Key US InsurTech investment stats in H1 2025:

- US InsurTech funding decreased by 61% in H1 2025

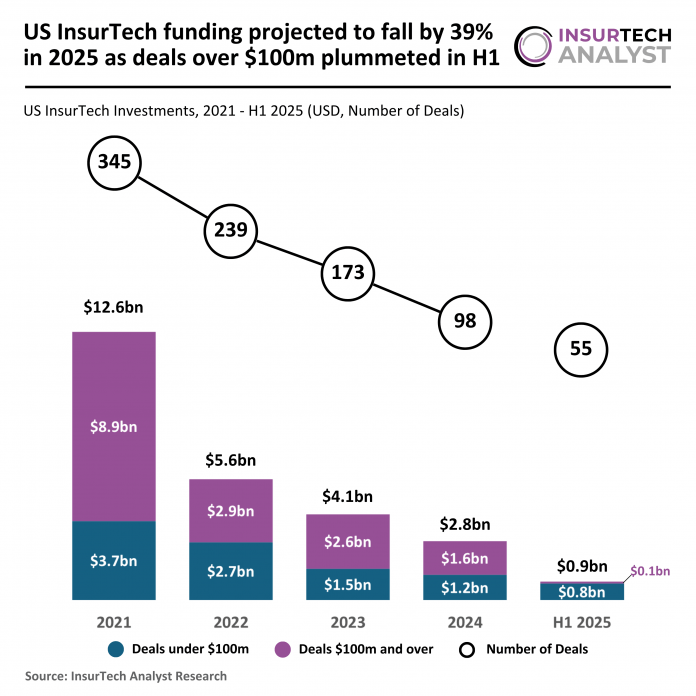

- Trend analysis showed a projected drop of 39% drop in funding for the year as deals over $100m plummeted in H1

- Coalition, an InsurTech specialising in cyber risk and active insurance, secured a $30m equity investment from Mitsui Sumitomo Insurance, making it one of the largest US InsurTech deals in the first half of the year

US InsurTech funding decreased by 61% in H1 2025

In H1 2025, the US InsurTech sector saw a modest increase in deal volume but a substantial decline in funding compared to H2 2024.

A total of 55 deals were recorded, up 22% from the 45 deals completed in H2 2024 and 4% higher than the 53 deals in H1 2024.

However, total funding fell sharply to $873m — down 61% from the $2.2bn raised in H2 2024, though still 66% higher than the $527m recorded in H1 2024.

This divergence reflects a recalibration in the market, with investor focus shifting away from large-scale deals seen in late 2024 towards a broader distribution of smaller rounds.

Trend analysis showed a projected drop of 39% drop in funding for the year as deals over $100m plummeted in H1

If the H1 2025 trend were to continue across the remainder of the year, 2025 would close with 110 deals and $1.7bn in total funding.

This would represent a 14% increase in deal volume from the 98 deals completed in 2024, but a 39% decline in total funding from the $2.8bn raised last year.

These figures point to a more cautious funding environment, where activity remains strong but investors appear increasingly selective, favouring more measured capital deployment across a wider pool of startups.

The average deal size in H1 2025 was $15.9m, down significantly from $49.5m in H2 2024, but still up from $9.9m in H1 2024.

This suggests a cooling of the outsized rounds that defined the latter half of 2024, as investors gravitate back toward smaller, more strategic bets — possibly favouring earlier-stage or capital-efficient companies with strong unit economics.

Deals under $100m accounted for $773m in H1 2025, a 47% increase from the $527m raised in H1 2024 and a 19% drop from the $648m recorded in H2 2024.

High-value deals of $100m or more contributed just $100m in H1 2025 — a steep 94% decrease from the $1.6bn raised through such deals in H2 2024.

This marks the weakest half for large-scale deals in the period reviewed, reinforcing the ongoing retreat from blockbuster rounds as investor attention returns to smaller transactions and more deliberate capital allocation.

Coalition, an InsurTech specialising in cyber risk and active insurance, secured a $30m equity investment from Mitsui Sumitomo Insurance, making it one of the largest US InsurTech deals in the first half of the year

The company offers a distinctive model that integrates cyber insurance coverage with proactive cybersecurity tools through its proprietary platform, Coalition Control®, enabling automated threat detection, expert incident response, and third-party risk monitoring.

Operating across the US, UK, Canada, Australia, and Germany, Coalition’s technology-driven approach addresses the growing needs of businesses facing complex cyber threats.

The funding deepens its strategic alliance with MSI, following prior joint efforts in Australia and Japan, and supports Coalition’s continued international expansion and innovation in cyber underwriting and prevention.

This deal not only underscores the rising relevance of cyber-specific insurance but also signals strong institutional confidence in integrated risk mitigation platforms within the InsurTech space.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst