Over the past seven days we have reported on 27 big FinTech deals. So why not take a closer look at what they mean for the industry.

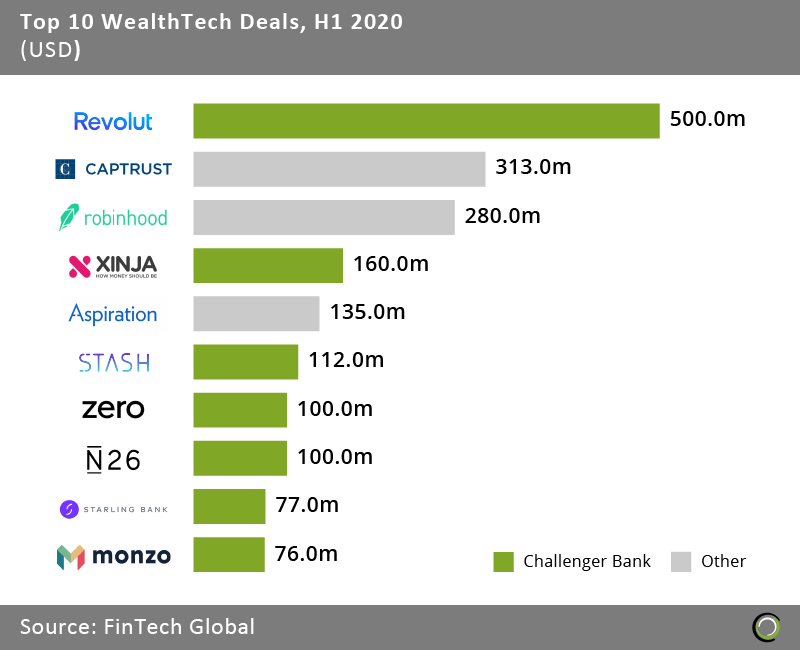

Last week saw neobanks Kard and Yotta Savings raise new investment. This fits into a bigger pattern of challenger banks raising big funds. Indeed, seven of the ten biggest WealthTech rounds in the first half of 2020 were developing products in the digital banking space: Revolut, Xinja, Stash, Zero, N26, Starling Bank and Monzo.

Apart from tripling its losses, Revolut is also struggling with the ongoing problem of top executives leaving the company as well as its staff members being frustrated of delays in getting the share options due to them in a company scheme.

Elsewhere, German challenger bank N26 has been embroiled in a very public battle with its employees who are advocating a bigger say in how the company is run. The issue has even involved the police being called to break up meetings, as we reported in August.

On the other hand, Chime achieved a $14.4bn valuation the other week, making it one of the world’s highest valued FinTech companies.

Like much else in this industry right now, only time will tell how bad or good things will get due to Covid-19.

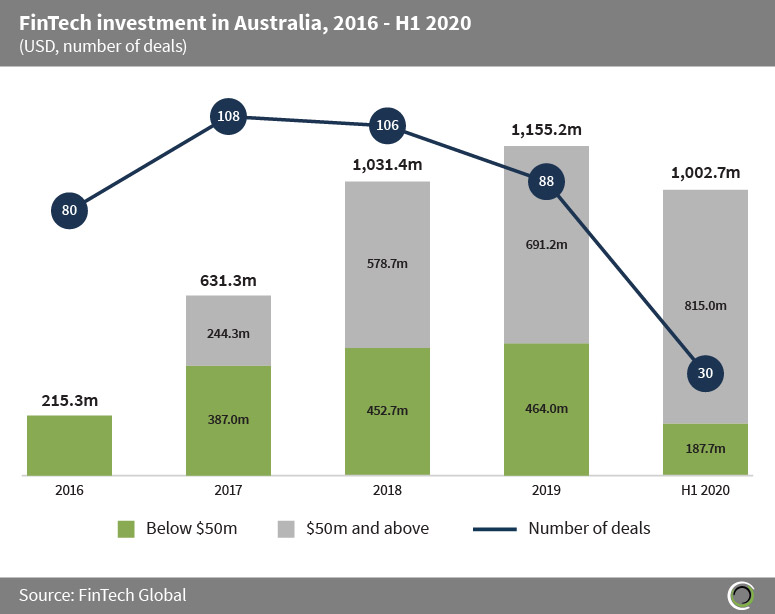

Last week also saw two Australian companies, Pollinate and Airwallex, raise new cash injections. This, of course, gives us an opportunity to take a closer look at what’s been going on in Oz recently.

