Last week’s 32 FinTech rounds highlight how Latin America is exploding with new activity, how open banking has nudged closer to being fully adopted across Europe and the rising popularity of teen-focused ventures.

Another week, another 32 funding FinTech rounds completed. While this week certainly saw the regular smattering of cybersecurity and InsurTech deals we’ve grown accustomed to during the Covid-19 crisis, the week also highlighted three other areas that demand special attention. Over the past seven days, FinTech Global’s team of journalists have reported on cash injections highlighting the growth of FinTechs in Latin America, the increasing adoption of open banking and how teen-focused FinTechs are coming of age. So what’s going on here?

Let’s start with Latin America. Last week saw companies in the region such as crypto exchange Bitso, challenger bank albo and money exchange Valiu secure impressive funding rounds. These deals highlight how Latin America’s FinTech sector has matured over the past five years.

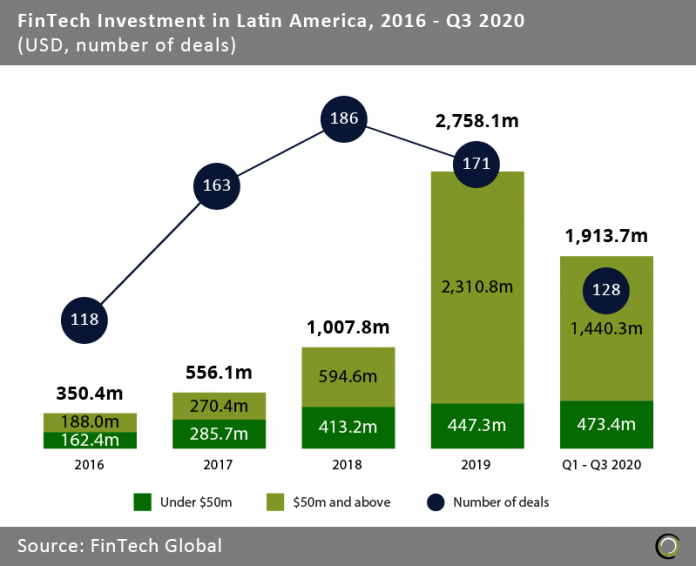

In 2016, the region’s FinTech industry secured $350.4m across 118 funding rounds in total, according to FinTech Global’s research. By 2019, that figure had skyrocketed to $2.75bn across 171 deals. Investment into the region seemingly cooled down in 2020, with it only raising $1.91bn across 128 rounds, representing roughly 89.6% of the total capital raised over the same period last year. However, while it’s hardly surprising that the coronavirus crisis would cool down investors’ interest of splashing out some more cash, that is still above the $1bn raised in 2018 across 286 deals.

There may also be reason to think that Covid-19 hasn’t struck the FinTech space in the region that badly. True, funding has slowed down. Although, you also have to recognise that the funding record reached in 2019 was fuelled by several large rounds worth over $100m, including Brazilian Nubank’s $400m Series F round, which placed the challenger bank firmly in the decacorn club of startups worth over $10bn.

When adjusting for these deals by excluding large rounds, funding coming from deals under $50m is already higher this year than the capital raised from transactions under that threshold during the whole of 2019.

