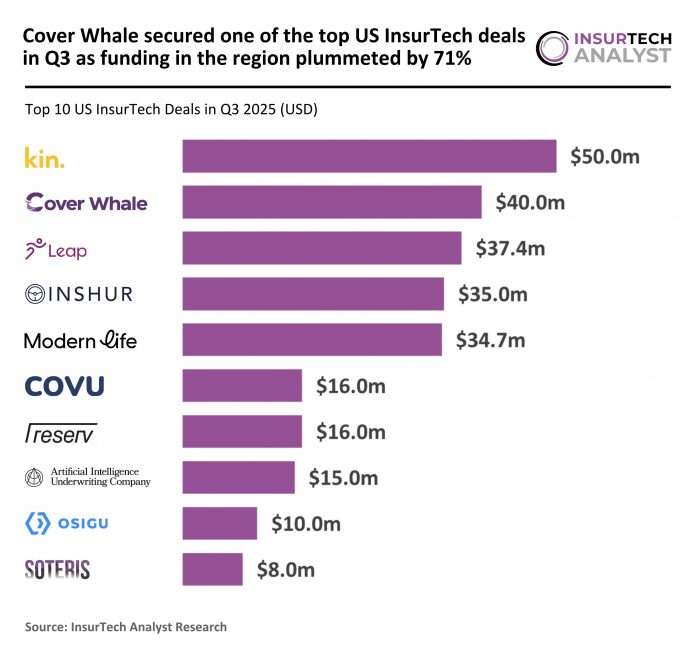

Key US InsurTech investment stats in Q3 2025:

- US InsurTech funding plummeted by 71% YoY in Q3

- New York emerged as the main hub for InsurTech deals as companies from the region secured four of the top 10 deals

- Cover Whale, a New York-based InsurTech specialising in connected insurance solutions for the commercial auto sector, secured one of the top US InsurTech deals of the quarter with a $40m equity investment

US InsurTech funding plummeted by 71% YoY in Q3

In Q3 2025, the US InsurTech sector recorded total funding of $559.5m across 32 deals, marking a sharp 71% decline in investment value compared to the $1.9bn raised in Q3 2024.

However, it is important to note that Q3 2024 included the $1bn Sedgwick deal, which was a major outlier and significantly inflated the previous year’s total.

When excluding this transaction, Q3 2024 funding amounted to $907.8m, representing a slower decline of 38% in total funding YoY.

Deal activity, in contrast, rose from 24 to 32 transactions, a 33% increase, indicating that while investment sizes were smaller, investor engagement within the sector remained active.

The data suggests that the US InsurTech market is experiencing a recalibration, with investors distributing capital more broadly across early- and mid-stage deals rather than concentrating it in large-scale funding rounds.

New York emerged as the main hub for InsurTech deals as companies from the region secured four of the top 10 deals

The composition of the top 10 deals in Q3 2025 highlights a shift in geographical concentration across the US.

New York led the quarter with four major transactions, overtaking California, which followed with three.

Florida, New Jersey and Illinois each secured one top deal.

Compared to Q3 2024, where California topped the list with three deals and New York held two, the latest results signal a growing diversification of InsurTech investment beyond the traditional technology hubs.

States such as Tennessee, Colorado and Massachusetts, which featured among the top 10 in 2024, were absent in 2025, reflecting a change in investor focus towards financial and regulatory centres like New York and New Jersey.

This evolving state-level distribution underscores the sector’s ongoing regional realignment as InsurTech innovation matures across the US.

Cover Whale, a New York-based InsurTech specialising in connected insurance solutions for the commercial auto sector, secured one of the top US InsurTech deals of the quarter with a $40m equity investment

The funding was from Morgan Stanley Expansion Capital.

Founded in 2020, the company leverages a proprietary technology platform and algorithmic underwriting to enable insurance agents to bind trucking policies online within minutes.

By integrating real-time telematics and continuous underwriting, Cover Whale helps reduce losses in the high-risk commercial trucking market while improving pricing precision and operational efficiency.

The latest funding follows Morgan Stanley Expansion Capital’s transition from lender to equity partner and will be used to enhance Cover Whale’s analytics capabilities, expand its product offerings, and accelerate upgrades to its technology stack.

Following a year of consolidation and platform enhancement, the company is now well-positioned to scale its connected insurance model and strengthen its leadership in technology-driven commercial auto underwriting across the United States.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst