Key Global InsurTech investment stats in H1 2025:

- Global InsurTech funding dropped by 47% in H1

- At current investment pace, funding is projected to drop by 29% in 2025

- Deals over $100m plummeted by 85% as investors grew cautious

- Naked, South Africa’s AI-driven digital insurance platform, secured one of the biggest InsurTech deals of the first half of the year with a $38m Series B2 funding round

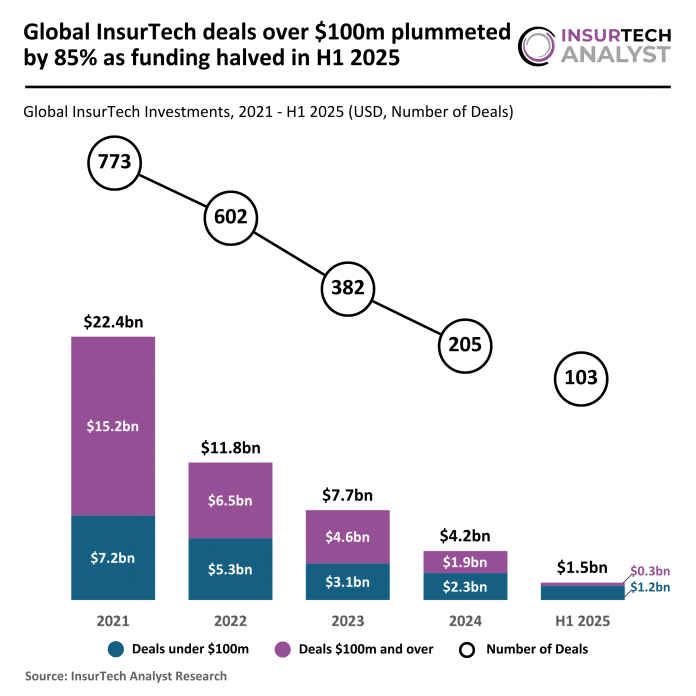

Global InsurTech funding dropped by 47% in H1

In H1 2025, the Global InsurTech sector recorded 103 deals, down 11% from the 116 transactions completed in H1 2024 but 16% higher than the 89 deals seen in H2 2024.

Funding reached $1.5bn, up 9% from $1.4bn in H1 2024, though significantly lower than the $2.8bn raised in H2 2024.

This indicates that while activity levels have picked up from late 2024, the overall size of funding rounds has reduced, reflecting a shift towards more cautious capital deployment.

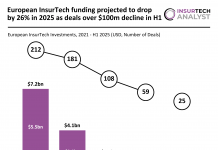

At current investment pace, funding is projected to drop by 29% in 2025

If the H1 2025 trend were to continue across the remainder of the year, 2025 would close with around 206 deals and $3.0bn in total funding.

That would be broadly flat on deal count versus 2024’s 205 deals, but funding would be materially lower — a 29% decline from the $4.2bn raised in 2024.

In short, deal activity could end up similar to last year while total capital deployed would fall sharply without another half comparable to H2 2024.

Deals over $100m plummeted by 85% as investors grew cautious

Deals under $100m accounted for $1.2bn in H1 2025, down 11% from the $1.4bn raised in H1 2024 and 31% higher than the $928m recorded in H2 2024.

Larger transactions valued at $100m or more totalled $275m in H1 2025, a sharp 85% fall from the $1.9bn raised in H2 2024.

This indicates a notable rebalancing in favour of smaller and mid-sized rounds, with large-scale investments pulling back significantly compared to late 2024.

Naked, South Africa’s AI-driven digital insurance platform, secured one of the biggest InsurTech deals of the first half of the year with a $38m Series B2 funding round

The round attracted participation from global impact investor BlueOrchard and saw continued backing from Hollard, Yellowwoods, IFC, and DEG.

Launched in 2018, Naked has redefined the insurance model by building a fully digital, automation-led platform that enables users to purchase and manage car, home, and single-item policies online—without human intervention.

The company’s proprietary AI technology enhances user convenience, optimises risk selection, and ensures strong unit economics.

Its unique business model, which allocates a fixed portion of premiums to operations and donates excess funds to user-nominated causes, fosters trust and transparency in claims handling.

With this fresh injection of capital, Naked is set to deepen its AI capabilities, expand its product suite and markets, and scale its customer acquisition efforts as it continues to modernise the insurance experience across the region.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst