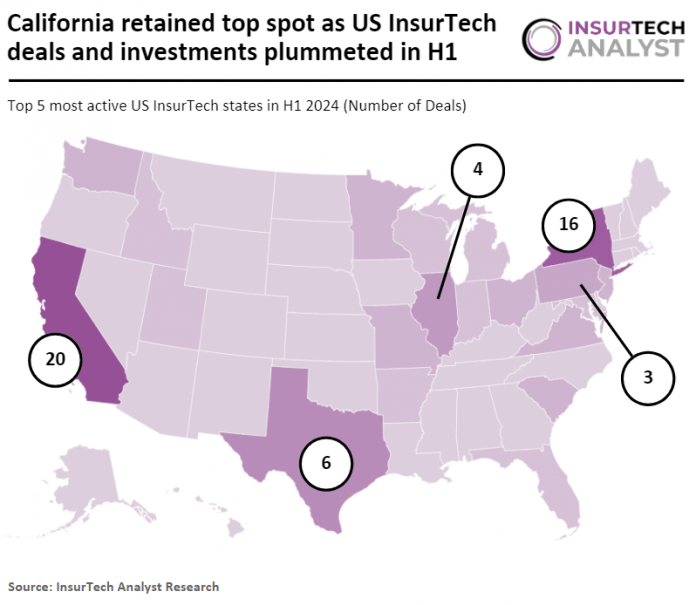

California retained top spot as US InsurTech deals and investments plummeted in H1

Key US InsurTech investment stats in H1 2024:

- US InsurTech deal activity plummeted by 60% in H1 YoY

- California retained its top spot for InsurTech deal activity in H1 2024 with 28% of all deals in the country

- Healthee secured the biggest InsurTech deal in the US in H1 2024 with Series A funding round of $32m

In H1 2024, the US InsurTech industry experienced a sharp decline in both deal activity and funding. The sector recorded 53 funding rounds, a significant 60% decrease from the 132 deals completed in H1 2023. InsurTech companies raised $527m during the first six months of the year, marking a dramatic 78% decrease from the $2.3bn raised in H1 2023. This huge decline in both deal volume and funding underscores the challenging environment facing the InsurTech sector in the US, with a clear pullback in investor activity.

California remained the most active InsurTech market in the US, with 20 deals (28% share) in H1 2024, though this represents a 41% decrease from the 34 deals recorded in H1 2023. New York followed closely with 16 deals (22% share), a 50% drop from the 32 deals in the same period last year. Texas completed six deals (8% share), emerging as the third most active state, replacing Illinois, which had completed 10 deals (8% share) in H1 2023. Despite the overall decline in the number of deals, both California and New York saw an increase in their percentage share of total deal activity. This suggests that while deal numbers have dropped, these key states have maintained or even strengthened their relative importance within the US InsurTech landscape amidst the broader slowdown.

Healthee, a healthcare tech and InsurTech pioneer, secured the largest InsurTech deal in the US for the first half of 2024 with a $32m Series A funding round co-led by Fin Capital, Glilot Capital Partners, and Group11, alongside strategic partner TriNet (NYSE: TNET). Focused on enhancing care outcomes and reducing costs for employers and employees, Healthee’s platform offers personalised, instant answers to coverage, treatment, and benefits questions, along with comprehensive open enrolment support and tailored preventive care suggestions. The new funding will drive strategic scaling, accelerate product development, and support expansion initiatives, reinforcing Healthee’s commitment to transforming the healthcare landscape through its innovative, AI-driven solutions. This investment highlights Healthee’s growing influence in the space, as it continues to empower employers to manage health costs effectively while enhancing the overall employee experience.

Keep up with all the latest InsurTech news here

Copyright © 2024 InsurTech Analyst