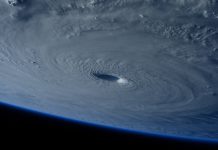

Arturo, a PropTech company that delivers intelligent analytics from individual property to portfolio, has partnered with expert in natural catastrophe (NatCat) ICEYE to bring insurers flood and property damage insights.

Arturo combines AI and machine learning models with property images to help businesses decide with intelligence from the property to portfolio level.

ICEYE’s near real-time flood imagery that provides flood depth, extent and duration data will combine with Arturo’s portfolio and property characteristics data to give insurers the ability to estimate and triage flood damage immediately following a flood event.

ICEYE owns the world’s largest SAR satellite constellation and combines the data from its spaceborne sensors with multiple auxiliary information sources on the ground to quickly produce a precise representation of a flood’s extent and depth anywhere in the world. ICEYE said when this intelligence is added to Arturo’s AI-enabled property analytics, insurers can now determine the extent of property damage in near real-time. This mission-critical information can help evaluate the ongoing risk, estimate claims payouts across portfolios and mobilize accordingly to support policyholders.

Neil Pearson, chief strategy officer of Arturo, said, “When a flood rushes in, an insurer’s response can make or break a policyholder’s experience and the insurer’s bottom line, so fast and accurate claims management is critical.

“This collaboration enables insurers to see down to the property level what type of flood damage a home will have, and get the policyholder the financial assistance they need to quickly repair their home.”

ICEYE recently received an investment from Tokio Marine Holdings to develop insurance products. The investment formed part of its $136m Series D funding.

As part of the new alliance between the two companies, ICEYE and Tokio Marine will collaborate on a series of initiatives designed to facilitate the digital transformation of insurance claims capabilities and develop new insurance products and services to address the increasing frequency and severity of natural catastrophes and the growing impact of climate change.

Copyright © 2022 FinTech Global