From GameStop chaos to how InsurTechs have benefited from the Covid-19 crisis, this is what you can learn from the 39 FinTech funding rounds of last week.

FinTech companies continue to make waves. The 39 ventures in the sector that topped up their accounts last week prove that.

However, even though we reported on the regular smattering of investment rounds in everything from online banking to cybersecurity last week, two segments of the industry stood out.

No matter how you cut it, last week was all about Robinhood and InsurTech. So, before we get into all the different funding rounds from last week, let’s talk a bit about why that is.

Robinhood stood out for a number of reasons. Firstly, it raised a whooping $2.4bn funding round last week, adding to the $1bn in emergency funds it had already raised in the previous week. Not only will the influx of fresh capital enable the WealthTech decacorn to continue to grow, but it is also a testament to the trust investors put into the stock-trading app.

The financial backing, notably, came despite Robinhood enduring two weeks of negative headlines and criticism after the venture was swept up in the chaos surrounding GameStop.

The trading turmoil began after amateur investors who were members of the WallStreetBets subreddit joined forces to bet on GameStop. Their actions went against the bets made by several institutional investors and hedge funds.

The incumbents had bet that the video game retail store would collapse, but when the price skyrocketed as a consequence of the actions of amateur traders, it made them lose billions of dollars.

The surge in trading made the GameStop stock value climb from just over $17 at the start of January to $347.51 at the trading chaos’ peak. It has now fallen again and was trading at $63.77 on Friday.

However, the increase of amateur investors betting on GameStop has also put Robinhood in the crosshairs of lawmakers and market experts.

On January 28, Robinhood restricted its users’ ability to trade in GameStop and other company securities associated with WallStreetsBets. These include Nokia, Blackberry and AMC.

Robinhood users were thus unable to buy more stock and were only able to close their positions. The WealthTech later explained that it had done so in order to ensure it could live up to its financial obligations as the trade increased. It would simply not have been able to afford it without introducing those restrictions.

Since enjoying the new cash injections, Robinhood has lifted the restrictions.

However, the restrictions caused a backlash from politicians on both side of the Congress aisle, with both Alexandria Ocasio-Cortez and Ted Cruz calling for an inquiry into Robinhood’s actions.

The chaos has also motivated the US government to move to ensure that a similar boom and bust doesn’t happen again.

Treasury secretary Janet Yellen has convened regulators to that affect and the government is reportedly exploring a crackdown on market manipulation and a tax on financial transactions.

The chaos has also put the finger on one of the problems of commission-free trading apps like Robinhood, with some investors liking it with gambling, with people betting on things without having the proper knowledge.

This issue has arguably been exacerbated by the Covid-19 pandemic. “[The] casinos are closed [and] a lot of sports are shut down,” as David Older, head of equities at Carmignac, explained the growth of amateur trading to the Financial Times.

Needless to say, Robinhood will continue to be in the headlines for some time yet.

Over to the InsurTech sector where Sidecar Health’s $125m Series C round proved to be the second biggest funding round we reported on last week. It also gave the InsurTech a valuation over $1bn, putting it firmly in unicorn territory.

But it wasn’t the only InsurTech venture to raise capital last week. Rhino, LeaseLock, DealerPolicy, Greater Than, INZMO and Eusoh were all companies whose cash injections FinTech Global reported on last week.

These rounds come after about a year after industry stakeholders, whilst worrying that some startups may have a harder time raising cash during the pandemic, argued that the Covid-19 crisis could trigger tremendous market growth for the InsurTech sector.

The argument was that the coronavirus fallout would prove to insurers that they had to digitalise their offering. This is something that the insurance industry has been sluggish to do, compared to other sectors.

The deals from the past seven days as well as the impressive growth of the market in the past 12 months may have proven them right.

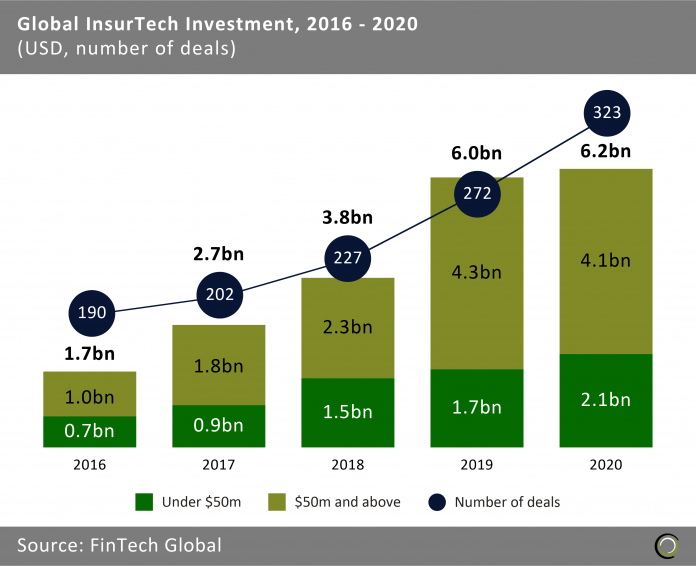

The global InsurTech industry has gone from strength to strength over the past five years. In 2016, the sector raised $1.7bn in total, according to FinTech Global’s research. By 2020, that figure had jumped to $6.2bn.

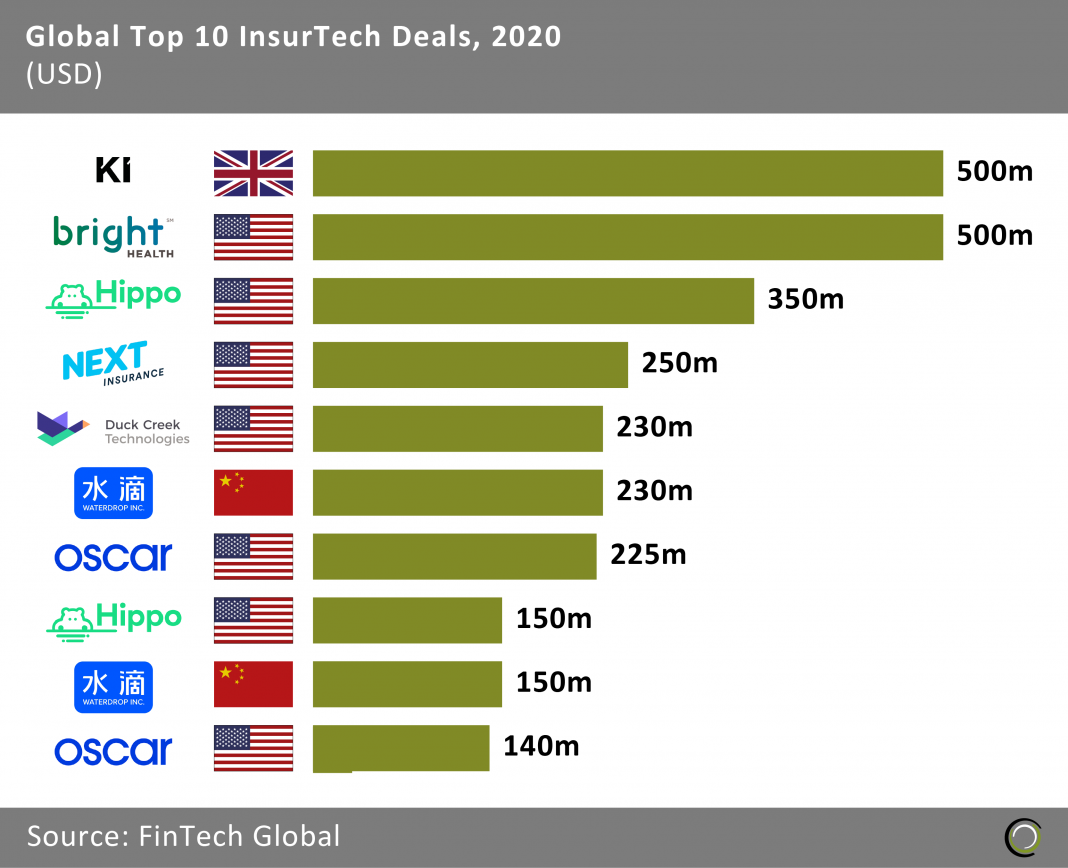

Still, the largest deal of the year was completed by UK-based Ki Insurance, which raised $500m in private equity from Blackstone Tactical Opportunities and Fairfax Financial Holdings.

US companies took two out of the top three deals via Bright Health and Hippo Insurance.

All in all, it seems as if the InsurTech industry has continued to enjoy growth despite the pandemic.

And now, let’s look at the different rounds raised last week in more detail.

Robinhood secures another $2.4bn

Retail trading app Robinhood has secured another $2.4bn. As mentioned above, this sudden capital raise came as a response to a surge of activity on the Robinhood platform. The app has seen a huge wave of investors buying stocks for companies including GameStop, putting the FinTech under a lot of pressure financially.

