FinTech Global reported on 36 funding rounds in the FinTech sector this week, with the FinTech and InsurTech market seeing considerable investment.

Leading the funding this week was Capchase, a provider of non-dilutive capital – while German InsurTech wefox also pulled in the same amount, highlighting a growing investor interest in the InsurTech market.

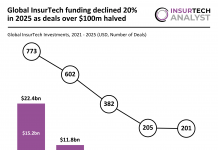

Despite this incline in InsurTech funding, recent research from FinTech Global detailed that global InsurTech investment in the second quarter of this year reached $1.5bn, which was a reduction of 45% from the first quarter. This brought total funding for the first half of the year to $4.3bn.

Deal activity in the second quarter of 2022 reached 92 transactions, which is a 40% drop from the first quarter of the year. This indicates that 2022 InsurTech deal activity will not surpass 2021 levels with total deals.

Meanwhile, research from FinTech Global found that Nigerian mobile banking platform Opay was the most well-funded FinTech firm in Africa. The company has raised $570m from 14 investors.

Opay is helping the underbanked population in Africa have access to global markets through its partnership with Mastercard.

In other research, FinTech deal activity in Singapore is on track to increase 11% despite a disappointing second quarter.

FinTech companies in Singapore raised $378m in funding during the second quarter of the year, a 55% reduction from Q1.

Here are this week’s reported funding rounds.

Capchase secures $400m

Capchase, a New York-based provider of non-dilutive capital, has raised more than $400m in additional debt financing, and launched an analytics tools to help software-as-a-service (SaaS) founders make real-time financial decisions for their business.

Capchase said the $400m in debt financing will be used to provide capital support for both current and future Capchase customers, and to diversify current product offerings.

The financing grows the existing partnership with the i80 Group and establishes a new financing partnership with an international banking group. These funding partners join a roster of the company’s existing investors, including SciFi VC, QED Investors, Bling Capital, Caffeinated Capital and 01 Advisors.

The recently-launched product, Capchase Analytics, is a tool designed to help SaaS business grow faster. Capchase said it will allow founders access to real-time business metrics to make key decisions.

wefox hits $4.5bn valuation after Series D $400m raise

Berlin-based InsurTech company wefox has closed its Series D funding round on $400m, bringing its valuation to $4.5bn.

This is a notable increase from its previous valuation of $3bn, which it reached in June 2021 after the close of its Series C on $650m.

With the funds, the InsurTech company plans to bolster its product development efforts and expand across Europe and into Asia and the US.

The company is a fully licensed digital insurance company that sells insurance through intermediaries and not directly to customers.

Freedom Financial Network closes $323m securitisation

Digital personal finance company Freedom Financial Network has closed a securitisation of $323m in rated notes backed by FreedomPlus personal loans.

It stated that this securitisation, FREED ABS Trust 2022-3FP, is the third Freedom deal to receive a AAA rating from DBRS and fifth to receive AAA rating from Kroll Bond Rating Agency.

This is the 13th securitisation by Freedom Consumer Credit Fund (FCCF), an investment fund managed by Freedom Financial Asset Management.

Cyber InsurTech Coalition lands $250m

Coalition, a cyber insurance provider, has raised $250m in Series F funding, propelling it to a $5bn valuation.

The round saw participation from Allianz X, Valor Equity Partners, Kinetic Partners and other existing investors.

Coalition’s Active Insurance combines cybersecurity tools, access to around-the-clock digital forensics and incident response, and broad insurance coverage to help organisations identify, mitigate, and insure digital risk.

The funding will accelerate this growth, power its international expansion, and broaden the services it provides to manage digital risk, Coalition said.

Pico signs agreement to secure $200m investment

Pico, a provider of mission critical technology services, software, data and analytics for the financial community, has secured $200m in strategic investment.

The investment was secured from Golden Gate Capital, a leading private equity investment company.

Founded in 2009, Pico was established to address the macro trends in electronification of markets across all asset classes. The company fofers financial services trading cloud infrastructure, connectivity, data, software and analytic solutions spanning 55 data centers across global markets.

According to Pico, it will use the new funding to pursue strategic M&A opportunities that further enhance its global ecosystem. It will also aim to build on the strategic investments it has previously made and continue to extend its data offering and market coverage across all regions and asset classes.

May Mobility rakes in $111m Series C

Tokio Marine and State Farm Ventures backed May Mobility, which develops autonomous vehicle technology, in its recent $111m Series C round.

The round was led by SPARX Group Co., Ltd.’s Mirai Creation Fund II alongside Tokio Marine, Toyota Tsusho, Bridgestone Americas and returning investors Toyota Ventures, Millennium Technology Value Partners, Cyrus Capital Partners, LG Technology Ventures and Maven Ventures, and others.

Established in Michigan in 2017, May Mobility said it is “building the world’s best autonomy system”. With partnerships including some of the world’s most innovative automotive and transportation companies, such as Toyota Motor Corporation, May Mobility is on a mission to achieve the highest standard in rider safety, sustainability, and seek new ways to bring equitable mobility solutions to the masses.

The investments from the likes of Tokio Marine are indicative of the insurance industry’s growing support for autonomous vehicle technology to reduce road accidents.

Gnosis Safe rebrands to Safe after $100m funding round

Digital asset management platform Gnosis Safe has reportedly raised $100m in a funding round, alongside the rebranding to Safe.

This investment round was led by 1kx, with commitments also coming from Tiger Global, A&T Capital, Blockchain Capital, Digital Currency Group and ParaFi, according to a report from Crypto Briefing.

Safe is a digital assets management platform for businesses and individuals. It boasts an option to require a predefined number of signatures to confirm a transaction, preventing unauthorised access to company crypto.

FPL Technologies closes Series D on $100m

FPL Technologies, which offers a metal credit card under the OneCard brand, has reportedly become India’s newest unicorn.

The company reached a $1.4bn valuation after the close of its Series D round on $100m, according to a report from TechCrunch. This valuation is nearly double its previous, which was at $750m in January.

OneCard offers a metal credit card and an accompanying mobile app. Its card boasts five-times rewards on spending and offers flexible payment options for transactions.

FinTech Wave Mobile Money raises €90m

Wave Mobile Money, a FinTech company that operates in Senegal and Côte d’Ivoire, has reportedly raised €90m debt funding.

Of the funds, IFC supplied a €25m loan, while Symbiotics, Blue Orchard, responsAbility and Lendable deployed a combined total of €41m in B loans, according to a report from Tech Moran. The remaining €24m came through parallel loans from Finnfund and Norfund.

This capital will help Wave Mobile Money boost financial inclusion and support economic growth in Senegal and Côte d’Ivoire.

Wave Mobile Money offers an app that lets consumers deposit, withdraw and pay bills for free, as well as send money to others for a 1% fee.

CyberTech Bishop Fox scores $75m from Series B

Bishop Fox, an attack surface management firm, has landed $75m from a Series B funding round headed by Carrick Capital Partners.

Bishop Fox is a leader in offensive security, providing solutions ranging from continuous penetration testing, read teaming and attack surface management to product, cloud and application security assessments.

The company claims its Cosmos platform is capable of performing continuous offensive testing at scale, executing over 2.3 billion operations and identifying over 13,000 exposures per week.

Innoviti closes Series D on $45m

India-based commerce platform Innoviti Payment Solutions has collected $45m in its Series D round.

Singapore-based growth equity firm Panthera Growth Partners served as the lead investor to the round, committing $15m to the round.

Other backers to the round include Alumni Ventures, Patni Family Office and existing investors FMO and Bessemer Venture Partners. Several angel investors also joined the round.

With the funds, the company plans to expand its product lines in electronics, fashion and grocery. Capital has also been earmarked for building products on top of UPI payment channels, enhancing product distribution and making strategic acquisitions in the marketing technology and data sciences fields.

Pulley closes Series B on $40m

Equity management platform Pulley has closed its Series B round on $40m, as it launches free service to startups.

Founders Fund general partner Keith Rabois led the Series B round. As part of the deal, Rabois will join the Pulley board of directors.

Other contributions to the round came from Stripe, Elad Gil, Jack Altman and Avichal Garg.

In addition to the funding, the company launched a free tier of its services, Pulley Seed. The service helps new startups get to the first stage of hiring and fundraising without spending thousands on legal fees.

Apiture closes $29m funding round

Digital banking solution developer Apiture has scored $29m in a funding round, which was led by Live Oak Bank.

With the capital, the company plans to expand its sales and marketing efforts, accelerate its product development initiatives and meet increased demand for the Apiture Digital Banking Platform, which is currently used by over 300 banks and credit unions in the US.

The company has an API-first strategy that helps clients implement their own digital banking services. These include consumer banking, business banking, accounting opening, data intelligence and more.

Kadmos bags €29m

Kadmos, which offers an end-to-end salary payments platform for cross-border employers, has bagged €29m in its Series A funding round.

With the funds, the company plans to bolster its product development and keep up with rising demand levels for its services.

Kadmos was founded to help tackle the restrictions placed on the financial freedom of cross-border employees and to use technology to allow migrant workers to have a streamlined salary experience.

The traditional financial system has unnecessary complexity when paying salaries across the globe, with employers typically needing to pay large fees to transfer salary payments. Kadmos gave an example of the shipping industry, which has expensive, slow and untransparent payment processes. It claimed that many shipping companies resort to bring significant amount of cash on board to pay employees.

Lightyear raises $25 from Series A

Lightyear, an investment platform that is commission-free, has secured $25m in a Series A round led by Lightspeed Venture Partners and Virgin Group.

Also taking part in the round were Mosaic Ventures, Metaplanet and Taavet+Sten as well as a number of new and existing angel investors. To date, Lightspeed has raised a total of $35m.

The company recently secured a European licence in Q1, which gave it the right to provide services in all EU and EEA countries, following its launch in the UK in October last year.

Countries that will be part of this first rollout include Ireland, the Baltics and most of Western Europe, including Spain, Italy, Germany, Portugal, France and the Netherlands.

IRALOGIX bags $22m

IRALOGIX, which develops IRA record keeping technology, has raised $22m in a new funding round.

The capital injection was led by a group of individual financial technology investors represented by Matt Vettel and Nick Cayer. Participation also came from Hybrid Capital, Roan Capital, University Growth Fund, Trog Hawley Capital, Circadian Ventures, Great North Ventures and Riverfront Ventures.

With the funds, IRALOGIX plans to accelerate the development of new platform features, increase its sales efforts and drive an annual growth rate of over 100%.

IRALOGIX empowers financial institutions to customise their IRA offering and compete in all segments of the IRA market. Clients can choose to use their internal investment or advisory capabilities or select from key industry providers.

InsurTech firm Element lands €21.4m financing

InsurTech Element has scored €21.4m in a Series B round headed by the Versorgungswerk Zahnärztekammer Berlin.

The round also saw participation from Alma Mundi, Witan Group and Ilavska Vuillermoz Capital. To date, Element has raised a total of €88m.

According to Element, the current investment round underlines the continuous growth of the firm. Last year, the business’ sales rose to €10.4m – an increase of over 50% compared to the year prior.

The company is now acting as a risk carrier in several EU markets and is continuing to expand its position as a leading pan-European provider of fast, efficient and reliable end-to-end insurance solutions.

Moove raises $20m funding

Moove, which stylises itself as the world’s first mobility FinTech company, has collected $20m in funding from Absa Corporate and Investment Banking.

This fresh capital puts the company’s total funding to-date at $200m since its launch in 2020.

With the capital, Moove plans to expand its vehicle financing offering to more customers in South Africa.

The platform was launched by Ladi Delano and Jide Odunsi, with the aim of democratising vehicle ownership across Africa by providing mobility entrepreneurs access to revenue-based financing markets with low access to credit.

Morpho pulls in $18m investment

Decentralised lending platform Morpho has raised $18m from a funding round headed by a16z Crypto and Variant.

The round also saw participation from 80 additional investors, which included advisors, founders, power users and builders.

Morpho has introduced a lending protocol called Morpho-Compound which combines the liquidity pool model found in its Compound solution with the capital efficiency of P2P matching engines used in order books.

Stableton Financial raises CHF 15m for its alternative investment platform

Stableton Financial, an alternative investment platform, has collected CHF 15m in its Series A funding round.

With the capital, the company hopes to grow its operations in Switzerland, expand its technological offering and investment structures, and move into new international markets.

The FinTech company enables individuals to invest their money like a top institutional investor. It currently boasts over 2,000 users in Switzerland.

PropTech startup Oper scores €11m in its Series A

PropTech platform Oper, which enables digital mortgages, has collected €11m in its Series A funding round.

Bessemer Venture Partners and ABN AMRO Ventures served as the lead investors to the round.

With the funds, the company plans to bolster its R&D and recruitment efforts. It will also look to grow in France, Germany, Austria, Czech Republic and Slovakia.

Noldor pulls in $10m to “redefine how insurance does data”

Noldor, an InsurTech looking to “redefine how carriers, reinsurers and reinsurance brokers connect” with programme data to optimise performance, has raised $10m in a seed funding round.

The funding round was led by the DESCOvery group at D.E. Shaw, a global investment and technology development firm based in New York, with participation from several other strategic investors.

Founded in 2021, Noldor’s technology integrates with any entity with delegated underwriting authority regardless of their existing tech stack. The InsurTech explained this integration allows its platform to leverage artificial intelligence and machine learning to aggregate data, uncover hidden drivers of loss ratios and automate back-office functions.

Noldor works with MGAs across multiple carriers and reinsurance brokers, across both London and Bermuda, and multiple lines of business.

TurnKey Lender closes $10m funding round

B2B software-as-a-service company TurnKey Lender has closed a funding round on $10m.

The round, which comprised of debt and equity, was led by OTB Ventures. Commitments also came from DEG and Vertex Ventures.

With the funds, the company plans to scale across North America, Europe and Southeast Asia.

Founded in 2014, TurnKey Lender aims to democratise digital lending in developing and developed markets through its lending automation and embedded financing software.

BlockSec scores $8m from seed funding raise

BlockSec, a blockchain security startup, has bagged $8m in a seed funding round co-led by Vitalbridge Capital and Matrix Partners.

The round also saw participation from CoinSummer, YM Capital and Mirana Ventures.

Established in 2021, BlockSec is focused on securing the blockchain infrastructure, to identify blockchain weaknesses, prevent cyberattacks and improve the security of decentralised applications.

The firm claims it can secure the whole lifecycle of smart contracts, which are used to automate blockchain transactions and to mitigate risks associated with cyberattacks and human error.

Onramp Invest closes Series A on $7m

Onramp Invest, which provides advisors with cryptoasset management tools, has raised $7m in its Series A funding round.

Contributions to the round came from JAM FINTOP and EJF Capital.

With the funds, Onramp plans to accelerate its innovation efforts and expand marketing and communications to financial professionals.

The mission of Onramp is to remove barriers to digital asset investment and help financial professionals offer safe crypto investment services to clients. It currently offers a suite of tools and services through a fully integrated platform. The company offers a consolidated view of clients and their portfolios to improve management capabilities.

Irish RegTech ID-Pal collects €7m investment

Ireland-based global identity verification provider ID-Pal has collected €7m in its Series A funding round, as it bolsters its expansion into international markets.

Inspire Investments served as the lead investor, with commitments also coming from Act Venture Capital.

With the funds, ID-Pal plans to bolster its global sales and marketing efforts to meet the growing demand for its services.

RegTech service provider Novatus collects £4m

RegTech solution developer Novatus Advisory has collected £4m in an investment from UK-based venture firm Maven Capital Partners.

With the capital, Novatus plans to hire more staff, particularly for its technical advisors’ team. Funds will also help the company also plans to expand its sales and marketing resources to support the growth of its RegTech offering, as well as bolstering the market penetration of its products.

Novatus, which is based in London, offers specialised advice to financial services firms to help with regulatory requirements, such as risk, compliance and ESG programmes.

Its flagship product, Novatus Transaction Reporting Analysis, enables banks and asset managers to meet their transaction reporting reconciliation requirements in an efficient and cost-effective manner.

UK-based pensions app Penny bags £4m investment

UK-based FinTech company Penny has reportedly collected £4m ($4.7m) in its seed funding round, which was led by Google’s Gradient Ventures.

Contributions also came from Monzo founder Tom Blomfield and Payhawk co-founder and CEO Hristo Borisov, according to a report from TechCrunch.

This fresh capital injection values Penny at £25m.

The company is currently planning to launch new features in its app, including the ability to trade stocks directly from pension pots. It is also exploring crypto tools.

