Key global InsurTech investment stats in Q3 2025:

- Global InsurTech deal activity grew by 8% YoY

- US companies secured 80% of the top 10 global InsurTech deals to dominate the market in Q3

- Kin, a Chicago-based digital home insurance provider, secured one of the biggest global InsurTech deals of the quarter with a $50m Series E funding round, nearly doubling its valuation from $1.1bn to $2bn

Global InsurTech deal activity grew by 8% YoY

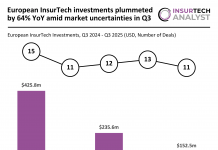

In Q3 2025, the global InsurTech sector recorded $758.6m in total funding across 54 transactions, representing a substantial 68% decline from the $2.38bn raised in Q3 2024, even as deal activity slightly increased from 50 to 54.

This sharp drop in investment highlights a significant cooling in the sector following an exceptional quarter in 2024.

It is important to note that Q3 2024 included the $1bn Sedgwick deal, which heavily inflated total funding for that period.

When excluding this outlier, the adjusted funding for Q3 2024 stands at approximately $1.38bn, meaning that the actual year-on-year decline narrows to around 45%.

This recalibration paints a clearer picture of a market experiencing a correction rather than a collapse, with capital deployment slowing as investors prioritise profitability and consolidation over aggressive expansion.

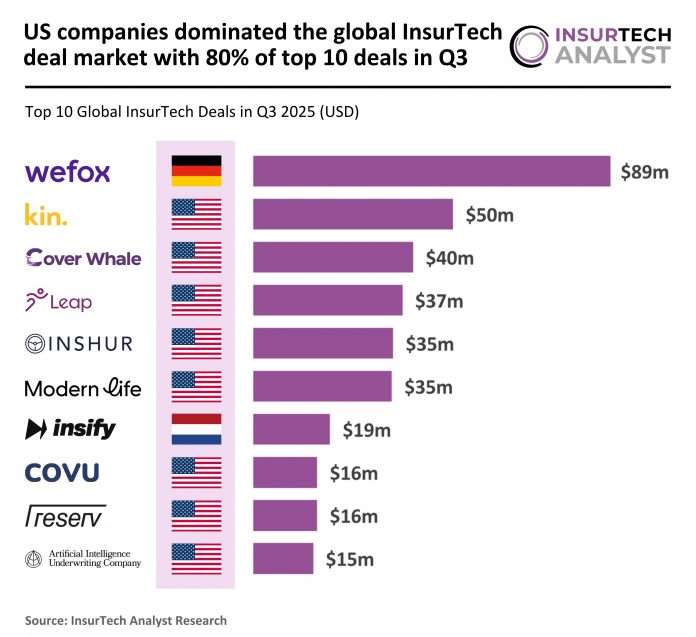

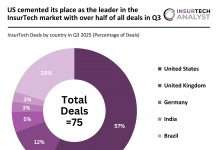

US companies secured 80% of the top 10 global InsurTech deals to dominate the market in Q3

The top 10 deals in Q3 2025 were overwhelmingly concentrated in the US, which accounted for eight of the ten largest transactions — a sharp increase from six in Q3 2024.

This further solidifies the US’s dominant position in the global InsurTech market.

In contrast, France, which had secured four top deals in Q3 2024, was absent from the 2025 list, replaced by Germany and the Netherlands, each capturing one top deal.

This shift underscores a refocusing of high-value investment back towards the US, with limited large-scale activity emerging from other regions.

Overall, the top deal distribution in Q3 2025 suggests a market consolidation around US-based players, while the absence of major European deals — particularly those like Sedgwick in 2024 — highlights the reduced diversity of large transactions within the global InsurTech landscape.

Kin, a Chicago-based digital home insurance provider, secured one of the biggest global InsurTech deals of the quarter with a $50m Series E funding round, nearly doubling its valuation from $1.1bn to $2bn

The round was led by QED Investors, Activate Capital, and Wellington Management.

Kin leverages advanced data analytics and proprietary risk modelling to offer competitively priced home insurance in disaster-prone regions where traditional insurers are retreating.

Operating across 13 US states and covering more than $100bn worth of property, the company manages over $600m in in-force premiums and has been profitable since 2023, consistently outperforming industry benchmarks.

Its technology-driven platform enhances underwriting precision, enabling fairer pricing and broader coverage for homeowners affected by extreme weather events.

The new funding will support the launch of an additional reciprocal exchange, continued national expansion, and further investment in innovative, AI-enabled insurance products that strengthen Kin’s position as a leader in data-driven, sustainable home insurance solutions.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst