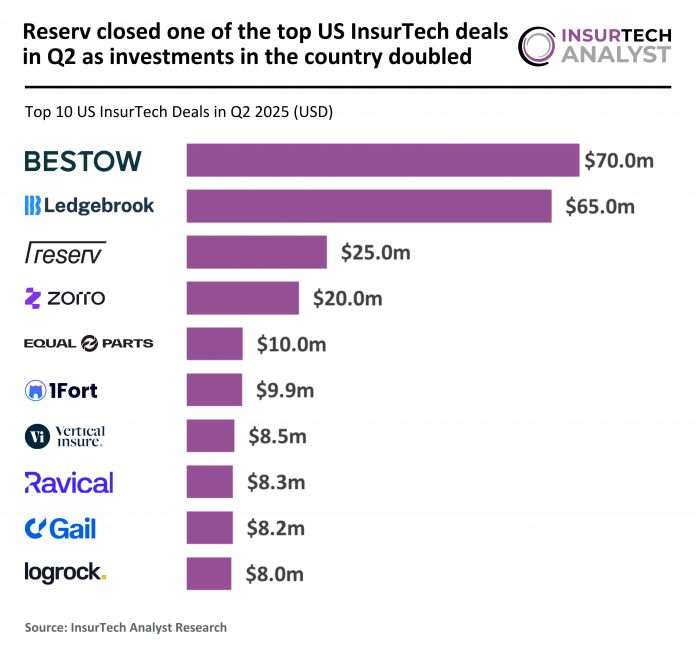

Key US InsurTech investment stats in Q2 2025:

- US InsurTech investments doubled YoY in Q2

- New York-based companies secured a third of the top 10 US InsurTech deals to position themselves as market leaders for the quarter

- Reserv, a New York-based tech-enabled third-party administrator (TPA) that combines experienced claims expertise with modern technology to transform the insurance process, secured one of the top US InsurTech deals of the quarter with a $25m Series B funding round

US InsurTech investments doubled YoY in Q2

In Q2 2025, the US InsurTech sector saw 23 transactions, a slight increase from the 21 recorded in Q2 2024.

More notably, funding value more than doubled year-on-year, rising to $474.9m, a 2x increase from the $237.1m raised in Q2 2024.

This sharp rebound in investment, despite only a modest rise in deal activity, highlights stronger investor appetite for larger-scale funding rounds, potentially signalling renewed confidence in the sector’s growth potential and the scaling opportunities of leading InsurTech firms.

New York-based companies secured a third of the top 10 US InsurTech deals to position themselves as market leaders for the quarter

The top 10 deals in Q2 2025 were led by New York-based businesses, which secured three major deals, strengthening the state’s position as the country’s leading InsurTech hub after recording two top deals in Q2 2024.

Texas emerged as a new stronghold with two top deals, while Illinois, Florida, Wisconsin, Minnesota, and Massachusetts each featured once, reflecting a broader geographical spread of high-value deals.

By contrast, California, which had been prominent in Q2 2024 with two top deals, was absent from the 2025 line-up, along with Michigan, Utah, South Carolina, and Idaho.

The more diverse mix of states in Q2 2025 underscores a decentralisation of InsurTech investment, with growth shifting beyond traditional hubs into emerging state-level markets.

Reserv, a New York-based tech-enabled third-party administrator (TPA) that combines experienced claims expertise with modern technology to transform the insurance process, secured one of the top US InsurTech deals of the quarter with a $25m Series B funding round

The funding round was led by Flourish Ventures, with participation from Accenture Ventures.

Since its launch in 2022, Reserv has grown to over 350 employees across the US and UK, supporting more than 80 MGAs and 20 carriers across multiple property and casualty lines.

Its platform leverages AI-driven tools, automated communications, and advanced rollover technology that can migrate legacy TPA data in under two weeks, dramatically reducing costs and enhancing claims visibility.

This innovation has fuelled triple-digit revenue growth for two consecutive years and positioned Reserv as a next-generation leader in claims processing.

The new funding, which brings total capital raised to $55m, will be directed towards developing enhanced claims automation models, accelerating integrations, and building new modules powered by its expanding proprietary dataset, further strengthening its role in driving efficiency and resilience within the insurance sector.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst