InsurTech platform Coverly is closing up shop and is no longer offering small business insurance.

The company revealed on its website that the company is closing, but those who already have cover will continue to be protected. All insurance will remain until their expiry date.

Coverly, which is based in the UK, was founded in 2018 to offer flexible online insurance to small businesses.

According to the website, existing customers that has already received a renewal quote can renew the policy if they wish. It says ?If your policy is due to renew on or after the 14thAugust 2020, then your policy will cease at its expiry date and we will not be able to renew your cover.p>

It is unclear why the InsurTech platform is closing.

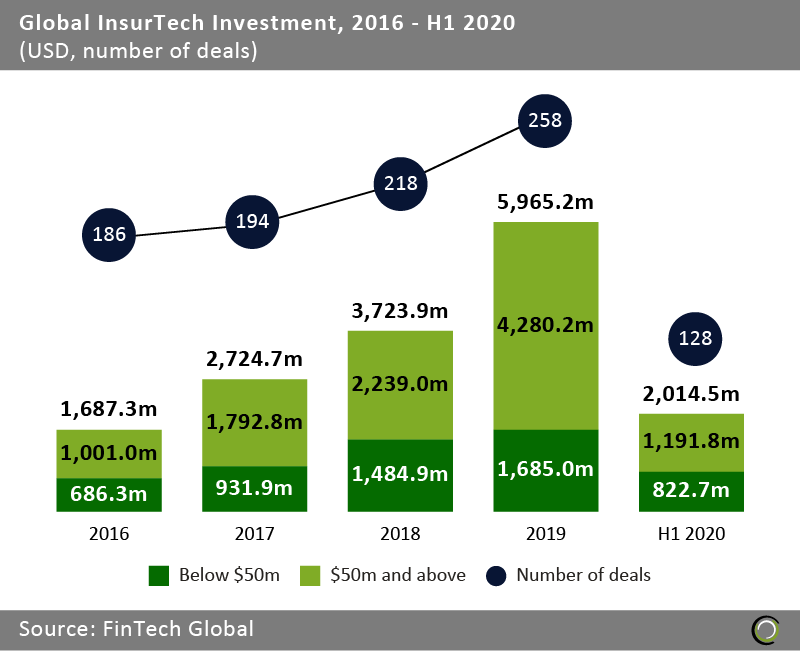

The funding of InsurTech companies has been growing each year. In 2019, the global InsurTech sector nearly reached $6bn in capital invested across 258 transactions, FinTech Global data shows. Funding has been growing at an accelerated rate year-on-year since 2016, growing at a 52.3% CAGR.

Speaking on the impact of the coronavirus on the InsurTech sector, Leo Corcoran, CEO of Insurance claim management software provider ClaimVantage said, ?I believe it will be tougher to raise funds if you have not already started the process. Funding will be available for companies that are core to digital transformation and mission-critical business functions, whereas nice to have products will struggle to get support, particularly for InsurTech funding.p>

The pandemic is also expected to see a number of InsurTech companies close up after struggling to get funding or business.

Copyright ? 2020 FinTech Global