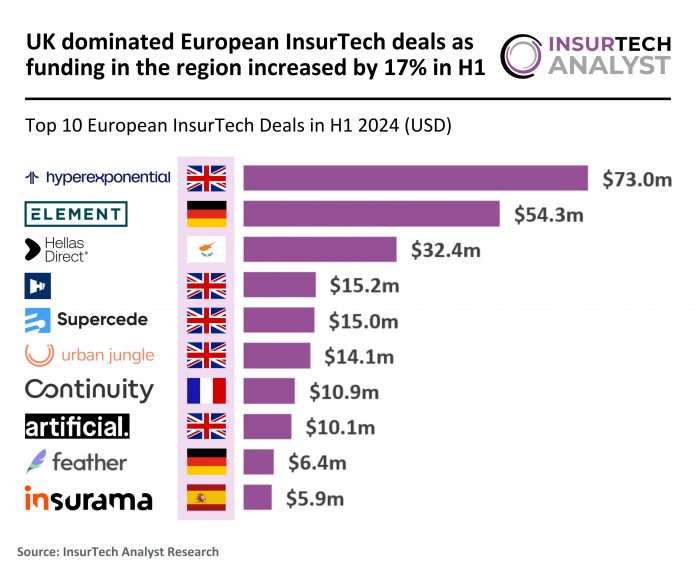

Key European InsurTech investment stats in H1 2024:

- European InsurTech funding increased by 17% in H1 compared to the last six months of 2023 as investors focused on larger funding rounds

- UK asserted its dominance with companies in the county completing half of the top 10 deals in Europe for H1

- Element secured the largest deal in the German InsurTech market for the first half of the year, with a funding round of $54m

In H1 2024, the European InsurTech sector recorded 35 transactions, reflecting a sharp decline of 42% from the 60 deals completed during the same period in 2023 and a 27% drop from the 48 funding rounds in H2 2023. Despite the reduced deal flow, total InsurTech funding in H1 2024 amounted to $1.16bn, representing a 6% decrease from the $1.24bn raised in H1 2023 but an 17% increase from the $992m raised in H2 2023. This suggests that while the number of deals has fallen significantly, there is still substantial capital being invested, particularly in larger funding rounds, signalling ongoing investor’s interest in the sector.

The top 10 deals in H1 2024 were distributed across six countries, with the United Kingdom dominating the list with five deals, compared to just three in H1 2023. Germany, which had three top deals in H1 2023, saw a decrease to two in H1 2024, while Spain maintained a presence with one deal across both periods. Notably, new entrants such as France and Cyprus appeared on the list in H1 2024, replacing The Netherlands, Switzerland, and Sweden, which were present in H1 2023. This change indicates a shifting landscape in European InsurTech, with the UK solidifying its lead while other countries experience fluctuations in deal activity.

Element, a German based InsurTech startup offering white-label insurance products, raised $54m from Versorgungswerk der Zahnärztekammer Berlin K.d.ö.R. and Alma Mundi, marking it the largest funding round in the German InsurTech market for the first half of the year. Founded in 2017, Element is a cloud-based InsurTech startup licensed by the German Federal Financial Supervisory Authority (BaFin) as a direct insurer for non-life insurance. The company provides white-labelled insurance products that clients market under their own brand. Element aims to become the first choice for Managing General Agents (MGAs) and reinsurers across Europe by leveraging its data-driven primary insurance capabilities. Licensed and approved in all European countries, Element supports MGAs throughout the EU, ensuring comprehensive and economically viable risk coverage through its integrated reinsurance panel, which matches MGAs with optimal reinsurance capacity providers.

Keep up with all the latest InsurTech news here

Copyright © 2024 InsurTech Analyst