Key US InsurTech investment stats in Q2 2025:

- US InsurTech funding doubled in Q2 YoY

- Average deal value increased to $19.9m as investors backed established business models

- Ledgebrook, an InsurTech firm focused on the excess and surplus (E&S) insurance market, secured one of the largest US InsurTech deals of the second quarter with a $65m Series C funding round, bringing its total capital raised to over $110m

US InsurTech funding doubled in Q2 YoY

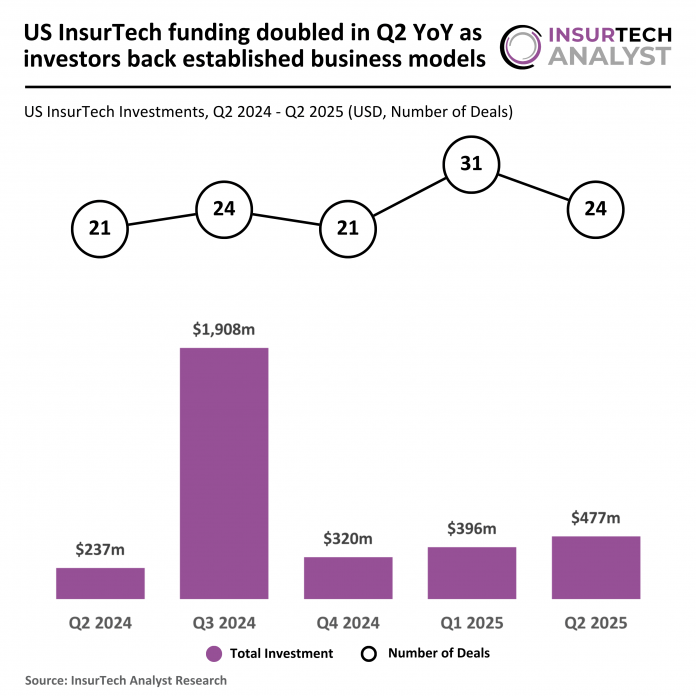

In Q2 2025, the US InsurTech market recorded an increase in both funding and average deal size compared to the same quarter last year, despite a reduction in deal activity.

A total of 24 deals were completed in Q2 2025, representing a 14% decline from the 21 deals recorded in Q2 2024.

Funding, however, surged to $477m in Q2 2025, a 101% increase from the $237m raised in Q2 2024.

This contrast highlights a market dynamic where fewer deals are attracting significantly more capital, signalling strong investor confidence in select, higher-value opportunities.

When compared to the previous quarter, deal activity slowed as the number of transactions fell from 31 in Q1 2025 to 24 in Q2 2025, marking a 23% decline.

Despite the fall in deal count, funding rose by 20% from $396m in Q1 2025 to $477m in Q2 2025, suggesting a concentration of capital into a smaller pool of companies.

Average deal value increased to $19.9m as investors backed scalable business models

The average deal value in Q2 2025 was $19.9m, a sharp increase from $11.3m in Q2 2024 and $12.8m in Q1 2025.

This rise in deal size underlines a growing investor preference for larger, more strategic bets, with capital directed towards InsurTech firms demonstrating resilience and scalability.

Ledgebrook, an InsurTech firm focused on the excess and surplus (E&S) insurance market, secured one of the largest US InsurTech deals of the second quarter with a $65m Series C funding round, bringing its total capital raised to over $110m

The round was led by The Stephens Group, with participation from Duquesne, Brand Foundry, Floating Point, Hummingbird Nomads, and American Family Ventures.

This latest capital injection will support the company’s rapid expansion, including talent acquisition, product diversification, and deeper collaboration with carrier partners through increased risk retention.

Ledgebrook aims to solidify its position as a premier E&S platform by enhancing its tech-driven infrastructure and strengthening relationships with wholesale brokers through consistent delivery and innovation.

The funding underscores strong investor confidence in Ledgebrook’s vision of blending underwriting expertise with modern technology to transform the traditionally complex E&S landscape.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst