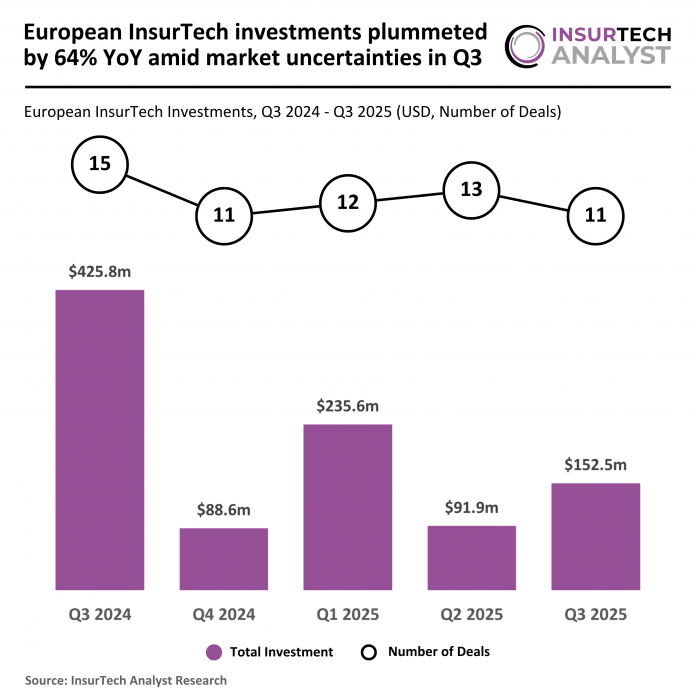

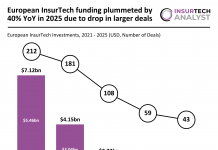

Key European InsurTech investment stats in Q3 2025:

- European InsurTech investments plummeted by 64% YoY in Q3

- Average deal value halved to $13.9m as investors grew cautious due to market uncertainties

- Insify, a Netherlands-based InsurTech platform focused on providing tailored digital insurance solutions for freelancers and small to medium-sized enterprises (SMEs), secured one of the biggest European InsurTech deals of the quarter with a $17.6m Series B funding round

European InsurTech investments plummeted by 64% YoY in Q3

In Q3 2025, the European InsurTech sector experienced a decline in both funding and deal activity compared to the same quarter last year.

Only 11 deals were recorded in Q3 2025, representing a 27% decrease from the 15 deals completed in Q3 2024.

Funding also dropped significantly, with InsurTech firms raising $152.5m in Q3 2025—a 64% decline from the $425.8m raised in Q3 2024.

This substantial contraction highlights continued investor caution across the European InsurTech landscape, as capital deployment remains restrained amid macroeconomic pressures and a more selective investment environment.

When comparing Q2 to Q3 2025, deal activity fell from 13 to 11 transactions, marking a 15% quarter-on-quarter decrease.

However, total funding rose sharply by 66% from $91.9m in Q2 2025, suggesting that while the number of deals declined, investors allocated larger sums to fewer, potentially higher-quality opportunities.

Average deal value halved to $13.9m as investors grew cautious due to market uncertainties

The average deal value in Q3 2025 stood at $13.9m, down 51% from the $28.4m average in Q3 2024 but up 95% from the $7.1m average in Q2 2025.

This pattern indicates a recalibration in investment behaviour, with capital shifting towards mid-sized rounds rather than the large-scale transactions that previously dominated the market.

The movement reflects ongoing market uncertainty, with investors maintaining a cautious stance and prioritising stability and resilience over aggressive growth amid evolving economic and regulatory conditions.

Insify, a Netherlands-based InsurTech platform focused on providing tailored digital insurance solutions for freelancers and small to medium-sized enterprises (SMEs), secured one of the biggest European InsurTech deals of the quarter with a $17.6m Series B funding round

It was led by Evli Growth Partners, alongside continued support from Accel, Opera Tech Ventures, Munich Re Ventures, Visionaries Club, and Frontline Ventures.

Founded to simplify and modernise business insurance, Insify leverages AI-driven technology to streamline onboarding, automate underwriting, and offer flexible, transparent coverage designed specifically for self-employed professionals.

The funding will be used to accelerate Insify’s European expansion, enhance its suite of AI-powered insurance products, and strengthen its digital platform across key markets including the Netherlands, France, and Germany.

Serving thousands of professionals across sectors such as consulting, design, and skilled trades, the company has seen its gross written premiums more than triple since its Series A extension, underscoring its growing role in reshaping the SME insurance landscape across Europe.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst