital injection, the company will accelerate its growth plans. The firm will look to improve its managed security services, third-party cyber risk services and cyber defence services.

Invoice FinTech Taulia closes $60m funding round

Taulia announced that it had secured a $60m investment. The Ping An Global Voyager Fund led the round, which also enjoyed investments from J.P. Morgan, Prosperity7 Ventures and existing investors including Zouk Capital. Taulia will use the money to fund its global expansion efforts.

Taulia offers an automated invoice processing solution designed to help firms quickly pay their suppliers. Clients can also earn discounts on their supplier fees through the use of Taulia.

FinTech Sezzle raises $55m in post-IPO round

Australian payment instalments company Sezzle has reportedly secured $55m in a funding round from new and existing CHESS Depositary Holders (CDI). The company announced to the Australian Securities Exchange that it had issued 14.1 million CDIs udder placement, representing 8.4% of its existing capital. As a result of the announcement, the company’s shares jumped by 22.3%.

Bond Financial pulls in $32m for its Series A

Bond Financial Technologies, which helps brands accelerate the pace of financial innovation and inclusion, has closed $32m Series A round. Coatue led the round. Bond Financial Technologies also enjoyed cash injections from Goldman Sachs, Mastercard and B Capital. Additional support also came from angel investors including former Morgan Stanley chairman and CEO John Mack.

Moneybox raises £30m in Series C funding round

UK-based FinTech Moneybox has bagged £30m in a Series C funding round led by Eight Roads and CNP. Breega also participated in the raise. The news comes as the savings and investment startup launched in 2016 announced that it was raising more fund through a crowdfunding campaign on Crowdcube.

Warren Brasil has raised $22.5m in a Series B round

Investment platform startup Warren Brasil has raised $22.5m in a Series B round led by QED Investors. Kaszek Ventures, Chromo Invest, Ribbit, MELI Fund, WPA and Quartz also participated in the Latin American FinTech company’s investment round. The startup will use the funds to boosts the development of its technology.

Traceable secures $20m in its Series A round

Traceable secured $20m in its Series A round last week at the same time as it launched from stealth. The investment was supplied by Unusual Ventures and BIG Labs.

Managed detection and response platform GoSecure closes $20m Series E

GoSecure, a managed detection and response platform launched in 2012 under the name CounterTrack, has secured $20m in its Series E round which will support its growth in North America. The capital was supplied by Yaletown Partners, Bank of Montreal and previous backers SAP/NS2 and Razor’s Edge.

Metaco secures $17m in Series A round

Swiss digital asset infrastructure startup Metaco has bagged $17m in a series A funding round. Giesecke+Devrient led the round, which also saw participation from Standard Chartered Bank, Zürcher Kantonalbank, VC Investiere Swisscom, Sicpa, Avaloq and Swiss Post.

Fraud detection startup Ravelin bags £16.4m in Series C round

Ravelin, the London-based fraud detection startup, has secured £16.4m to fund its expansion into new markets and reach more industries. Draper Esprit led the Series C round. Amadeus Capital Partners, BlackFin Tech and Passion Capital also participated in the raise.

RealityEngines.AI rebrands to Abacus.AI alongside $13m funding round

RealityEngines.AI has rebranded to Abacus.AI, alongside the close of a $13m Series A round. The investment was led by Index Ventures, with support also coming from Eric Schmidt, Ram Shriram, Decibel Ventures, and Jerry Yang. As part of the deal, Mike Volpi and Ram Shriram have joined the Abacus.AI board of directors.

Virtual card provider Privacy.com closes Series A on $10.2m

US-based virtual card platform Privacy.com has scored $10.2m in its Series A round, which was led by Teamworthy Ventures. Tusk Venture Partners, Index Ventures, Quiet Capital, Exor Seeds and Rainfall Ventures also joined the round as investors. It will use the money to keep developing its innovative solutions.

TradeDepot secures $10m to expand its financial services

Nigerian TradeDepot has reportedly netted $10m in a new funding round co-led by Partech, the International Finance Corp., Women Entrepreneurs Finance Initiative and MSA Capital. Partech previously injected $3m into the e-commerce startup in 2018, according to Techcrunch.

CYR3CON secures $8.2m in new investment

Cybersecurity company CYR3CON has closed an $8.2m investment round led by Pivotal Group, with participation by Trumpf Ventures, 3Lines Venture Capital, DF Enterprises, Hike Ventures and other investors. CYR3CON will use the money to grow its AI-powered cyber attack prediction software platform.

Blockchain startup Valid Network bags $8m in seed round

Last week saw Israel-based cybersecurity startup Valid Network announce the close of an $8m seed round to fuel the development of its technoloy, expand its team and to open a New York office. Its solution helps businesses adopt blockchain in a secure and compliant way.

CyberSmart collects £5.5m in its Series A round to capitalise on strong growth in the market

CyberSmart has bagged £5.5m in its Series A which will be used to better position itself in helping secure small and medium-sized businesses. The capital injection was supported by IQ Capital and a group of unnamed individual investors.

Orbital Witness secures £3.3m in seed capital

Orbital Witness is a startup launched in 2018 with the mission to create a universal risk rating for the real estate industry and has just bagged £3.3m to make that happen. LocalGlobe and Outward VC led the round. Orbital Witness also enjoyed a capital influx from existing investors such as Seedcamp and JLL Spark.

Evertas said to raise $2.8m in its seed round

Cryptoasset insurance startup Evertas has reportedly raised $2.8m in its seed funding round. The investment was led by Morgan Creek, with participation also coming from Plug n Play, Kailash Ventures, RenGen, Vy Capital and Wavemaker Genesis.

Circit collects €1.1m in funding round

Circit, the audit confirmation platform, has collected €1.1m in a funding round, as the RegTech gears up for “significant expansion.” Commodore Investments served as the lead investor for the round with additional capital coming from Enterprise Ireland. A selection of angel investors also contributed to the round including former Ulster Bank CEO Jim Brown and former AIB general manager John Power.

goDutch scores $1.7m in its seed round

India-based goDutch, a FinTech app helping to split payments, has scored $1.7m in its seed round. Venture capital firm Matrix India led the round. goDutch also enjoyed contributions also coming from Y Combinator, Global Founders Capital, Soma Capital and VentureSouq. A handful of angel investors also joined the round, including Tinder co-founder Justin Mateen and Twitch co-founder Kevin Lin.

Eversend bags $1.01m in new crowdfunding campaign on Seedrs

Ugandan neobank Eversend has reportedly closed an oversubscribed crowdfunding campaign on Seedrs. The digital banking startup bagged €897,000 ($1.01m) through the round, according to Disrupt Africa.

Finnu bags $800,000 to launch its personal credit solution in Latin America

Fintech Finnu has secured $800,000 investment to give loans for phones to customers in Latin America. Speedinvest led the the round, which also saw participation from, Kima Ventures, Seedrocket4founders Capital and ArkFund as well as from two angel investors.

Hardbacon secures $50,000 grant to develop AI tool

The penultimate round to report about from last week is also one of the most sizzling ones. Hardbacon is a budgeting and investment tracking mobile app. Last week we reported that the it netted $50,000 in a funding round to support its AI development.

The National Research Council of Canada’s Industrial Research Assistance Program brought home the bacon in this round in the form of a grant.

This money is earmarked for the research and development of AI technology to predict stock prices. This tool will guide investors with their decisions. Ratings will be created by the AI solution and will help users to better understand opportunities and risks of opportunities.

Walrus bags pre-seed round of undisclosed amount

India-based neobank Walrus is aimed at teenagers. Last week it announced the pre-seed capital last week. The value of the investment was not disclosed. Better Capital led the investment, with contributions also coming from angel investors Myntra co-founder Raveen Sastry and ex-TaxiForSure founder and CEO Raghunandan G, according to a report from The Economic Times India.

Copyright © 2020 FinTech Global