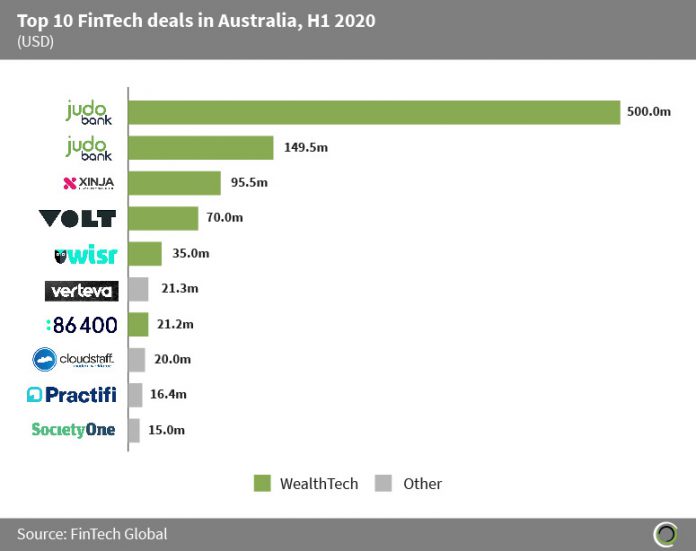

Things in Australia looked more than promising in the first half of 2020. Between January and June, the FinTech sector raised over $1bn in investment, almost up to the $1.15bn raised over the 12 months of 2019, according to FinTech Global’s research.

Looking closer at the deals, it is clear that the WealthTech sector dominated the FinTech industry Down Under. The largest deal of the period was raised by neobank Judo Bank, which secured $500m from the Australian government to help provide loans to small businesses in the country. Verteva’s $21.3m deal was the largest deal outside of the WealthTech.

Digital banking solution Alkami Technology closes $140m in funding

Cloud-based digital banking solutions provider Alkami Technology has added $140m to its coffers after closing funding round. D1 Capital Partners led the cash injection that also enjoyed participations from Fidelity Management & Research Company, Franklin Templeton and Stockbridge Investors. General Atlantic is also a backer of the business.

Earlier this month adoption of Alkami digital platform reached nearly 10 million digital users under contract, while the company also crossed over $130m of annual recurring revenue under contract by adding its 165th client.

Acesso Digital raises $108m funding round

Brazil-based digital identity business Acesso Digital has closed a $108m investment, which is one of the largest of its type in the region. The round was led by growth equity firm General Atlantic and the SoftBank Latin America Fund. The company claims this is the largest Series B investment into a Latin American SaaS company.

Proceeds from the round will help the RegTech continue its growth, launch new products and services, and increase the size of its team. Accesso will lao explore acquisition and investment opportunities.

Pollinate closes £70m investment

Australian merchant acquiring FinTech Pollinate has closed a £70m funding round. The close of the round has come alongside the formation of a partnership with National Australia Bank. As part of the partnership, Pollinate will implement its global cloud-based platform to help the bank’s SME customers better manage and grow their businesses.

Bitpanda closes $52m round

Austrian FinTech platform Bitpanda has closed a $52m funding round, which it claims to be the largest Series A to be raised in Europe in 2020. Valar Ventures led the investment, which will be used to increase Bitpanda’s expansion efforts and presence in the European market.

Papaya Global closes $40m in funding

Payroll and payment company Papaya Global has closed $40m funding round. Scale Venture Partners led the round, with other contributions coming from Workday Ventures, Access Industries, Insight Venture Partners, Bessemer Ventures Partners, New Era Ventures, Group 11 and Dynamic Loop. Papaya Global will use the funds to support its rapid growth, scale its market penetration and to launch new products. The company is releasing its HRIS solution in January 2021.

Airwallex adds $40m to its Series D round

Australia-based payments firm Airwallex has extended its Series D by $40m to bring the round’s total to $200m. The extra cash will enable the payments company to buildout its product suite and strengthen its existing footprint in key regions such as Asia Pacific and Europe. It also hopes to expand its global payment coverage to include further regions, including the Middle East, Eastern Europe and Africa.

Facet Wealth secures $28m in its Series B round

Last week we reported that financial planning company Facet Wealth had added $25m to its treasure chest as part of its Series B round. At the same time it announced the launch of a new financial wellness product for employers.

Warburg Pincus led the investment, with contributions coming from unnamed existing backers of Facet. The equity infusion will be used to aid the company’s continued growth, which has seen it more than doubled since the start of the coronavirus pandemic.

Servify closes $23m Series C round

Servify, which offers warranty protection for devices, has closed a $23m Series C round led by existing Servify backer Iron Pillar. SPF, Blume, Beenext, Tetrao, Global Alternatives Investor 57 Stars and Trifecta Capital as well as a number of strategic investors also contributed to the raise.

BioCatch secures $20m months after bagging $145m Series C

Behavioural biometrics startup BioCatch has secured a $20m cash injection from Barclays, Citi, HSBC and National Australia Bank. The investment comes just months after BioCatch closed its $145m Series C round, which was backed by Bain Capital Tech Opportunities, Industry Ventures, American Express Ventures, CreditEase, Maverick Ventures, OurCrowd and more.

In tandem with the round close, the company has established the BioCatch Client Innovation Board. The invitation-only innovation board will be a collaborative forum where members will meet regularly to build new tools for the platform.

Rally secures $17m in funding

Rally, the rare and one-of-a-kind collectibles investment startup, has added $17m to its coffers in an oversubscribed funding round. Upfront Ventures led the investment, with contributions also coming from Porsche Ventures, Raptor Group, Global Brain, Relay Ventures and Alexis Ohanian.

Rally will use the new money to add new partnership programmes to reach additional sources of supply. It will also help it to further the development of its technology and expand its compliance capabilities.

Noyo secures $12.5m in its Series A

InsurTech Noyo has secured a $12.5m Series A funding round that was backed by Costanoa Ventures and Spark Capital. Other participants included previous Noyo backers Homebrew, Fika Ventures, Precursor Ventures, Core Innovation Capital, Garuda Ventures and Webb Investment Network.

Noyo will use the new cash injection to increase development of its technology to support the entire insurance lifecycle, with APIs available for everything from price quotes through to member enrolment.

Finom said to raise $12m to fuel European expansion

Netherlands-based financial service provider Finom has secured $12m in funding round to expand across Europe. The capital was supplied by Target Global, Cogito Capital, Entree Capital, Avala Capital, Tal Capital and AdFirst Ventures. This investment will enable the FinTech to increase its market activities, develop new products and enter more European countries.

Acin closes $12m round

Non-financial risk management startup Acin has secured a $12m Series A round led by Notion Capital. Other commitments came from Fitch Ventures, former SunGard president and CEO Cris Conde, Artorius Wealth Management chairman Christopher Carter and GoCardless COO Carlos Gonzales-Cadenas.

PayMongo said to close $12m Series A

Online payment company PayMongo has reportedly raised $12m in its Series A round, which was led by payments monolith Stripe. Other participants of the round include Y Combinator, Global Founders Capital and BedRock Capital.

Collective secures $8.65m in funding

Collective, an online back-office platform aimed at the self-employed, has scored $8.65m in a funding round led by General Catalyst and QED Investors. Google’s Gradient Ventures and Expa, also joined the round, as well as several angel investors, including Expa and Uber founder Mike Garrett Camp, Fundera founder and CEO Jared Hecht, Convoy founder and CEO Dan Lewis, SV Angel co-founder Topher Conway and others. Collective will use the money to bring its product to market, develop new technologies and products, and build out additional community features.

Data management platform Fluree scores $6.5m in seed funding

Secure data management company Fluree has netted $6.5m in seed capital. 4490 Ventures led the round, which was also backed by Rise of the Rest, Good Growth Capital, Engage Ventures and former Venrock Managing Partner Ray Rothrock. Fluree will use the money to fund further the development of its platform and build upon the growth of the company by adding more marquee customers.

Insurwave closes its latest funding round on £5m

InsurTech Insurwave has secured £5m in new funding. The investment was led by unnamed existing shareholders. This capital injection will be used to expand the features available on the platform and improve innovation within commercial insurance.

Quasar Flash reportedly closed a $4.5m Series A round

FinTech Quasar Flash has reportedly raised $4.5m in its Series A round to help it deepen its credit risk analytics. Brazil-focused investment firm Valor Capital Group led the investment. Quasar Flash helps businesses access financing options for their receivables, with Quasar assessing an applicant’s balance sheet to judge the eligibility and terms of the loan.

Kard said to close $3.5m round

Teenage-focused neobank Kard has reportedly raised $3.5m in a funding round, which was led by Founders Future. Other participants of the round included angel backers Laurence Krieger, Michael Vaughan, Jon Oringer and Iris Mittenaere, according to a report from TechCrunch. The FinTech platform is mobile app aimed at helping educate teenagers about money. Parents can use the mobile app to add more pocket money.

Yotta Savings secured $3.3m funding round

Lottery-styled neobank Yotta Savings has reportedly closed a funding round on $3.3m. Startup is behind a mobile app where saving money gives people the chance of winning $10m.

Investors of the round included Slow Ventures, FundersClub, TwentyTwo VC, Chapter One, CapitalX, Y Combinator and some angel investors, according to a report from Crunchbase. The investment brings the company’s total funding to $3.9m, it said.

Following the close of the round, the company will hire additional staff for its engineering and customer support teams. It will also begin paid advertising and the deployment of comprehensive banking offering such as debit and credit cards.

Riskbook closes £2m in funding to revolutionise reinsurance

InsurTech developer Riskbook has secured £2m in funding to bolster its position in the market, go on a hiring spree and enhance its reinsurer interface. The company will also launch a new tool, which will automate the preparation and validation of submission exhibits in collaboration with their brokers. Episode 1 Ventures, MMC Ventures and Seedcamp backed the investment.

WeMoney reportedly netted $2m in new investment

Last week we wrote about how personal finance platform WeMoney was said to have nailed raised $2m in a funding round led by BetterLabs. Full Circle VC, Prospa CCO Ben Lamb, Proviso founder Luke Howes, Jacanda Capital executive director Rob Antulov and Harmoney general manager Ben Taylor also participated in the raise.

Millennial-focused investment app QUIN said to close its seed round on €1m

Digital investment advisor QUIN is said to have netted €1m in seed capital. The German FinTech received the funds from investors including Sino Ag, which acted as the lead backer, Runa Capital and APX. QUIN will use the money to keep attracting millennial customers.

ID-Pal scores €1m investment to support geographic growth

Irish FinTech ID-Pal has netted €1m in new investment to further its growth across Ireland and internationally. Act Venture Capital and several unnamed private investors invested the startup.

DeepSurface Security closes $1m seed round

DeepSurface Security has closed a $1m seed round to help it launch the industry’s first automated predictive vulnerability management tool suite. Cascade Seed Fund led the round. SeaChange Fund and Voyager Capital also participated. DeepSurface will use the money to launch a product in the end of 2020 and expand its team.

SPARQ raises €440,000 in new funding

Estonian personal finance startup SPARQ has reportedly closed a €440,000 investment from the Baltic International Bank, extending the seed round to a total of €500,000.

AeroPay has raised a seed round

Alternative payments company AeroPay has closed its seed round to support the growth of its team and operations. The investment was led by Continental Investors, with a number of unnamed angel backers and strategic investors from the Chicago tech community.

Copyright © 2020 FinTech Global