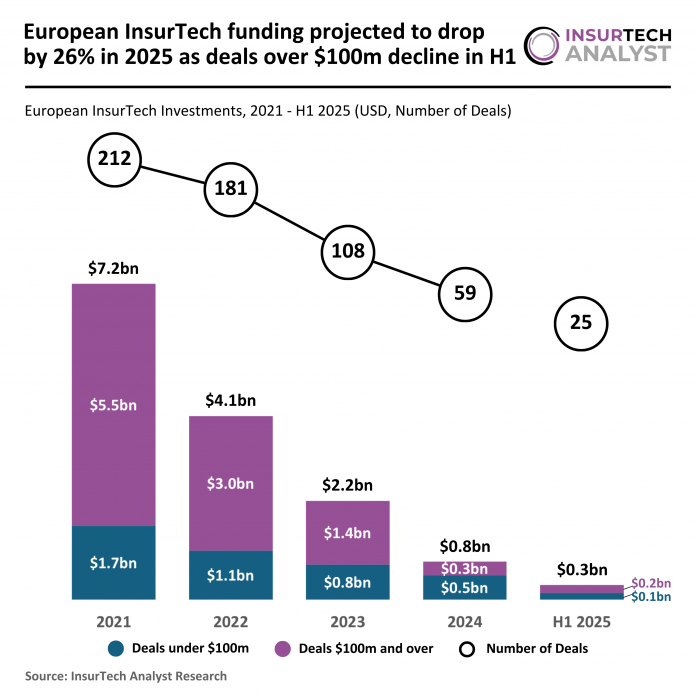

Key European InsurTech investment stats in H1 2025:

- European InsurTech funding dropped by 38% in H1

- At current investment pace, funding is projected to drop by 26% in 2025

- Deals over $100m fell as investors held back from investing

- Napo, a UK-based digital-first pet insurance provider, secured one of the biggest European InsurTech deals of the first half of the year with a $15.2m Series B funding round

European InsurTech funding dropped by 38% in H1

In H1 2025, the European InsurTech sector saw 25 deals completed, down 24% from the 33 deals recorded in H1 2024 and a 4% decline from the 26 deals seen in H2 2024.

Total funding fell to $317.5m, representing an 8% drop compared to the $346.3m raised in H1 2024 and a 38% decline from the $514.4m secured in H2 2024.

The simultaneous fall in deal activity and capital raised reflects a cooling investment climate, with investors becoming more selective in their commitments.

At current investment pace, funding is projected to drop by 26% in 2025

If the H1 2025 trend were to continue across the rest of the year, 2025 would close with around 50 deals completed and $635m in total funding.

This would represent a 15% drop in deal volume from the 59 deals completed in 2024 and a 26% decrease in funding compared to the $860.7m raised last year.

Such a trajectory would underscore a sustained contraction, with investor appetite favouring caution over aggressive expansion.

The average deal size in H1 2025 was $12.7m, compared to $10.5m in H1 2024 and $19.8m in H2 2024.

While the YoY increase highlights greater concentration of capital into individual firms, the sharp fall from H2 2024 suggests that larger, late-stage deals have become less frequent, with investors shifting back towards mid-sized opportunities.

Deals over $100m fell as investors held back from investing

Funding from deals under $100m accounted for $142.5m in H1 2025, down 59% from $346.3m in H1 2024 and 29% lower than the $200.9m raised in H2 2024.

Deals valued at $100m or more contributed $175m, marking the first time this category has appeared in the first half of the year, as H1 2024 had none.

However, this still represents a 44% decline from the $313.5m secured in H2 2024.

The drop across both small and large transactions reflects a broad pullback in investor activity, with fewer high-value deals to offset weakness in early-stage funding.

Napo, a UK-based digital-first pet insurance provider, secured one of the biggest European InsurTech deals of the first half of the year with a $15.2m Series B funding round

The funding round was led by Mercia Ventures, alongside participation from existing investors including DN Capital, Companion Fund, and Helvetia Venture Fund.

Specialising in lifetime coverage that includes dental care, behavioural consultations, 24/7 vet access, and multi-pet discounts, Napo is redefining pet insurance by integrating AI-driven claims handling and automation into a seamless digital platform.

Its end-to-end model reduces administrative costs while maintaining high customer satisfaction, as evidenced by a standout NPS and Trustpilot reviews.

The fresh capital will fuel Napo’s geographical expansion, enhance its AI capabilities, and support talent acquisition as it continues to scale a sustainable and customer-focused approach to pet insurance across Europe.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst