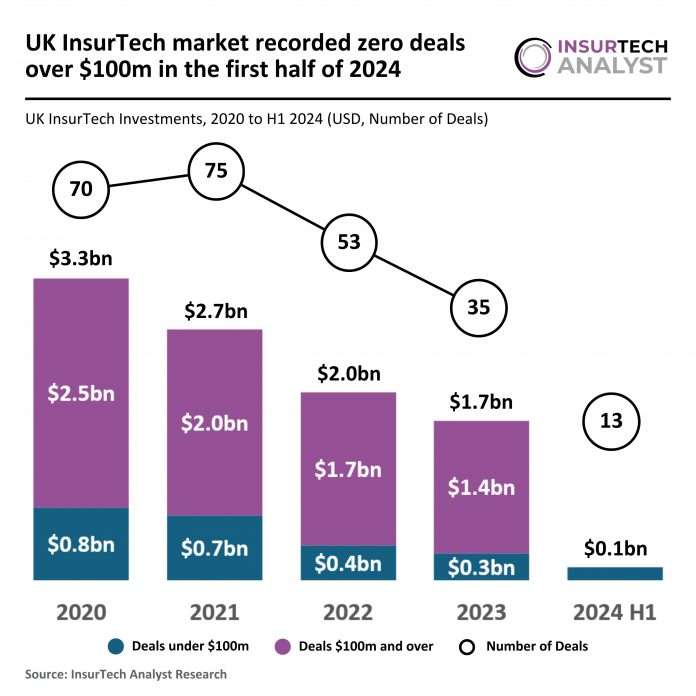

Key UK InsurTech investment stats in H1 2024:

- UK InsurTech investments continued to drop in H1 2024, which caused the region to not report any deals over $100m

- The average deal size completed by UK InsurTech companies dropped to $10.9m due to economic uncertainty

- Hyperexponential secured the biggest InsurTech deal in the UK for the first half of the year with Series B funding round of $73m

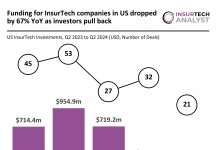

In a dramatic shift for the UK InsurTech market, H1 2024 saw no deals surpassing the $100m mark, a stark contrast to the previous periods. In H1 2023, the market recorded $959m across 19 deals, with $769m coming from deals over $100m. Similarly, H2 2023 saw $778m across 16 deals, with $673m attributed to transactions exceeding $100m. However, in H1 2024, the total deal value plummeted to $142m across 13 deals, all under the $100m threshold. The average deal value in H1 2024 was approximately $10.9m, a significant decrease from the $50.5m average in H1 2023, which reflects both the lower overall deal volume and the lack of large-scale investments.

Several factors may have contributed to this slowdown. The broader economic environment has become increasingly uncertain, with rising interest rates and inflation leading to more cautious spending and investment. Additionally, tighter funding conditions, possibly influenced by a more conservative approach from venture capital and private equity firms, could be limiting the availability of large-scale financing. This cautious sentiment may also reflect a shift towards smaller, incremental investments as companies and investors wait for clearer economic signals before making larger commitments.

Hyperexponential, a global leader in pricing decision intelligence (PDI) software, concluded the biggest funding round of the first half of the year in the European InsurTech space with a $73m Series B funding round, backed by major US venture capitalists. Hyperexponential’s PDI platform, hx Renew, enabled insurers to leverage large and alternative datasets, develop and refine rating tools rapidly, and employ sophisticated machine learning approaches to price risk and make data-driven pricing decisions at the portfolio and individual level. Since the company’s Series A in 2021, Hyperexponential grew sales 10x while staying profitable, serving some of the world’s largest insurers, including Aviva, HDI, and Conduit Re. This latest round of financing would support Hyperexponential’s expansion into the United States, targeting the opening of its New York office this year, and enabling increased investment in new product capabilities to serve growing client demand in adjacent insurance markets, including the SME insurance sector. The company planned to double its global team to over 200 in the next year.

Keep up with all the latest InsurTech news here

Copyright © 2024 InsurTech Analyst