The capital injection will help it to build and enhance its products for consumers as well as invest into its financial literacy tools to help those new to investing better understand the ecosystem.

Sidecar Health raises $125m in Series C round

InsurTech company Sidecar Health has reached unicorn status after the close of a $125m Series C round put its valuation at $1bn. Capital from the round will be used to accelerate its growth and support the launch of its Affordable Care Act offering for federal and state exchanges. Funds will also be used to hire more staff and build new products.

The platform is currently available in 16 US states, but is hoping to continue its expansion efforts during 2021. Drive Capital led the raise with participation also coming from BOND, Tiger Global, Menlo Ventures, Cathay Innovation and GreatPoint Ventures.

Investing app Stash bags $125m in its Series G round

Stash, which helps Americans build diverse investment portfolios, has netted $125m in its Series G funding round after a record year of growth.

The FinTech managed to surpass five million customers and reach $2.5bn in assets under management in 2020. The company also witnessed a 100% increase in account opening times.

It claims that customers have earned around 23 million stock awards through Stash’s Stock-Back card, a debit card that rewards customers with pieces of stock when they buy products with select stores.

Eldridge served as the lead investor for the round, with additional capital coming from Owl Ventures, funds and accounts advised by T. Rowe Price Associates, Goodwater Capital, Entree Capital and others.

Dave secures $100m credit facility

American challenger bank Dave has received a $100m credit facility from Victory Park Capital. The capital injection will support the growth of its product development and its expansion of its service offering.

Dave was launched in 2017 with the aim of helping consumers avoid overdraft fees. Since then, the company claims to have become the third most valuable challenger bank in the US. It is not clear what Dave’s valuation is.

Rhino scores $95m investment

Rhino, which offers security deposit insurance policies, has collected $95m in its new funding round, which was led by Tiger Global Management. Funds from the round will be used to double its headcount to 200 and help it reach $500m in direct savings for renters.

This investment comes after a strong period of growth for Rhino. Over the past 18 months, the company has tripled the size of its team to reach 100 employees and expanded from 200,000 homes to over one million, it claims.

Furthermore, the company has witnessed a 1,500% growth in contracted annual recurring revenue, rising from $4m in January 2019 to $60m in January 2021.

LeaseLock holds $52m close for its Series B round

LeaseLock, an InsurTech platform for real estate, has closed its Series B round on $52m to help it expand its lease insurance product offering. Westerly Winds served as the lead investor, with capital also coming from SoftBank Ventures Asia, Vertex Ventures US, Liberty Mutual Strategic Ventures, American Family Ventures, Moderne Ventures, Strata Equity Group, Veteran Capital and Mucker Capital. To-date, the InsurTech has insured $1bn in leases across the US’s multifamily operators and preeminent asset owners, it claims.

Valon scores $50m in its Series A round

Valon, which aims to make the mortgage process easier and more transparent, has collected $50m in its Series A round. Andreessen Horowitz served as the lead investor, with participation also coming from Jefferies Financial Group, New Residential Investment Corporation, an affiliate of Fortress Investment Group LLC, and 166 2nd LLC. In line with the deal, Andreessen Horowitz general partner Angela Strange and Blend president Tim Mayopoulos has joined Valon’s board of directors.

Scalapay closes $48m investment round

Buy now and pay later solution provider Scalapay has scored $48m in a seed round of funding, continuing the recent surge of funding for these types of FinTechs.

The investment round was led by Fasanara Capital, with capital also coming from Baleen Capital and Italian Family Office Ithaca Investments.

Scalapay enables consumers to split up their payments into three easy instalments with zero interest. Through this capability, merchants can grow their sales, acquire new customers and offer better experience to customers.

Storfund said to raise $36.5m in fresh funding

Storfund, which helps retailers improve their e-commerce operations, has reportedly raised $36.5m in new funding. Swiss bank Union Bancaire Privée supplied the capital.

Capital will be used expand its operations and help more merchants get access to working capital loans, is said. The FinTech aims to help e-commerce companies to accelerate their growth. Clients can take control of their cashflow through access to working capital, and enables them to send money around the world.

Axoni nabs $31m in new funding

Financial market infrastructure platform Axoni has closed a $31m funding round from a wave of new strategic investors. The round was backed by first time investors Deutsche Bank, Intel Capital. and UBS. Previous Axoni investors Citi, Goldman Sachs, HSBC, J.P. Morgan, Nyca Partners and Wells Fargo also joined the round.

