Aurenity, a managing general agent (MGA) in the excess and surplus (E&S) insurance market, has partnered with global data analytics provider Verisk to gain a better view of risk.

Founded by insurance entrepreneurs, newly launched Aurenity plans to unveil its initial excess casualty product in the third quarter.

Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk said it aims to empower customers to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud, and make informed decisions about global issues including climate change and extreme events as well as political and ESG topics.

The partnership will see Aurenity deploy multiple underwriting and rating solutions from Verisk to get a better view of risk and pricing in the E&S market.

Patrick Safino, Aurenity’s COO, said, “We are a business built by and for underwriting expertise, focused on creating the kind of differentiated insight that is very uncommon amongst our peers.

“Verisk’s unrivaled actuarial expertise, predictive models, and rich underwriting data analytics will enable us to make more informed decisions with highly sophisticated risk selection and pricing segmentation, providing us with a powerful platform for profitable growth.”

Earlier this year, M Financial Group, a financial service design and distribution company, and global insurer Pacific Life tapped Verisk to build a new life insurance product.

This new life insurance product, which is powered by Verisk’s FAST technology, will have flexible options and pre-configured tax rules designed exclusively for high-net worth individuals.

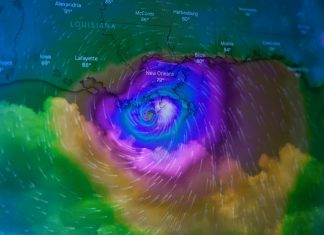

Also earliet this year, The Louisiana Insurance Guaranty Association (LIGA), implemented Verisk’s property estimating technology to streamline its claims handling process.

The move has saw LIGA adopt Verisk’s Xactware® property claims-handling solutions, including Xactimate® and XactAnalysis®, to assign claims to independent adjusting firms, improve communication with its claims vendors and monitor claims in progress.

Copyright © 2022 FinTech Global