Key US InsurTech investment stats in Q2 2025:

- US InsurTech deal activity grew by 31% YoY in Q2

- Californian companies secured 26% of US InsurTech deals to dominate the market in the second quarter

- Ledgebrook, an InsurTech firm focused on the excess and surplus (E&S) insurance market, secured one of the largest US InsurTech deals of quarter with a $65m Series C funding round, bringing its total capital raised to over $110m

US InsurTech deal activity grew by 31% YoY in Q2

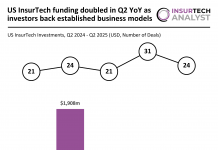

In Q2 2025, the US InsurTech industry recorded a strong recovery in funding compared to the same period last year, while deal activity remained stable.

The sector recorded 34 funding rounds, up 31% from the 26 deals completed in Q2 2024.

InsurTech companies raised $474.9m in Q2 2025, a significant 2x increase from the $237.1m raised in Q2 2024.

Compared with Q1 2025, funding grew by 20% from $396m, while deal activity held steady at 34, highlighting sustained investor interest following a subdued 2024.

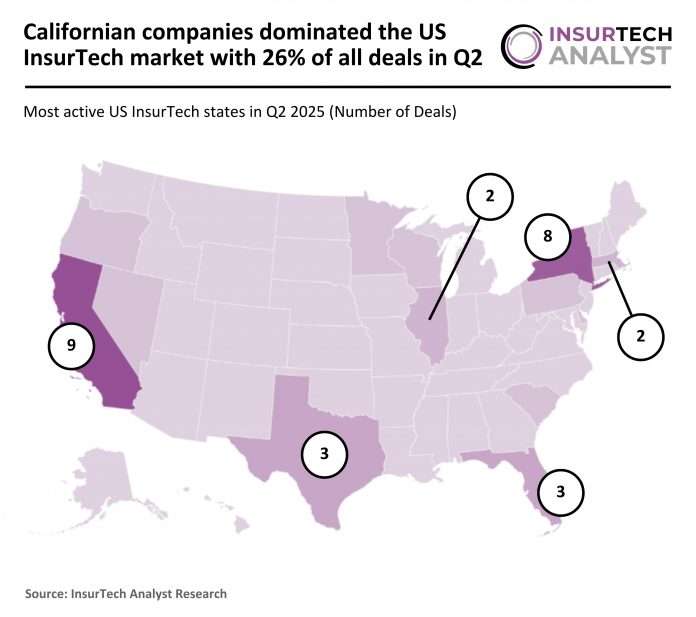

Californian companies secured 26% of US InsurTech deals to dominate the market in the second quarter

California remained the most active InsurTech market in the US during Q2 2025, with nine deals (26% share), a 13% increase from the eight deals recorded in Q2 2024.

New York followed closely with eight deals (24% share), doubling the four deals completed in the same period last year.

Texas completed three deals (9% share), up from two deals in Q2 2024, while Florida also recorded three deals (9% share), entering the top three and replacing Illinois, which had recorded two deals (8% share) in Q2 2024.

Despite overall deal activity rising, both California and New York saw a stronger share of transactions, reinforcing their dominant positions within the US InsurTech landscape as momentum returned to the sector.

Ledgebrook, an InsurTech firm focused on the excess and surplus (E&S) insurance market, secured one of the largest US InsurTech deals of quarter with a $65m Series C funding round, bringing its total capital raised to over $110m

The round was led by The Stephens Group, with participation from Duquesne, Brand Foundry, Floating Point, Hummingbird Nomads, and American Family Ventures.

This latest capital injection will support the company’s rapid expansion, including talent acquisition, product diversification, and deeper collaboration with carrier partners through increased risk retention.

Ledgebrook aims to solidify its position as a premier E&S platform by enhancing its tech-driven infrastructure and strengthening relationships with wholesale brokers through consistent delivery and innovation.

The funding underscores strong investor confidence in Ledgebrook’s vision of blending underwriting expertise with modern technology to transform the traditionally complex E&S landscape.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst