Of the 41 FinTech investment deals last week, companies in three sectors, in particular, proved to be exceptionally successful as the list of FinTech unicorns continues to grow.

While it’s been a week of massive investment rounds, with startups like Fireblocks, Payfit, and many others raising significant figures, it was the payment, cryptocurrency infrastructure and cybersecurity sectors that garnered the most capital.

For instance, the two biggest funding deals last week were raised by payment firms SumUp and Stripe, raising €750m ($895m) and $600m, respectively.

Last week was all about card payments company SumUp whose €750m debt financing is something to behold. It is one of the biggest rounds raised by a private European tech company to date. With capital flowing from Goldman Sachs, Temasek, Bain Capital Credit, Crestline and funds managed by Oaktree Capital Management, the firm now plans to keep expanding its product suite in the 33 different markets it is available in, therefore strengthening its position against competitors like Square and PayPal.

To add on, having previously bought businesses such as Danish invoicing platform Debitoor, ecommerce platform Shoplo, point-of-sale software provider Goodtill and Lithuanian mobile banking platform Paysolut, SumUp will pump some of the capital to close more acquisition deals, it said.

The London-based FinTech helps businesses of all sizes receive payments more efficiently both in-store and online. While it has been tight-lipped about its total valuation, rumour has it the firm surpassed the $1bn valuation milestone in 2019.

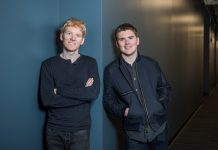

Stripe, which fell short of reaching the hectocorn status despite its $600m round, was the second biggest funding round of the week. Its valuation now stands at $95bn, triple the figure since the last year’s funding round. The latest round saw Stripe overtake Elon Musk’s SpaceX, which is valued at $75bn.

Backers in Stripe’s Series G round included Allianz via its Allianz X fund and AXA, along with Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital and Ireland’s National Treasury Management Agency.

Although the FinTech firm continues to be silent on user numbers, revenue and profit, as well as its potential plans for an IPO, more than 200,000 new European companies signed up to the platform for a year. Stripe president and co-founder John Collison even went as far as to claim that the firm handled almost 5,000 requests a second in 2020, for services including payments, refunds and customer data checks among other queries.

Stripe aims to use the latest cash injection to scale its European operations, especially at its Dublin headquarters, to meet the growing demand for its services. There have also been talks about the FinTech possibly foraying into the InsurTech sector.

Europe has indeed been home to a slew of successful FinTechs in the payment sector with startups such as Checkout.com, Adyen and Revolut scaling up.

The aforementioned rounds clearly show that the PayTech industry is alive and on an upward trajectory. For starters, buy-now-pay-later provider Klarna’s valuation skyrocketed to $31bn making it Europe’s most valuable privately-owned FinTech after it completed a $1bn funding round this month.

Furthermore, the top ten PayTech deals globally in 2020 raised nearly $5.3bn, making up 44.5% of the overall investment in the FinTech sector. Payment app Gojek secured the largest round, in a whopping $1.2bn Series F led by Mitsubishi Corporation and Visa.

However, recent studies show that there are signs that the PayTech boom might be cooling down as investments in the sector globally recorded the lowest funding levels last year since 2017. PayTech companies raised over $11.8bn in 2020, a decline of 13.19% year-on-year compared to 2019 according to FinTech Global’s research.

The drop in funding can be attributed to the global remittance industry’s 20% decline in 2020, which was caused by the Covid-19-induced economic crisis. While arguably virtual payments, remittances and no contact POS post the pandemic have been in demand, the decline in total funding and the low number of deals signals that investors are hesitant to take any risks or make new large investments.

The drop came after several years of substantial growth. The sector only attracted $9.7bn in funding in 2016. Fast-forward to 2018 and that figure jumped to $24.6bn.

Nevertheless, others are predicting that the PayTech sector will continue to grow once companies are more confident. In fact, the global payments market is expected to reach $2tn by the end of 2025, with a compound annual growth rate of 7.83% according to a report by Valuates.

While it might seem worrisome, many remain optimistic about the payment sector.

Now, let’s talk about the cryptocurrency space. Contrary to the PayTech sector, a deluge of startups have hit the market, as the volatile price of bitcoin continues to attract more investors. It’s therefore easy to see how companies like Bitpanda achieved the unicorn status after a massive $170m funding round.

With this round and its $52m Series A in September last year, the Vienna-based neobroker marked its position as Austria’s first unicorn. While it started with crypto trading, the firm aims to become a pan-investment platform and make it easier to invest in not just in bitcoin and other digital assets but also gold as well as ETFs and fractional trades.

The investment was led by Valar Ventures, with participation from DST Global – the firms which also co-invested in cryptocurrency financial services provider BlockFi in a $350m round the previous week.

Bullish about the firm’s growth, Bitpanda co-founder Paul Klanschek said, “Very soon we will cross the €100m revenue mark for the first few months of this year.”

He noted that for many, investing in bitcoin is not too distinct compared to the stock market. Apps like Robinhood, Square Cash and Bitpanda have made it easier for newbies to engage with crypto and other trading by lowering the minimum investment amount therefore aiming to encourage more people to use their money smartly.

Although, Bitpanda is not the only crypto trading solution riding the bitcoin wave. Many startups around the world are actively offering services to help banks keep up with the trend of digital assets. More recently, digital currency exchange Coinbase filed for a direct listing which might value it at circa $100bn.

Transak, FalconX, Fireblocks and Efficient Frontier were among other crypto-focused companies whose cash injections FinTech Global reported on last week.

Elsewhere, continuing the growth from the previous week, the cybersecurity sector saw more investment to prove that the industry is indeed heating up. Clearly, the rising number of hack attacks, phishing schemes and other financial crimes have forced companies to ramp up their defences against bad actors.

One of the most eye-catching rounds was raised by identity verification and risk management firm Socure, which snagged $100m taking its valuation to $1.3bn, therefore, adding it to the list of new unicorns last week.

The round led by Accel received additional backing from Citi Ventures, Wells Fargo Strategic Capital, Commerce Ventures and others. Founded in 2012, Socure leverages artificial intelligence and machine learning where its predictive analytics platform correlates over 300 data points to provide a detailed view of fraud risk.

By using Socure, B2C enterprises can achieve KYC auto-approval rates of up to 97%, as well as identity and synthetic fraud capture rates of up to 90%, it claimed.

Alongside Socure, in the past seven days, FinTech Global reported how other startups in the sector such as Cylera, Seon, FiVerity, Vulcan Cyber, SecurityScorecard, HeraSoft, LoginID and Cyware topped up their accounts with new funding. In fact, the ID verification sector is estimated to grow from $7.6bn in 2020 to $15.8bn by 2025, making it an attractive sector for more startups to scale up.

However, despite the rising cyber threats caused by Covid-19, investments in the cybersecurity sector paint a lacklustre picture for the industry. Businesses in the cybersecurity space only reached $700m in the second quarter, representing a decline of over 60% from the first three months of 2020, according to FinTech Global’s research. The key reason is being attributed to investors and businesses’ reluctance to invest in cybersecurity infrastructures at a time when overall revenues are getting compromised in the wake of the pandemic.

Joining Bitpanda and Socure in the unicorn league was InsurTech Coalition after its valuation hit $1.75bn thanks to the new funding round.

The California-based security company raised $175m in funding led by Index Ventures, with participation from General Atlantic and existing investors. The company intends to use the funds to accelerate growth and global expansion and extend its product line, to address a range of risks facing the modern enterprise — many of which are not well covered by standard business insurance policies, it said.

Boasting over 42,000 customers, Coalition provides cybersecurity tools at no cost to prevent losses, incident response services to contain them and comprehensive insurance to help organisations recover from failures and breaches.

Seemingly, Covid-19 continues to affect the FinTech industry. Now, here are the other rounds we reported on in the last week which you should know about.

SecurityScorecard’s massive $180m Series E round becomes soonicorn

SecurityScorecard, platform for predicting and remediating security risks, raised $180m in a Series E funding round backed by Silver Lake Waterman, Intel Capital, NGP Capital, AXA Venture Partners and Google Ventures among a list of other investors.

The latest round, which totals its funds raised to $290m to date, sets a valuation of close to $1bn for the New York-based company. Currently, it says that nearly two million organisations are monitored and rated by SecurityScorecard daily.

The company intends to use the funds to accelerate global expansion and corporate growth with planned investments across new product lines and additional functionality to assess and mitigate cybersecurity risks.

Crypto firm Fireblocks hauls in $133m

NYC-based crypto infrastructure provider Fireblocks raised $133m in a Series C funding round led by Coatue, Ribbit, and Stripes with strategic investment from The Bank of New York Mellon and SVB and participation from previous investors, including Paradigm, Galaxy Digital, Swisscom Ventures, Tenaya Capital and Cyberstarts Ventures.

The company, which has raised a total of $179m to date, intends to use the funds to expand global resources to service banks and FinTechs and connect them to the entire crypto capital markets.

French FinTech PayFit gets $107m in a Series D round

The company payroll finance firm secured $107m in a Series D investment round with Eurazeo Growth and Bpifrance’s Large Venture leading the way. Existing backers Accel, Frst and Xavier Niel also contributed to the round.

Offering payroll and human resources automation, PayFit helps firms streamline a variety of workflows, including exporting payroll data to accounting software, payslip creation and insights into benefits payments like health insurance, all while remaining compliant with continually changing regulations. It also introduced support for employee expense management, with the ability to automate reimbursements. The new funding will support PayFit’s growth trajectory through the addition of new employees this year, the firm said.

Illuminate Financial scores cash from JP Morgan, Barclays in $100m round

London-based VC firm Illuminate Financial closed a massive $100m round with backing from JP Morgan Chase and Barclays.

The fund was launched in early 2019 before closing in January 2021. “It has been a true fundraising marathon with Brexit deadlines and Covid shutdowns being major events outside our control that we had to contend with,” the firm said in a blog post.

Founded in 2014 by Mark Beeston the VC firm aims to focus on backing software companies that provide services to big financial institutions.

InsurTech PolicyBazaar rakes in $75m to fuel growth in the Middle East

India-based insurance firm PolicyBazaar secured $75m in a new round led by Falcon Edge Capital along with Temasek, Steadview Capital, Ribbit Capital and True North among other investors.

The unicorn plans to build motor, health and life insurance product categories in the UAE region. So far, it claimed it sold a sum assured worth $100m through its term life insurance products and intends to scale this figure to $1bn in the next 12 to 18 months, it said.

Berlin-based FinTech MODIFI secures $60m

Berlin-based FinTech firm MODIFI secured $60m from Silicon Valley Bank, bringing its total capital to $111m.

MODIFI fronts money for SMEs, buyers or sellers, to pay or receive payments for their invoice, with payments due 30, 60 or 90 days later, or outstanding invoices as soon as vendors ship the goods, respectively.

The funding is expected to address increased demands in existing marketing, as well as continue growth and market penetration, primarily in the US.

Tiger Global backs $50m round in crypto firm FalconX

San Francisco-based cryptocurrency financial services company FalconX secured a $50m investment round led by Tiger Global and B Capital Group. With this round, the firm’s total funds raised comes to $67m in known funding following the $17m seed round last May.

The crypto-focused company aims to provide financial institutions with the tools for trading, credit and clearing.

Over the past year, the startup grew its net revenue 46 times, it claimed, adding that it was due to “increased demand for cryptocurrencies from institutional investors seeking an inflationary hedge in an unprecedented macroeconomic environment.” The new funds will also be used to build out the team and expand business lines.

Pollinate bags $50m in a Series C to expand to North America

UK-based Pollinate closed a $50m Series C funding round led by Insight Partners, the global venture capital and private equity firm. Other participants included its existing investors NatWest Group, Mastercard, National Australia Bank, EFM Asset Management and Motive Partners.

The investment signals Pollinate’s further global expansion into North America where it plans to sign partnerships with various banks to enable them to create data-driven experiences for business customers. Additionally, the funding seeks to accelerate the expansion of Pollinate’s white-label marketplace offering to meet the needs of banks’ small and medium-sized business customers.

Banks using Pollinate are able to offer businesses a one-stop-shop for accessing capital, taking payments, setting up rewards programs, marketing tools and insights.

Genesis raises $45m in Series B led by Accel

London-based Genesis, a low-code platform for financial markets, raised a $45m series B led by Accel. New investors GV and Salesforce Ventures joined the round along with existing investors Citi, Illuminate Financial and Tribeca Venture Partners.

Genesis has now raised $50m since its first external capital injection in November 2018. The startup will use the investment to further the development of its platform’s core technology as well as to bolster sales and marketing.

The company helps financial institutions build new applications faster and with Genesis Application Library, which offers products ranging from interest rate pricing to a wealth management portfolio structuring product.

Cybersecurity company Cyware collects $30m in new Series B round

NYC-based virtual cyber fusion provider, Cyware raised $30m in Series B funding.

The round, which brought total funding raised to date to $43m, was led by Advent International through Advent Tech, as well as Ten Eleven Ventures, with participation from previous investors, including the Prelude Fund, Emerald Development Managers, Great Road Holdings and Zscaler.

The company will use the funds to double down on product innovation, increase recruitment across all departments and expand its global sales and channel programs.

Brim’s investment round overflows with a $25m round

Toronto-based FinTech Brim Financial closed on a $25m Series B round co-led by Desjardins Group and EPIC Ventures with participation from goeasy Ltd., White Owl and Impression Ventures. The company which issues credit cards as part of a platform as a service enables banks, credit unions and large commercial partners to roll out financial products, credit cards and integrated buy-now-pay-later tools.

Commenting on the round, CEO and founder of Brim Financial Rasha Katabi stated that it’s more important now than ever to power banks with better tools. “Today’s digital environment has brought a new sense of urgency for institutions to assess how they will interact with their customers,” he said.

Payments and financial services solution Zeller secures a $25m round

Australian FinTech company Zeller brought in $19.4m in a Series A round led by Addition. Coming out of stealth last July, the firm offers integrated payments and financial services tools for business banking. It intends to use the funds on product development, marketing and sales functions, as well as building a local customer success team.

The company claims the Series A raise is one of the largest ever for an Australian company’s pre-launch.

According to Lee Fixel, founder of Addition, “There is an immediate and significant opportunity to disrupt traditional business banking, and Zeller has the experience, integrated suite of products, and strategic vision to provide a viable alternative to the status quo.”

Kuda hauls in $25m to make digital banking more mainstream in Nigeria

Nigeria-based challenger bank Kuda, raised $25m in a new round with the aim to provide a modern banking service for Africans. The Series A funding led by Valar Ventures, with Target Global and other unnamed investors comes just four months after Kuda raised $10m in a seed financing round.

The company’s plan is to use these new funds to continue expanding its credit offerings, build more services for businesses, add in more integrations and explore more markets. Since launching in September 2019, Kuda has provided consumer and business banking services to over 600,000 Nigerians.

Vulnerability remediation platform Vulcan Cyber snags $21m in a Series B

Israel-based Vulcan Cyber closed a $21m Series B led by Dawn Capital with participation from Wipro Ventures and existing investors YL Ventures and Ten Eleven Ventures.

The cybersecurity company offers a free risk-based vulnerability management platform and layers an added remediation orchestration feature that allows IT to fix issues. The company grew its annual recurring revenue by 500% in 2020.

The company intends to use the funds to enhance direct sales, expand its channel program and managed security service provider relationships and enhance its freemium strategy with Remedy Cloud, a free database of vulnerability intelligence. It also plans to introduce Vulcan Free, a free risk-based vulnerability management platform for vulnerability and cyber risk prioritisation.

FinTech Immediate bags $15.5m to help employees manage their money

With the aim to help more employees overcome the challenges and burdens of financial stress through elective access to earned pay, financial wellness firm Immediate scored $15.5m capital.