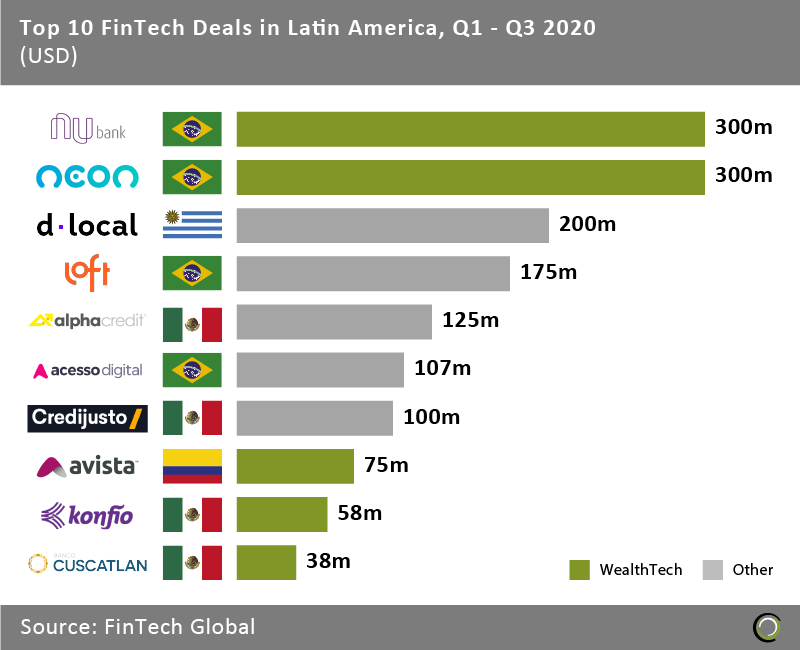

Looking at the biggest rounds in 2020 so far, it is clear that the WealthTech space is proving to be a big winner in Latin America. Those ten rounds raise nearly $1.5bn, making up 77.3% of the overall investment in the region during the period. Five of the companies in the top ten rounds this year has been in the WealthTech industry.

This is hardly surprising, given the opportunity for FinTech companies to provide services to underservered people in the region.

In short, things are looking promising for Latin America.

Open banking is the second area that may require some analysis following last week’s funding rounds. Last week, Tink raised a huge round, highlighting the maturiation of the Swedish FinTech ecosystem. The €85m round also demonstrated the growing acceptance of open banking across Europe.

“2020 has seen payments powered by open banking take-off and in 2021 we expect to see this scale – most prominently in the UK, followed by Europe,” said Daniel Kjellén, co-founder and CEO of Tink.

The concept of open banking was introduced in Europe as part of the EU’s Revised Payment Service Directive (PSD2).

Essentially, the concept would give customers more freedom to pick and choose between providers, whether they be incumbent banks or new FinTech startups. It would accomplish this goal by forcing financial services firms to share their current account holder data through application programming interfaces (APIs).

Supposedly, once users gave their permission, these APIs could be used by third parties such as neobanks and credit reference agencies to provide tailored services to consumers.

However, not everyone has been thrilled about the progress of open banking so far. Monzo’s founder and president Tom Blomfield famously said earlier this year that the “positive effect of open banking on innovation has been nil.”

“I don’t see any businesses based on open banking in Europe whatsoever,” he said.

Nevertheless, things seem to be changing. Monzo itself, despite Blomfield’s trepidation about the concept, did announce that it would introduce a new open banking feature in July. UK-based rival Revolut has also annouced its own open banking solutions.

Another key indicator that open banking is becoming reality is that Tink is not alone in having raised money this year. Open banking companies like Yapily and LUXHUB have also announced big funding rounds.

Moreover, the majority of European financial institutions are in general optimistic about open banking, according to a recent report from Tink.

So while it may have taken a bit longer than what some people may have wanted, open banking seems to be becoming more popular.

The third area for us to have a closer look at is teen-focused FinTech startups. Last week, Cleo raised a $44m Series B round. The startup has developed an app to make it easier for teens and young people to manage their finances. The round demonstrates that this segment of the industry is seemingly growing up.

Cleo is only the latest teen and millennial-focused FinTech to have completed big deals in 2020. For instance, investment app QUIN, InsurTech Urban Jungle and Justin Timberlake-backed neobank Step are just some of the startups in this segment of the industry to have raised fresh capital in 2020.

These rounds are not that surprising. It’s hardly a state secret that young people are driving the FinTech revolution. After all, challenger banks are more popular among younger generations than among baby boomers.

In fact, Revolut and Starling Bank have both launched services catering to young people this year. The services are marketed as tools to teach children how to manage their financial health. These accounts give parents more control and supervision over how kids spend their money. Although, both also have the benefit for the FinTechs that the accounts can be transformed into adult accounts once the teens come of age.

Moreover, speaking at the Sthlm Fintech Week earlier this year, Jeffrey Kim, vice president, head of Nordics and Baltics product at Visa, warned that if businesses don’t pay attention to the fact that millennials and Gen-Z are increasingly demanding seamless digital financial services, then they risk losing out on a lot of custom.

In short, neglecting to focus on the younger generation, whether through teen apps or more family-focused FinTech solutions, could prove a massive mistake.

Now, let’s take a look at the 32 rounds from last week.

Pico scores $135m in its Series C round

FinTech Pico has secured $135m in its Series C round. Intel Capital, EDBI and CreditEase Fintech Investment Fund backed to the cash injection. Pico aims to leverage the new capital influx and its new partnership to accelerate its global growth and expansion plans. Pico provides a portfolio of transparent, low-latency market solutions empowering companies to tap into financial markets around the globe.

Tink adds €85m in investment round extension

Open banking platform Tink has added another €85m to its coffers in a new investment round-extension. New investor Eurazeo Growth and existing backer Dawn Capital co-led the raise. Existing investors PayPal Ventures, HMI Capital, Heartcore, ABN AMRO Ventures, Poste Italiane and BNP Paribas’ venture arm, Opera Tech Ventures also contributed to the raise. Tink will use the money to expand further across Europe. The money adds to the €90m investment round Tink completed in January and brings the total invested in Tink during 2020 to €175m.

CRED said to raise $80m in round

CRED, which provides consumers with rewards for paying their credit card bills, has reportedly closed a new funding round on $80m. The Series C round was led by partners at existing CRED backer DST Global, according to a report from TechCrunch, which cites people familiar with the matter. Other existing CRED backers, including Ribbit Capital and Sequoia Capital, also contributed to the raise. This capital injection was raised at a post-money valuation of $800m. That valuation represents a massive increase, given it stood at $450m after CRED added $120m to its coffers in a Series B round completed in 2019.

Beyond Identity closes a $75m Series B round

In April, Beyond Identity came out of stealth with huge fanfare on the back of a $30m Series A round. The New York-based company is set up to put an end to poor password management. Now, not even nine months later, the company has closed another investment round, this time it secured $75m in a Series B capital raise. The latest round was backed by existing Beyond Identity investors, including New Enterprise Associates, Jim Clark and Koch Disruptive Technologies. Capital from the round will enable the RegTech to accelerate development of its platform. Beyond Identity will also strengthen its global expansion efforts on the back of the raise by investing in its distribution channels, increasing OEM partners and boosting international sales and support.

Bitso secures $62m funding round

Mexican crypto exchange Bitso has collected a massive $62m investment in a round led by QED Investors and Kaszek Ventures. Coinbase Ventures, the venture arm of crypto exchange Coinbase, and Pantera Captial also participated in the raise. Nigel Morris, co-founder and managing partner of QED Investors, and Nicolas Szekasy, co-founder and managing partner at Kaszek Ventures, are joining the Bitso board.

CHAI raises $60m in a Series B round

South Korean payments company CHAI has reportedly scored $60m in its Series B funding round, which will bolster its global expansion efforts. Seoul-based Hanwha Investment and Securities reportedly led the raise. It was supported by investors like SoftBank Ventures Asia, SK Networks, Aarden Partners, Hashed and other unnamed strategic backers. CHAI has established an import service empowering online businesses to accept more than 20 different payment options , including digital wallets, credit cards and more.

Squire Technologies collects $59m in funding

Squire Technologies, a FinTech platform designed for barbershops, has reportedly bagged $59m in its Series C round. ICONIQ Capital led the round, which was split between $45m in equity and $15m in debt financing. This fresh investment comes hot off the heels of its former round, which closed on $34m just six months ago, it said. The new investment also shoots the FinTech’s valuation by nearly three-times. Squire was valued at $85m in June, but the Series C investment brings its valuation to $250m. In the highly competitive world of FinTech, it seems like Squire is making the cut.

Orca Security nets $55m in its Series B round

Israel-based Orca Security made quite a splash last week after netting $55m in its Series B round. ICONIQ Growth led the raise, with contributions also flowing in from GGV Capital, YL Ventures, and Silicon Valley CISO Investments, and brings the RegTech’s funding to $82m over the past two years. The company previously raised $20.5m in its Series A earlier this year and closed its seed round on $6.5m in 2019. Funds from the Series B will be used to further Orca’s technology development and improving its capabilities.

Luko secures €50m Series B round

French InsurTech startup Luko has closed a €50m Series B funding round led by EQT Ventures. The company will use the money to fuel further development of its insurance solutions backed by social responsibility efforts. Existing investors Accel, Founders Fund, Speedinvest, and Orange Ventures also participated in the round. A smattering of angels with insurance and technology backgrounds, including Hippo Insurance co-founder and CEO Assaf Wand, also backed Luko’s Series B raise. The venture topping up its war chest came in tandem with the news that it will soon face increased competition as US InsurTech beheamoth Lemonade has announced plans to launch in France.

Neobank albo secures $45m round

Mexican challenger bank albo has secured $45m as plans on becoming the nation’s answer to Chime. Valar Ventures, Greyhound Capital, Mountain Nazca and Flourish Ventures backed the round. It will use the money to expanding its lending, insurance and its other services, similar to how Brazilian neobank Nubank, which raised a $300m round in September, has successfully done.

Gen-Z financial management app Cleo bags $44m Series B round

EQT Ventures, which we mentioned led Luko’s investment run, also supported Cleo’s $44m Series B raise last week. Cleo is the company behind a financial assistant app designed to help Gen-Z customers better manage their personal finances. EQT Ventures was joined by existing Cleo investors Balderton Capital, LocalGlobe and SBI. They join existing angel investors including TransferWise co-founder Taavet Hinrikus, GoCardless’ Matt Robinson, Wonga founder Errol Damelin, Skype and Atomico founder Niklas Zennström, Zoopla founder Alex Chesterman and Songkick founder Ian Hogarth.

Child-focused banking app gohenry closes $40m round

gohenry, a prepaid card that aims to help children build health financial habits, has collected $40m for its latest funding round. This capital injection was led by Edison Partner, with commitments also coming from Gaia Capital Partners, Citi Ventures and Muse Capital. UK-based gohenry is a digital banking solution, which includes a card and app, aiming to help parents educate their children about earning, saving, and spending money. The company aims to improve financial education for children between the ages of six and 18.

Outfund collects £37m in late seed investment

Fuel Ventures has led a £37m late seed investment round for Outfund, the startup helping online business scale without giving away equity. TMT Investment Force over Mass also participated in the raise. Outfund will reportedly use the investment to offer bigger chunks of investment into more enterprises as well as investing in new financial product and growing its team. It also committed to lending £100m to e-commerce and subscription-based businesses.

At-Bay secures $34m in its Series C round

Cyber insurance company At-Bay has raised $34m in its Series C round, which brings its total equity raised during 2020 to $74m. The fresh equity injection was led by Qumra Capital, with contributions also coming from Microsoft’s M12 fund, Acrew Capital, Khosla Ventures, Lightspeed Venture Partners, Munich Re Ventures and entrepreneur Shlomo Kramer. Capital from the round will enable At-Bay to increase the size of its team, launch new products, build digital collaborations and improve its automated underwriting capabilities.

Salt Security scores $30m in its Series B

API security company Salt Security has scored $30m in its Series B round, which was led by Sequoia Capital, marking its second funding round of the year. Other commitments came from previous Salt Security backers Tenaya Capital, S Capital VC and Y Combinator. Equity from the round will be used to support the company’s development in 2021, with a focus on boosting product development, sales and marketing, and customer acquisition.

Getsafe secures $30m Series B funding round

InsurTech startup Getsafe has secured $30m in funding through a Series B round led by Swiss Re’s digital platform iptiQ. The investment, which brings the total capital injected into Getsafe to $53m, was also backed by existing investors Earlybird, CommerzVentures, btov Partners and Capnamic Ventures.

Moov bags $27m Series A just months after closing its seed round

Moov Financial has closed a $27m Series A round, which comes just three months after it closed its $5.5m seed round. The capital injection was led by Angela Strange, Peter Levine, Seema Amble and venture capital firm a16z. Other contributions came from Gokul Rajaram and previous Moov backers Abstract Ventures, Bain Capital Ventures, Canapi Ventures, Commerce Ventures, Gradient Ventures, RRE Ventures, Uncorrelated Ventures and Veridian Credit Union. There were also an additional 27 angel investors participating in the round.

Unit closes $18.6m round

Unit, which enables companies to integrate banking features, has launched its services, alongside the close of an $18.6m round. The capital was supplied by Better Tomorrow Ventures, Aleph, TLV Partners, Flourish Venture, Operator Partners and a group of 30 angel investors.

Salty Dot comes out of stealth after $16m funding round

Embedded insurance technology company Salty Dot has launched out of stealth mode, alongside the close of a $16m funding round. The company offers a software-as-a-service solution that enables carriers and distribution partners to offer a personalised policy to insure a product or service in real-time during the purchase process. Its services are licensed in all 50 US states. With the capital from the round, the company hopes to extend its intelligent systems and continue to support recruitment of its distribution network.

IDnow closes a €15m growth investment from the ECB

Identity verification-as-a-service platform IDnow has closed a €15m growth funding from European Investment Bank. Capital from the investment will be used to support the RegTech’s research and development, as well as its international expansion efforts. Germany-based IDnow offers secure, digital identification and electronic signature services. Companies can use the platform to quickly onboard customers and manage transactions, whilst complying to know your customer and anti-money laundering regulations.

battleface scores $12m in its second fundraise of 2020

Specialty travel insurance provider battleface has netted $12m in its Series A funding round, which was supplied by US-based venture firm Drive Capital. The capital injection will support the InsurTech’s growth, market expansion and the establishment of its global headquarters in Columbus. It will also enable it to focus on expanding its B2B2C partnerships with custom built products for partners, as well as expand its B2C digital offerings in additional markets.

Neuro-ID secures $7m Series A funding round

Behaviour-as-a-Service company Neuro-ID has bagged $7m in a Series A funding round led by Fin VC and TTV Capital. Canapi Ventures also participated in the round. Founded in 2014, Neuro-ID solution analyses organisations’ behavioural data to detect signs of fraud and thus preventing it in real-time. It serves industry leaders in payments, lending, insurance and banking.

Valiu secures $5.25m in seed round

Money exchange platform Valiu has scored $5.25m in its seed round, as it continues its ambition of financially empowering people in Latin America. The investment was led by Blockchange Ventures and Pomp, with contributions also coming from Castle Island, Y Combinator, IDEO Colab, Mercy Corps and others. Valiu aims to democratise access to borderless digital dollars in Latin America. The FinTech leveraged the Venezuelan diaspora to expand in Latin America and offer a cross-border network.

ChannelVAS bags $5m in funding

FinTech company ChannelVAS has secured $5m in funding from investment firm Convergence Partners. ChannelVAS provides mobile financial services across Sub-Saharan Africa and beyond.

Upvest scores €5m in its Series A extension

Berlin-based plug-and-play pan-European securities API platform Upvest has scored €5m in an extension to its Series A round. The fresh equity was supplied by Earlybird and comes a year after the FinTech bagged €7m in its initial Series A round. Investors to the former capital injection included Notion Capital, HV Capital, Partech and a number of FinTech angel investors. Upvest’S Securities API is designed to transform the traditional securities infrastructure. Through a simple gateway API, FinTech organisations can develop and create investment products with greater flexibility.

Modularbank said to close its seed funding round on €4m

Modularbank, a banking software developer, has reportedly raised €4m in its late seed funding round. The capital infusion was led by Karma Ventures and BlackFin Capital Partners, with contributions also coming from Plug and Play Ventures, Siena Capital and Former Skype CTO Ott Kaukver. Estonia-based Modularbank plans to use this capital to expand into the UK as well as other countries in Europe. This will be supported by the launch of an office in the UK and growing its Berlin office to improve its reach in France, the DACH region and Southern Europe.

Payaut said to raise €2.6m in its latest equity investment

Netherlands-based automated payments company Payaut secured €2.6m in seed capital last week. Previous Payaut investor LocalGlobe led the round, with contributions also coming from Finch Capital, Entrée Capital and several unnamed angel investors. This equity infusion will enable the company to scale its payment service for online marketplaces and continue its European expansion, it said. Proceeds will also be used to expand the company’s product development team in the Netherlands.

Currencycloud invests £1.5m into its long-term remote working strategy

Currencycloud, an embedded cross-border solutions platform for financial services, is investing £1.5m into its new remote-first working strategy. With the pandemic forcing most businesses to adopt a temporary remote working system, Currencycloud is looking to make it more permanent. Under its new strategy, the FinTech is going to repurpose its London, New York, Amsterdam and Cardiff offices to be used for relationship building and collaboration, as opposed to open-plan working. The buildings will now be used at the employees’ discretion, with no set quota for when employees are required to be in the office.

CredPal raises $1.5m to scale the platform

Nigerian FinTech CredPal has secured $1.5m in funding to build the “American Express of Africa”. Y Combinator, GreenHouse Capital and insurer Tangerine Life as well as venture capital firms backed the raise.

NOW Insurance scores $1.25m in its seed extension round

NOW Insurance, an AI-powered platform that matches small business owners with affordable insurance, has scored $1.25m in its seed extension round. This capital injection was led by The MFO Group, and brings the total seed round to $2.5m. 8th Light was among the investors to the round. With the close of the round, the company is hoping to invest into its machine learning algorithms, expand its software engineering team and continue to build its products and service offerings for small businesses and professionals.

Rundit secures €1m in seed round

Finland-based FinTech company Rundit has secured €1m in its seed funding round, which will help it streamline investor reporting. The investment was co-led by two angel investors. With this capital injection, Rundit is hoping to scale across Europe and the US, whilst improving its offerings to investors. Rundit is a portfolio management and monitoring platform, which aims to make investor reporting easy and transparent so VCs and LPs can make better data-driven decisions.

OpenFin collects investment from SC Ventures

Digital operating systems developer OpenFin has closed a strategic investment from SC Ventures to support the development of new products. The value of the investment was not disclosed, but brings the FinTech’s total equity raised to $50m.

Copyright © 2020 FinTech Global