With the close of the round, the FinTech has raised a total of $90m in funding. Axoni plans to use the capital to expand its networks across asset classes and regions.

DealerPolicy raises $30m in Series B funding

DealerPolicy, an insurance marketplace for car dealerships, has bagged $30m in its Series B round, which will help it expand its team. The round was led by 3L Capital and Hudson Structured Capital Management. With the capital injection, the company plans to increase the development of its platform and hire more staff.

As part of the deal, Wayne Pastore has been named the InsurTech’s new president and chief operating officer and Tara Kasica as senior vice president of sales. DealerPolicy offers a choice-based insurance solution at the point-of-sale at car dealers. Var buyers can view multiple insurance quotes and connect with licensed insurance agents to buy a policy.

Narmi closes $20.4m Series A round

Digital banking solution developer Narmi has bagged $20.4m in its Series A funding round to help community banks and credit unions better compete against megabanks, challenger banks and FinTechs, it claims.

New Enterprise Associates acted as the lead investor, with other contributions coming from Patriot Financial Partners, Picus Capital, Contour Ventures and Firebolt Ventures. Additionally, executives from Plaid, Brex, Expanse, as well as other companies, also supplied capital to the round.

The FinTech has created an API-driven and cloud-based platform that enables financial institutions to leverage a range of tools to drive growth, deposits and efficiency. Some of its features include digital account opening, consumer digital banking, business digital banking and workflow management.

Greater Than completes $16m share issue

Swedish InsurTech company Greater Than has completed a directed share issue of around $16m. The share issue was entirely subscribed to new long-term shareholder Cuarto, a subsidiary in the Nidoco group. With the funds from the sale, the InsurTech hopes to scale further, accelerate its revenue generation and bolster its organic growth globally.

The company offers an actuarial pricing and risk predictions model, based on artificial intelligence. It leverages AI to offer future claims cost predictions, per the individual and aggregated for the sample.

Flink scores $12m in its Series A round

Flink, which offers an investment app, has scored $12m in its Series A round, which will help it expand across Latin America. The investment was supported by Accel, ALLVP, Raptor Financial Group, Clocktower Ventures, Kevin Efrusy and Oskar Hjertonsson.

Flink is available in Mexico, but the company hopes to expand across Latin America, including Colombia, Chile, Peru and Argentina. Part of the capital will be used to support its expansion across the region and getting licences in the various countries. Funds will also be used to continue improving user experience and product offering, as well as increasing its team size.

CybSafe said to close $7.9m Series A

Cybersecurity software platform CybSafe has reportedly netted $7.9m in its Series A funding round, which was led by IQ Capital. Additional contributions came from Hanover Digital Investments and B8 Ventures. Funds will be used to focus on expanding its enterprise and mid-market client base, the article said.

Founded in 2015, the cybersecurity company launched its services in 2017 and helps businesses safeguard their operations. Its behaviour-based model tracks user interactions and helps them improve their cybersecurity awareness to reduce the rate of incidents.

NymCard secures $7.6m in Series A round

Banking as a service startup NymCard Banking has bagged $7.6m in a Series A funding round. Shorooq Partners led the raise with participation with OTF Jasoor Ventures and VentureSouq. NymCard has now raised a total of $12m to date. Abu Dhabi-based NymCard delivers card-issuing and processing solutions for financial institutions, banks and fintechs in the region.

SecurityAdvisor closes $7.3m investment

Personalised security awareness platform SecurityAdvisor has scored $7.3m in its Series A funding round. The capital investment was led by ClearSky Security, with other participants including Crosslink Capital, SixThirty Ventures and Cyber Mentor Fund.

With the funds, the RegTech plans to deepen its product development and boost market awareness of its platform. SecurityAdvisor’s platform integrates within existing security infrastructure to offer targeted coaching to employees, helping them to get better at identifying and remediating cyberattacks.

Opyn said to raise $6.7m in its Series A

Opyn, which enables users to trade options on Ethereum, has reportedly received a $6.7m in its Series A funding round. Paradigm led the round, with a contribution also coming from previous investor Dragonfly Capital. With this capital, the company hopes to further the development of its gamma protocol and bolster the security of the platform. Furthermore, funds will be used to hire more staff for its research and engineering teams.

