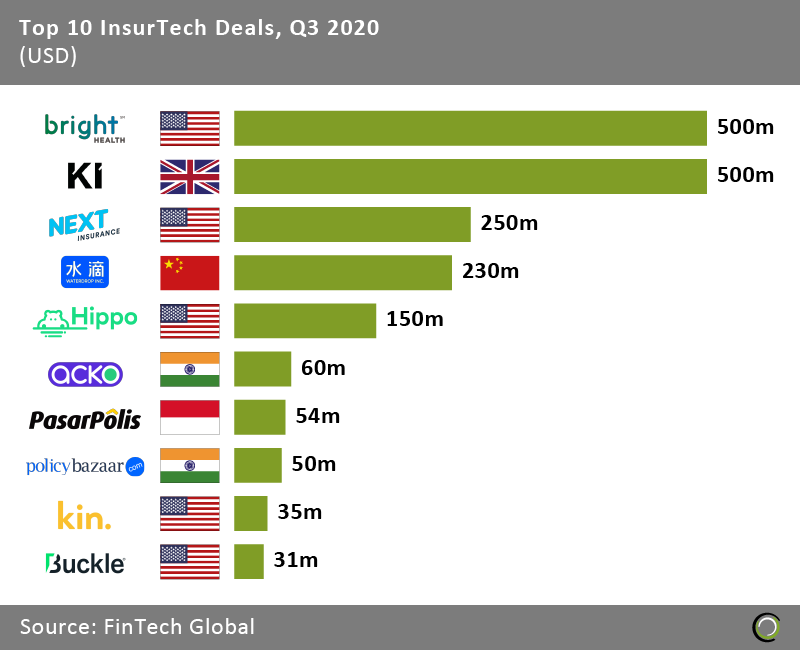

The three largest InsurTech deals so far this year all took place during the third quarter.

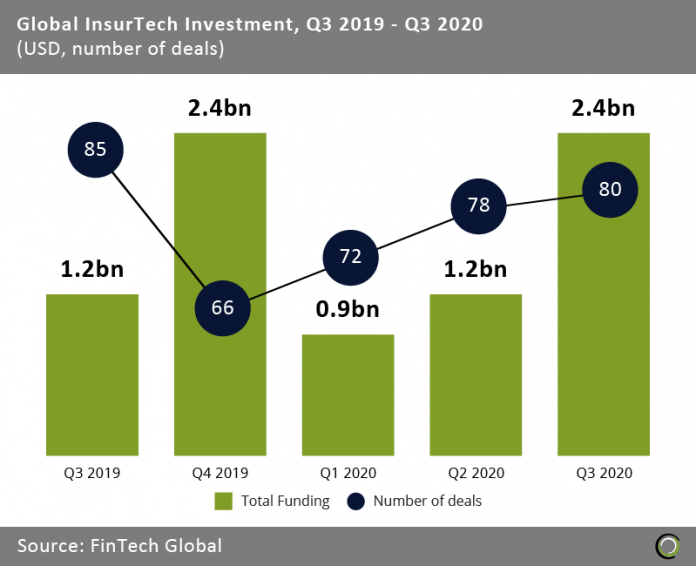

- Global InsurTech funding recorded its second consecutive quarter of growth in Q3 2020. Companies in the sector raised nearly $2.4bn during the period, which is double the amount of capital raised in the previous quarter of the year and matches the five-quarter high recorded at the end of 2019.

- The huge surge in funding comes after a slow start to 2020 where investors were cautious given Covid-19 uncertainty, but also busy reassessing new opportunities given the huge digital shifts caused by increased online distribution and working remotely. As a result, InsurTech funding in H1 2020 was 9.2% lower than the capital invested during the first half of last year.

- The strong funding levels recorded in Q3 were driven by five large deals over $100m, including the top three funding rounds raised in the sector so far this year completed by Bright Health ($500m), Ki Insurance ($500m) and Next Insurance ($250m).

- Deal activity also continued to recover, recording its third consecutive quarter of growth to reach 80 transactions in Q3. However, the figure remained below the 85 funding rounds completed during the same period last year.

The three biggest InsurTech deals in 2020 all took place in Q3

- The top ten InsurTech deals in the third quarter of the year collectively raised $1.86bn, making up 78.2% of the overall investment in the sector during the period. As mentioned previously the three biggest deals so far this year all took place in Q3 with Bright Health and Ki Insurance sharing the top spot after the two companies raised $500m each.

- Bright Health offers a range of health insurance plans that are tailored to people’s requirements. Its platform is currently available in 43 markets and 13 US states and the company claims to have over $1.2bn in annual net revenue. While Ki Insurance is the first fully digital and algorithmically-driven Lloyd’s syndicate. The company is launching in Q4 2020 and is going to underwrite using an algorithm-driven approach and offer instant follow capacity through its proprietary digital platform.

- The third largest deal of the year was raised by Next Insurance, an online-based small business insurance provider, which completed a $250m Series D round in September. Having closed the round, the company is looking to increase the size of its team by 50% by the end of the year and aims to hire 200 new employees over the next 12 to 18 months across its Palo Alto, Austin and Israel offices. The company has helped over 100,000 customers get access to small businesses and is currently available to 1,300 types of businesses in all 50 US states.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global