Split between growth equity and working capital, the fundraise involved a diverse group of investors including Rockledge Capital. The cash injection will be used to continue its accelerated growth path in the foreseeable future.

Mexican challenger bank Fondeadora adds $14m to its Series A

Mexican digital bank Fondeadora topped its Series A funding round with an additional $14m. It previously raised $14m in August 2020, bringing the Series A total to $28m.

The extension comes from existing investor Gradient Ventures and new investor Portag3, plus contributions from angel investors Gokul Rajaram and Anatol von Hahn.

Aiming to democratise personal finance in Mexico and digitalise the system, neobank Fondeadora’s platform is free to use and operates with an app and debit card. More recently, the company launched a card without any personal info or card numbers with a QR code on the back. which can be scanned to pay and receive money.

Cognism raises $12.5m to foster its European expansion

Compliance prospecting solution, Cognism scored $12.5m in funding round led by AXA Venture Partners and joined by Swisscom Ventures.

The capital will support Cognism in its plans to expand further across Europe and consolidate its position as a leading provider of compliant and intelligent B2B contact data. Its AI technology solution makes the process of finding the right prospect faster, more accurate and compliant. January 2021 saw record-breaking growth for the company as its revenue for the month surpassed $1m for the first time.

Seon raises a $12m funding in series A led by Creandum

Seon successfully raised $12m in the Series A funding round making it one of Hungary’s largest series A rounds to date. Led by Creandum which has backed tech companies like Spotify, Klarna and Kahoot, the funding will help the cybersecurity firm to work with neobanks and companies in the esports, gaming, Forex and crypto trading sector in a bid to help them battle online frauds like fake accounts.

With a clientele in the likes of Patreon, AirFrance, Rivalry, and Ladbrokes, the firm heavily focuses on social media accounts to eliminate accounts that appear to be owned by fraudsters and imposters.

InsurTech Asteya starts off its journey with $10m round

Miami-based income insurance distribution startup Asteya whose declared mission is to provide financial health and wellbeing by transforming the disability insurance space, announced its launch alongside a $10m fundraise. Investors include I2BF Ventures, Capital Factory among other angel investors.

Founded by CEO Alex Williamson, the former chief brand officer at Bumble, the company will be working with A-rated carriers including Munich Re and certain underwriters at Lloyd’s.

Commenting on the launch and funding, Williamson said, “For so many of us, our income and wellness are intertwined—and yet there are not enough solutions for when the unexpected happens. Asteya is designed to empower people for the way we work and live today.”

Cybersecurity firm Cylera scores $10m

NYC-based cybersecurity and intelligence company, Cylera secured $10m in Series A funding.

The round, which brought total funding to $17m, was led by Concord Health Partners and Maverick Ventures with participation from Concord Health Partners, Maverick Ventures, Contour Venture Partners, Red Bear Angels and Samsung NEXT among others.

The company intends to use the funds to expand its presence into new global markets through strategic channel partners, extend the technology into new verticals, boost its teams across research and development, channel support, customer success, sales and marketing over the next six months.

Lendo closes a $7.2m Series A round

Saudi-based shariah-compliant FinTech firm Lendo, which targets SMBs with crowdsourced invoice financing, has raised $7.2m in Series A funding from Derayah Ventures. The crowd-lending marketplace allows companies to upload invoices to the platform and access short-term funding of up to $800,000 alongside digitally pre-finance their outstanding invoices.

Founded in 2019, Lendo offers loans starting from about $27,000 going up to $800,000 by connecting SMEs with investors. CEO and co-founder of Lendo Osama AlRaee plans to scale up the startup after it saw an upward graph last year. He said, “Since our launch, it is noteworthy that we were able to finance more than 100 invoices worth more than SAR 60 million to SMEs and give back more than SAR 3,000,000 to our investors in profit, with more profit distribution in the pipeline.”

Authentication provider LoginID closes a $6m seed round

California-based LoginID raised a $6m seed round led by Fabrice Grinda from FJ Labs alongside several FinTech entrepreneurs and former investors in Mobeewave. The company intends to use the funds to accelerate the adoption of its passwordless solutions.

LoginID adds biometrics security features to websites, applications and e-commerce platforms therefore avoiding potential bottlenecks in the datacenter. It’s APIs and SDKs give enterprises the ability to integrate FIDO-certified authentication in less than 15 minutes.

DIEM nets $5.5m in seed funding

UK-based circular economy-oriented FinTech startup DIEM raised a seed investment round of $5.5m. The new cash injection will boost DIEM’s acceleration plans in expanding its consumer base both in the UK and the pan-European region.

The investment round was led by Fasanara Capital and supported by Chris Adelsbach, founder of Outrun Ventures. Additional investors included Andrea Molteni, an early investor in Farfetch.com, Ben Demiri, the co-chairman at fashion tech PlatformE and Nicholas Kirkwood.

Capdesk banks £5m as its Series A fundraise totals £8m

Equity management platform Capdesk secured £5m in a Series A extension, led by Fidelity International Strategic Ventures and MiddleGame Ventures, to give it a total of £8m.

Including the new funding, the company has raised circa £11.7m since its inception in 2015. Capdesk enables founders, employees and investors to digitise their equity, options and warrants transactions, giving shareholders access to a private secondaries market via a partnership with the Seedrs crowd-equity platform. The company said the new funding will help it to build a ‘seed to post-IPO’ equity platform for a traditionally underserved European space.

HeraSoft raises $5m in Series A funding

Oklahoma-based blockchain startup focused on cybersecurity HeraSoft raised $5m in Series A funding led by United Capital Management of Kansas.

The firm aims to develop its ransomware-proof solution for enterprises as well as support companies and government organisations to secure their cloud-based systems against ransomware and other cyber attacks.

Given how ransomware attacks specifically are estimated to cost the world $20 billion, with an attack executed against a business every 11 seconds, cybersecurity investment is slowly becoming a priority for most companies, it said.

Lending firm Indifi nabs $5m in debt financing

India-based online lending platform Indifi Technologies, which enables credit for small businesses, secured $5m in debt financing from IndusInd Bank Ltd, with a guarantee from US International Development Finance Corporation.

These funds will be used for onward lending to small businesses to accelerate post-COVID economic recovery.

Equipped with its objective of addressing the SME financing gap in India, Indifi has disbursed 30,000 loans across 12 industries since its inception, actively leveraging its network of 20 lenders.

upSWOT banks $4.3m to help SMBs with financing

Fintech platform upSWOT raised $4.3m in seed funding led by Common Ocean Ventures. The North Carolina-based company enables banks to serve small and medium businesses by connecting and collecting data from more than 120 business software tools such as Quickbooks, Xero, Salesforce, Amazon, eBay, Shopify, Freshbooks, Sage among others.

SMBs can track business operations through KPI dashboards, real-time insights and get automatic alerts as their bank partners obtain actionable data to engage and help accelerate growth. The new funding is intended for its ongoing US expansion, hiring new staff and product development.

DepositLink raises $3.5m to ease payments for real estate firms

Boston-based provider of electronic payments for residential real estate transactions, DepositLink closed a $3.5m seed financing round. The company will use the funds to bolster its sales team, enhance technology and boost infrastructure to accelerate marketplace adoption and its development roadmap.

Led by Jay Rooney, DepositLink is a mobile responsive payments platform for real estate and title companies to collect earnest money deposits, send and request commission payments, issue refunds, and request rental deposits electronically.

Glovebox inks $3m to help connect policyholders and insurance agents

The single sign-on mobile platform that connects insurance agencies, policyholders, and carriers, raised $3m in a seed funding round led by Mercato Partner’s Prelude Fund, with participation from Heffernan Insurance Brokers.

The InsurTech intends to use the funds to expand features and enhance the functionality of its product, benefiting both agencies and policyholders.

Since its launch in March 2020, the company has signed up over 100 agencies and is averaging five new entities a week.

Crypto market maker Efficient Frontier scores $2m

Sam Bankman-Fried’s Alameda Research invested $2m in Tel-Aviv-based algorithmic crypto market maker Efficient Frontier.

Efficient Frontier is also backed by venture capital firms Collider Ventures and Follow The Seed. Since launching in 2017, the market maker has provided liquidity to dozens of crypto exchanges, including both centralized and decentralized platforms.

The funding will be used to “expand its balance sheet” and build its position within the crypto-asset sector, it stated.

Cyber fraud detection firm FiVerity adds $2m to its coffers

The Boston-based cyber fraud detection and threat intelligence platform FiVerity closed a $2m round of financing led by Mendoza Ventures. Others participating in the round included super angels from the cybersecurity and financial services industries, as well as serial entrepreneur Doug Levin, who has been appointed as the company’s executive chairman.

The company will use the funds to expand its products and ramp up sales and marketing efforts. The machine-learning platform detects and prevents new and existing types of fraud more effectively than current alternatives at banks, credit unions, credit card providers and other financial institutions.

Honeycomb Credit to scale its loan crowdfunding platform with $1.75m round

With the aim to make capital more accessible to entrepreneurs through a loan crowdfunding model, Honeycomb Credit raised a $1.75m seed round led by investors at the American Family Insurance Institute for Corporate and Social Impact. Innovation Works, K50 Ventures, The Urban Redevelopment Authority of Pittsburgh, Reinforced Ventures and Flight.vc also participated in the fundraise.

Honeycomb Credit’s business model is made possible by Regulation Crowdfunding, which lowers barriers for non-accredited investors to participate in crowdsourced financing. The company’s CEO George Cook pointed to increasing capital needs among small businesses through the pandemic and the need for alternative ways to access funding beyond traditional bank loans.

UAE-based FinTech KLAIM raises $1m in seed funding

The UAE-based factoring and medical claim management SaaS platform secured a $1m seed funding round from Techstars and a group of strategic regional investors.

As the name suggests, KLAIM helps healthcare providers who are losing cash every day due to delayed and rejected payments from insurance companies. KLAIM intends to minimize revenue loss and predict cash flows by streamlining the medical billing processes healthcare providers have to go through to get paid.

The new capital will help KLAIM to grow its presence in the UAE and expand its operations into Saudi Arabia.

Transak’s $660,000 seed round to help crypto trading for corporates

Cryptocurrency payment gateway Transak bagged a $660,000 seed funding round led by Consensys, The Lao, IOSG, Lunex and Koji Capital, as well as angel investors.

Transak which offers a fiat-to-crypto gateway facilitates the exchange between crypto and fiat currency for corporates and will deploy the latest funding to expand operations, secure new partnerships and grow its staff in India, with a focus on engineering experts. “The Indian blockchain market is growing rapidly and needs on- and off-ramps to make the crypto world accessible to all,” the company’s co-founders Sami Start and Yeshu Agarwal said.

Malaysian InsurTech Ouch! scores $364,600

InsurTech player based in Malaysia Ouch! raised $364,600 in a seed funding round from Vynn Capital and Temokin, along with a few unnamed angel investors.

With the funding, Ouch! will focus on further product and business development to prepare a stronger foundation for growth. Its efforts going forward will be directed towards improving the platform and service for users, as well as rolling out more features and upgrades.

As CEO Shazy Noorazman put it, people, especially millennials and new graduates, are intimidated by the complicated terms and policies when purchasing insurance, and Ouch! aims to change that.

RegTech Encompass Corporation secures new funding from Beacon Equity Partners

Hot off the heels of significant revenue growth and a 74% increase in headcount over the last 12 months, Encompass secured an undisclosed sum from Beacon Equity Partners, the Boston-based private equity group focused on companies that solve regulatory and compliance challenges.

RegTech provider of Know Your Customer automation software, Encompass expanded its footprint in Singapore, the US, Serbia and Sweden. With the new cash injection, it plans to scale further with its presence in more countries.

Copyright © 2021 FinTech Global