Quiltt lands $4m funding

Quiltt, a low-code consumer FinTech platform, has raised $4m in venture capital investment.

The seed round was co-led by Greycroft and Newark Venture Partners, and included participation from Motivate Ventures, Tectonic Capital, Abstraction Capital, Bridge Investment and others.

Quiltt claims its platform comes pre-integrated with best in-class FinTech providers like Plaid, Spade and ApexEdge, which frees up businesses to focus on their core competencies. Alongside its unified API, Quiltt also provides a suite of no-code UI modules to allow anyone to rapidly experiement on top of its data platform.

According to the firm, the funding will be used to add data integrations, build new capabilities and expand the engineering team.

Ride Capital scores €3m funding round

Germany-based Ride Capital, which aims to democratise wealth structuring, has reportedly raised €3m in funding.

The capital was supplied by a group of investors, including professional football player Mario Götze.

With the capital, the company plans to bolster its offering with new features, according to a report from tech.eu. Ride Capital’s goal is to become a fully licensed private bank.

The company enables tax-optimised investments for assets from €80,000. Users can invest into shares, futures, property and investment funds.

Swedish app Quartr extends seed round by $2.6m

Quartr, an app that helps investors gain access to company information and earnings calls, has extended its seed round to $7.1m.

The company raised $2.6m in the recent top-up, which was headed by the Öhman Group and saw participation from Flat Capital and Centripetal Capital.

Through the Quartr app, users are able to access company information from the likes of Spotify, Apple, Moderna and Meta amongst many other publicly listed companies. This is different from the traditional method of dialling in live to discover company information.

Recently, the business introduced a new feature called ‘Search For Anything’, where all company transcripts globally on the platform are included in the same search engine and timestamped to audio so users can scroll to key moments.

FinTech Mode bags £2m

Mode, a FinTech firm, has completed recent fundraising by way of the issue of convertible loan notes to existing and new investors for proceeds of £1.9m.

Following its 2021 annual results on 28 June this year, certain directors of Mode also agreed to subscribe for loan notes for an aggregate sum of £65,000, which, taken alongside one delayed subscription, will result in total gross proceeds of the fundraising being £2m.

Fuell eyes expansion following €1.5m raise

Fuell, a company that has developed a corporate card and expenses management SaaS, has raised €1.5m in funding.

Fuell claims it helps businesses better manage and organise expenses via corporate cards and employee reimbursements. The firm also automates expenses management enabling employees, accountants and CFOs to save money and time.

The company’s platform synchronises expenses within companies’ accounting software. Teams are able to monitor employee-spending in real time, and track and assign card usage controls per employee, as well as send money to employees. Users are also able to earn 3% cashback on all expenses made with Fuell corporate cards.

The new funding will be used to consolidate the firm’s Spanish and Portuguese markets and launching in Italy.

Sustainable investing platform Goodvest closes crowdfunding on €588,739

Goodvest, a sustainable investment platform, closed its crowdfunding platform on €588,739, which was more than double its original target.

Its crowdfunding campaign, which was held on Crowdcube, had an initial target of €250,000.

The company raised the capital at a pre-money valuation of €9.1m, with shares priced at €73.38 apiece.

A total of 517 investors contributed to the round, with 6.06% of Goodvest’s equity distributed amongst them.

The FinTech company’s mission is to create a sustainable investment platform committed to climate change.

UK-based CyberTech Melius Cyber raised £350k

UK-based Cybersecurity platform for SMEs Melius Cyber has reportedly raised £350,000 in funding.

The capital was supplied by the North East Venture Fund and the European Regional Development Fund, according to a report from Business Cloud.

With the funds, Melius Cyber hopes to expand its client base and further the development of its platform. It currently has a team of eight but plans to hire an additional five over the next six months.

Pebble nets seed round for its indexing app

Pebble, which offers direct indexing services, has closed its seed round on an undisclosed amount.

The company was founded in 2021 by a group of FinTech veterans that wanted to level the playing field for the self-directed investor.

It offers a personalised index ETF that helps people make their own ETF. The company will use the funds to streamline the app and improve user experiences.

The mobile app also lets users create their own portfolio, with the ability to quickly add or remove companies.

Copyright © 2022 FinTech Global