Hot on the heels of raising a $127m round in May, Pie Insurance has now announced that it has added?automated bind requests within its partner portal.

The InsurTech company offers workers’ compensation insurance to small businesses, today unveiled automated bind requests within its partner portal. The latest addition to its services will enable partner agents to submit requests to bind on eligible submissions within the partner porta.

“We are deeply committed to providing a world class experience for our 1,000+ partner agencies and growing,” said Dax Craig, president and co-founder of Pie Insurance. “Today’s launch of automated bind requests in the partner portal is incredibly exciting for our team and partners. It brings Pie one step closer to our vision of making an agent’s day less complicated through the powerful combination of technology, data, and insurance.”

Pie Insurance also boasted that the new feature would empower partner agents to view more relevant information on the status of their small business client submissions throughout the issuance process.

“One constant in my many years in the insurance industry is the desire from agents for more information to share with clients,” said Danielle Lucas, lead business development manager at Pie. “With these updates, our partners will be able to log into the portal and instantly have the information they need right in front of them, without having to reach out to their business development manager or underwriter to ask for an update.”

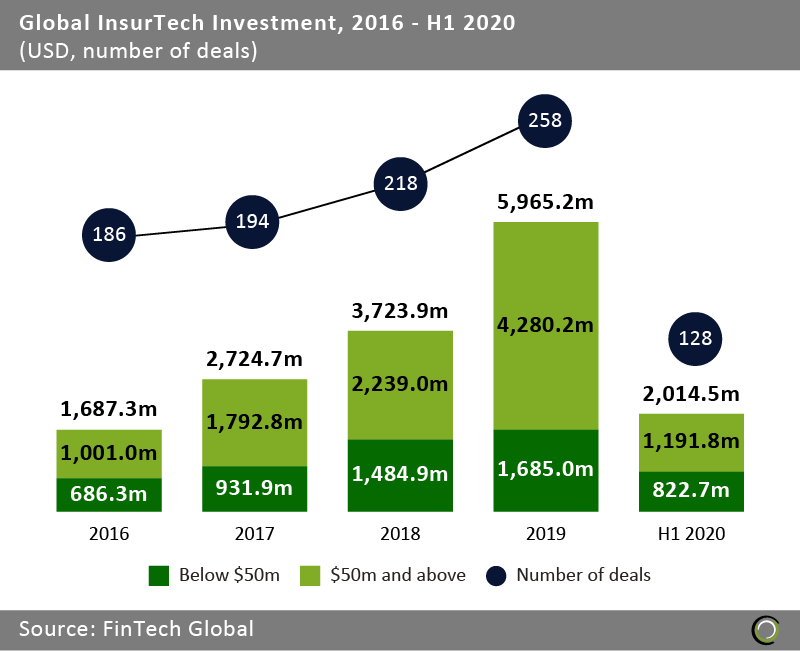

The news comes after the total investment in the InsurTech sector grew at a compound annual growth rate of 52.3% between 2016 and 2019, according to FinTech Global’s research. In 2016, the global InsurTech space raised $1.68bn across 186 deals. By 2019, that figure had jumped to $5.96bn across 258 deals.

The rise in total funding was driven by large deals over $50m which made up 71.8% of the total funding recorded last year. The sector record level of investment was driven by an 18.3% increase in the number of deals and a 60.18% increase in total funding.

The sector raised $2.01bn across 128 deals between January and June 2020.