Kin Insurance, a direct-to-consumer home insurance company, has closed a $100m private placement catastrophe bond transaction.

The company strives to make home insurance more convenient and affordable by cutting out administrative and agent-related expenses.

Kin’s technology platform draws on thousands of data points to evaluate the risk profile of each home and price policies accurately. Kin said this is particularly important for homes that are hard to insure, including those that are impacted by severe weather events caused by climate change.

The latest catastrophe bond brings Hestia Re’s total outstanding limit to $275m. The new multi-year reinsurance arrangement with Hestia Re provides the Kin Interinsurance Network with indemnity-based coverage for large hurricanes and other named storms affecting the State of Florida.

In addition to securing the targeted $100m in notional limit, investor demand allowed the transaction to tighten by 175 basis points from the wide end of the initial price guidance. Howden Tiger Markets & Advisory and Swiss Re Capital Markets acted as joint structuring agents and joint bookrunners on the transaction.

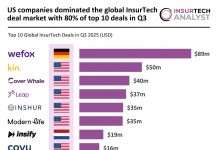

This announcement comes on the heels of Kin’s recent upsize of its Series D round of funding by $15m, taking the total round to $109m.

According to Kin, this latest financing demonstrates strong investor confidence in the company’s technology-driven insurance model and its plans for growth and expansion.

Mitchell Rosenberg, managing director of ILS at Howden Tiger Capital Markets & Advisory, said, “In this dynamic market environment, Kin’s performance, transparent communication with stakeholders, and proven technology-driven advantage drove a phenomenal result…We’re pleased to advise Kin on their market-leading Cat Bond program and are confident both the capital and traditional markets will continue to grow their support for Kin.”

Andras Bohm, head of ILS structuring for the Americas at Swiss Re Capital Markets, added, “Swiss Re Capital Markets is pleased to partner with Kin to facilitate another successful transaction. Investors appreciated Kin’s return to the ILS market, and we are proud to be a part of Kin’s strategy to grow its access to alternative capital through Hestia Re.”

Earlier this year, Kin Insurance expanded its coverage into South Carolina.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global