TrustLayer closes oversubscribbed seed round on $6.6m

Risk management platform TrustLayer has completed a $6.6m seed round. Abstract Ventures led the round with participation from Propel Venture Partners, NFP Ventures, BoxGroup and Precursor Ventures. BrokerTech Ventures, a group made of 13 insurance agencies in the US and 11 top-tier insurance companies, also committed capital.

TrustLayer also claims that 20 of the top 100 insurance agencies in the US, as well as their C-suite executives participated in the round. Some of the participating agencies include Holmes Murphy, Heffernan, M3, NFP and Graham Company.

We.Trade said to raise €5.5m in funding

Dublin-based We.Trade, which offers a blockchain-enabled trade finance platform, has reportedly collected €5.5m in funding. The capital was supplied by a consortium of 12 banks, which includes HSBC, Santander, KBC and Deutsche Bank. IBM was also among the investors to the round. Funds from the round will be used to support product development and increase sales activity, it said.

Balance raises $5.5m seed round

B2B payments FinTech Balance has secured $5.5m in seed capital from Stripe, Tal Morgenstern of Lightspeed, and Max Levchin through his SciFi VC. Balance is set up to offer B2B payment methods for merchants, enabling them to offer a variety of payment methods including automated clearing house and bank wires as well as a variety of payment terms

Banxware secures €4m in seed funding round

Berlin-based Banxware has closed a €4m seed funding round hot on the heels of its December launch. The embedded finance FinTech is set up to offer loans to SMEs, in partnership with marketplaces, payment providers and others. Pomelo Pay and Artificial investor Force Over Mass led the round together with VR Ventures. HTGF and a smattering of private investors also joined the raise. Banxware will use the money to fuel the further development of its solution and to grow its team.

Casa scores $4m round

Casa, which offers a secure location to store bitcoin, has reportedly netted $4m in its seed funding round. Avon Ventures acted as the lead investor, with additional contributions coming from Tioga Capital, Castle Island, Cadenza, Champion Hill, Compound VC, Precursor, Lerer Hippeau and Coinbase Ventures. This capital infusion will enable the company to extend its market reach and build new products.

Vested Finance scores $3.6m in its seed round

Online investment platform Vested Finance has scored $3.6m in its seed round, which will help it hire talent across the US and India. The round was supported by Moving Capital, Ovo Fund, TenOneTen Ventures, Inflection Point Ventures and Venture Catalysts.

Funds from the round will be used to accelerate the product development and hire staff across its US and Indian offices. The Silicon Valley-based FinTech enables Indian investors to invest in the US stock market. The zero-commission online platform requires no minimum balance and enables users to invest in US stocks within minutes. Users can back individual stocks or ETFs, or choose a curated portfolio.

Routefusion bags $3.6m to aid its product expansion

Routefusion, which enables companies to embed cross-border payments within their applications, has scored $3.6m in its seed round. Silverton Partners served as the lead investor, with additional commitments coming from Initialized Capital, NextWorld Capital and Plaid co-founder William Hockey.

Based in Texas, the company plans to use the capital to support its product expansion, build new global banking partnerships and expand its current partnerships with AFEX, MoneyCorp, Cambridge, Tempus, ReserveTrust, Nium and Buckzy.

Millions raises $3.3m seed round

Millions, a FinTech handing out free money through a lottery, has reportedly raised $3.3m in seed funding. Contributions to the seed round came from Giant Ventures, 8VC, Supernode, Twitter co-founder Biz Stone, Italic CEO Jeremy Cai, Allbirds co-founder and CEO Joey Zwillinger, Casper co-founders Neil Parikh and Luke Sherwin, and a number of other angel investors.

Crush Capital collects $3.25m

Crush Capital, which helps retail investors support IPOs, has collected $3.25m in its seed round to support its growth in the US. The oversubscribed round was supported by over 30 angel investors, including Backstage Capital managing partner Arlan Hamilton, Tory Burch co-founder Chris Burch and Acorns co-founder and chairman Walter Cruttenden. Crush Capital claims to be the only company in the US to have signed a distribution deal for an original series that allows viewers to invest in IPOs.

INZMO said to raise €3.1m in its seed round

German InsurTech company INZMO has reportedly netted €3.1m in its seed round to support its aim of simplifying the insurance process. The round was led by Change Ventures, with contributions also coming from Helvetia. INZMO plans to use the capital to double its headcount, accelerate product development and design a range of new insurance products for its customers.

Policies available on the platform include protection for rental, mobile phones, laptops and tablets, and bikes. Through the mobile app, consumers can easily monitor their insurance cover, with the ability to quickly report any damage and get real-time updates on the claim progress.

