Key global InsurTech investment stats in Q1 – Q3 2025:

- Global InsurTech deal activity dropped by 12% YoY

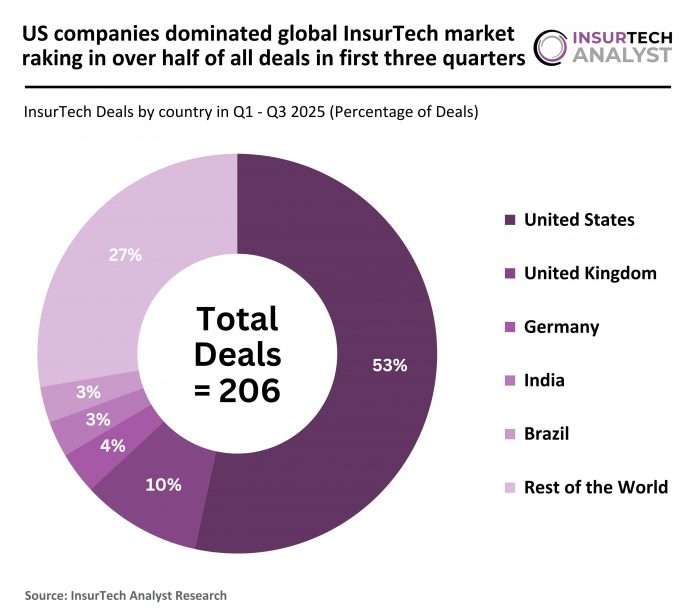

- US companies secured over half of all InsurTech deals globally to dominate the market in the first three quarters

- Kin, a Chicago-based digital home insurance provider, secured one of the biggest global InsurTech deals of the quarter with a $50m Series E funding round, nearly doubling its valuation from $1.1bn to $2bn

Global InsurTech deal activity dropped by 12% YoY

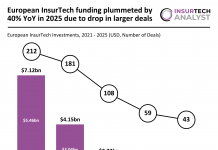

In Q1-Q3 2025, the global InsurTech market saw declines in both funding and deal activity compared with the same period in 2024.

Total funding fell to $2.2bn, representing a 40% decrease from the $3.7bn raised in Q1-Q3 2024.

Deal activity also contracted, with 206 deals recorded, a 12% drop from the 235 deals completed during the first nine months of 2024.

This simultaneous decline in both funding and deal volume reflects the continued cautious stance of investors toward the InsurTech sector globally, with a reduced pace of capital deployment and a sharper focus on profitability and sustainable growth models.

US companies secured over half of all InsurTech deals globally to dominate the market in the first three quarters

The US remained the dominant InsurTech market in the first three quarter of the year, as companies secured 110 deals (53% share), unchanged in absolute deal numbers from the same period last year but reflecting a rise from a 47% share, indicating strengthened relative market concentration despite the global slowdown.

The UK recorded 20 deals (10% share), a 11% increase from the 18 deals (8% share) completed in the same period in 2024.

Germany ranked third with 7 deals (3% share), replacing Canada, which had completed 13 deals (6% share) in Q1-Q3 2024.

Although overall global deal activity declined, both the US and the UK increased their percentage share, suggesting that leading markets have consolidated their influence within the global InsurTech landscape as investment activity became more selective.

Kin, a Chicago-based digital home insurance provider, secured one of the biggest global InsurTech deals of the quarter with a $50m Series E funding round, nearly doubling its valuation from $1.1bn to $2bn

The round was led by QED Investors, Activate Capital, and Wellington Management.

Kin leverages advanced data analytics and proprietary risk modelling to offer competitively priced home insurance in disaster-prone regions where traditional insurers are retreating.

Operating across 13 US states and covering more than $100bn worth of property, the company manages over $600m in in-force premiums and has been profitable since 2023, consistently outperforming industry benchmarks.

Its technology-driven platform enhances underwriting precision, enabling fairer pricing and broader coverage for homeowners affected by extreme weather events.

The new funding will support the launch of an additional reciprocal exchange, continued national expansion, and further investment in innovative, AI-enabled insurance products that strengthen Kin’s position as a leader in data-driven, sustainable home insurance solutions.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst