Australian digital insurance company Open has signed a partnership with Bupa, an international healthcare group,

Beginning July 2022, Bupa members will gain access to Open’s omnichannel car, home and travel insurance products.

Bupa Health Insurance managing director Chris Carroll said this partnership will give customers more control in what they get covered and better flexibility with pricing. Customers will also benefit from streamlined digital experiences across sales and services, such as claims.

Open gives customers 24/7 online access to buy and manage policies, lodge and manage many claim types.

Open’s chief revenue officer Bayne Carpenter said the end-to-end solution will be provided to Bupa within just ten weeks. He said, “Typically, a partnership like this would take double the time to get live.”

Speaking on the deal, Open co-founder and CEO Jonathan Buck said, “This partnership with Bupa is Open’s biggest to date and is an incredible opportunity to bring simple, powerful insurance to more Australians. Bupa will be leveraging the best of Open’s white-label insurance products and embedded technology to provide a truly omnichannel insurance experience for their customers.”

Bupa is an international healthcare group that offers a selection of health and care services including health insurance, aged care, dental, medical, optical and hearing services.

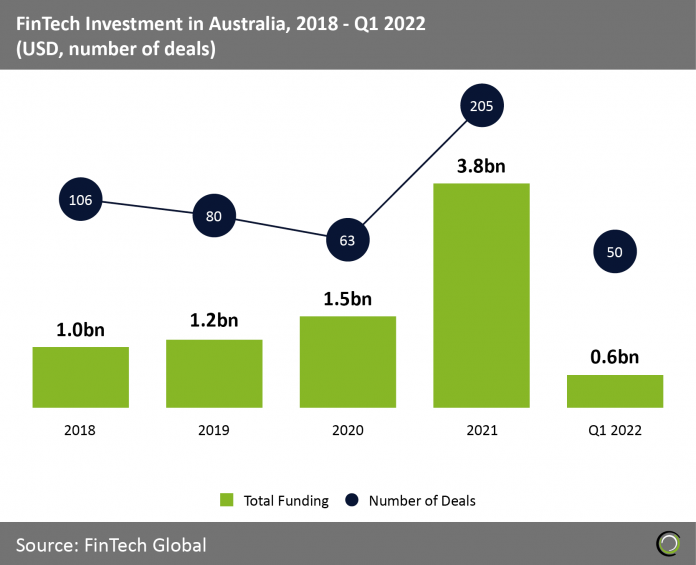

Australian FinTech funding reached a new record in 2021, according to data from FinTech Global. A total of $3.8bn was invested through 205 deals, compared to the previous record reached in 2020, where $1.5bn was invested in 63 deals.