Twinco Capital secures €3m in new funding round

Supply chain finance FinTech Twinco Capital has raised €3m in a new funding round. +Simple investor Mundi Ventures led the startup’s investment round with participation of Finch Capital and a smattering of unnamed angel investors, TechCrunch reported. Finch Capital has previously backed enterprises like Goodlord and PerfOps. Founded in 2016, the Spain and the Netherlands-based venture offers a solution to make it easier to access supply chain funding.

Cowrywise said to raise $3m in its pre-Series A round

Nigerian FinTech company Cowrywise has reportedly raised $3m in its pre-Series A round, which was led by Quona Capital. Other participants of the round include Tsadik Foundation, Gumroad CEO Sahil Lavingia and a group of angel backers.

Funds will be used to help Cowrywise to expand its product offering, help more fund managers in Nigeria and enhance its investing infrastructure. The mobile app provides consumers with a tool to plan, save and invest their money. Through the app, a user can plan for their future and the various milestones along the way, such as housing, education, family and retirement.

DynaRisk extends seed round to now totalling over $3m

Cyber-risk management startup DynaRisk has extended its seed funding round, bringing the total funding raised to over $3m. Nexus Investments led the round with participation from existing investors Insurance Capital Partners and Jonathan Marland. The company was originally backed by London based Cylon Lab.

GajiGesa Indonesia raises $2.5m in seed funding

GajiGesa Indonesia, which helps consumers improve their financial wellness, has netted $2.5m in seed funding. The round was backed by defy.vc, Quest Ventures, Next Billion Ventures, GK-Plug and Play Indonesia, Alto Partners, Kanmo Group and a number of unnamed angel investors. Based in Jakarta, the company enables employers in Indonesia to offer financial wellness services to their staff. Founded in 2020, GajiGesa offers a selection of tools, including early access to earned wage, financial education and other financial management tools.

Ben said to close $2.5m round

UK-based employee benefits platform Ben has reportedly collected $2.5m in funding. Cherry Ventures and Seedcamp served as the lead investors, with commitments also coming from a series of angel investors. Among the angel backers are Indeed founder Paul Forster, TransferWise founder Taavet Hinrikus, Index Ventures partner Carlos Gonzalez-Cadenas, Nested Founder Matt Robinson and Workday vice president of engineering Philip Reynolds.

The company empowers businesses to give each of their employees a range of benefits that meets their needs. Ben works with existing benefits systems and gives them flexibility so employees can pick which ones they want.

Payflow said to close €2m in its seed round

Spanish FinTech company Payflow has reportedly added additional funding to its seed round, bringing the total to €2m. The round was backed by Wayra, Zone2boost and Plug & Play. With the equity, the company will further its growth and bolster its position in the market. Founded in 2020, Payflow is an employee benefits platform which gives consumers early access to their salary.

Eusoh closes $1.3m round led by Insurtech Gateway

InsurTech startup Eusoh has secured $1.3m in an investment round led by Insurtech Gateway alongside Sure Ventures. Eusoh was founded in 2017 and has developed a new model to offer customers the same protection as best in class insurance products, but at a lower price. The InsurTech venture has already launched its pet insurance products in the US and boasts having achieved 50% savings for customers in their first year.

DigiKhata wins $93,632 grant

DigiKhata has won a $93,632 grant in the Karandaaz Financial Inclusion for Women Challenge 2020. The Pakistan-based FinTech is created to empower women-led SMEs with tools to record and recover credit and enabling financial services. DigiKhata provides its service on the web and on an app.

BukuWarung has raised another funding round

Indonesian FinTech BukuWarung has raised an undisclosed funding round said to bring the total invested into the Indonesian FinTech to $20m. Rocketship.vc and an Indonesian retail conglomerate backed the raise.

Dellfer receives investment

Cloud security platform Dellfer has received an equity injection from cybersecurity-focused investor Option3Ventures. Dellfer specialises in cloud-based cybersecurity, IOT and automotive software. The security-as-a-service platform has real-time code-level cyberattack visibility, enabling clients to identify the origin of the attack, improve detection capabilities and simplify threat tracking and management.

Stratis collects investment from Alphabit

Blockchain-as-a-solution provider Stratis has secured an investment from digital asset investment fund Alphabit. With the support from Alphabit, Stratis hops to improve the development of its solutions and increase the onboarding of blockchain solutions in the global market. Stratis claims to make decentralised adoption of blockchain services much simpler.

Copyright © 2021 FinTech Global