A single claim used to take an hour to process. Now it takes four minutes. In a quiet corner of the office, the hum of computers has replaced the shuffle of papers, and the decisions once made by teams are executed by an AI agent with surgical precision.

For decades, insurance moved at a human pace: slow, methodical, predictable. But in that four-minute blink, the industry’s rhythm is changing. It no longer tires, it doesn’t second-guess, and it doesn’t pause.

From the ground up, AI is redefining the insurance landscape.

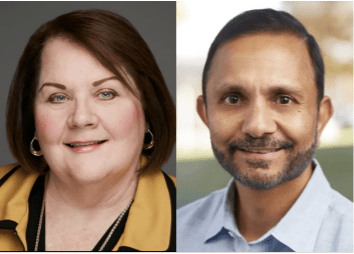

Having been named as part of FinTech Global‘s prestigious InsurTech100, Majesco‘s Chief Strategy Officer, Denise Garth, and President and Chief Product Officer, Manish Shah, decided to lift the lid on AI’s role in the future of insurance.

New boundaries

Insurance has long been an industry defined by careful calculation and incremental change. Legacy systems, rigid workflows, and painstaking manual processes meant innovation moved slowly.

Today, the arrival of AI is forcing a reconsideration of every step. Majesco is among those leading that charge.

This is the first time in decades we can rethink the business operating model,” says Garth. “It’s not just about speeding up tasks — it’s about redesigning workflows, elevating customer experience, and creating consistent, high-quality processes across the board.”

Shah adds, “AI will not remain a bolt-on. It will become central to decision-making and operations. We’re already seeing hybrid workforces emerge, where humans and AI agents collaborate seamlessly. That changes everything—from process design to the core systems that underpin the business.”

Insurers that can successfully integrate AI will indefinitely gain a lasting advantage against their competitors. Those who treat it as optional risk falling behind in a world where speed, precision, and scale increasingly define success.

Measuring impact

But how can insurers quantify the impact of AI? For Majesco, the evidence is in operational improvements.

Garth highlights the opportunity to rethink workflows from the ground up: “It has the opportunity to really leap forward… understanding what you can do from a business perspective to create some consistency, some quality, elevate a customer experience, elevate the employee experience.”

Shah adds that AI’s effect is tangible, not just theoretical, “This is a big deal,” he says, noting the dramatic reductions in time required for complex processes when AI is applied strategically.

The results are concrete. with teams able to complete repetitive tasks faster, with greater accuracy and consistency.

Performance can be tracked, measured, and benchmarked against previous standards, offering managers clear insight into where AI is most effective. The approach allows organisations to handle higher volumes without expanding staff and provides a framework for continuous improvement.

Majesco’s experience demonstrates that AI’s value is far from abstract. When applied across operational processes, it delivers measurable gains in speed, quality, and scalability.

From differentiation to core systems

Reshaping the very fabric of insurance, the ramifications of AI now vastly overpower just tweaking workflows. To make meaningful impacts to their performance, insurers cannot adopt AI in isolated pockets, the switch has to be encompassing, effecting the DNA of your firm.

“To make these large tangible gains, though, it can’t be just little bits and pieces here. You’ve got to really think about it across the entire business value chain,” Garth says.

Majesco has seen these success stories first hand. Perhaps, in most eye-catching fashion in its claims triage. A task formerly handled by multiple staff in about an hour now only takes a meagre four minutes.

In other functions, processes once consuming 400 minutes are compressed to 10.

“Allowing you to do it quicker, more consistently and in a quality manner… it’s real value,” she adds. Efficiency, consistency, and auditability all improve, while employees are freed to focus on higher-value work.

The challenge extends to the systems that underpin insurance operations. Shah highlights a looming mismatch between traditional software and future users.

“Primary driver for changing it always is the end users, because in future the end users of the core systems are not going to be just humans. The future demands a hybrid workforce,” he explains.

AI agents will take on repetitive tasks, leaving humans to operate at higher skill levels.

Shah emphasises that most legacy systems are optimised for human interaction, with screens, structured data, and static rules.

“If 50–60% of your users are AI agents, and your software is designed for humans, that is a misfit,” he warns.

Majesco sees the future clearly, affirming that insurers must rethink these core system designs, crafting AI-first architecture that accommodates hybrid workforces.

This divide is only likely to exacerbate further going forward, with those that embed AI gaining a decisive advantage. This ultimately could even prove to be a watershed moment for the sector, a blueprint for an industry-wide transformation, from customer experience to core operational systems.

By embedding intelligence into every layer of the business, firms can cultivate agility, anticipate change, and make decisions with unprecedented speed and accuracy.

This shift also opens the door to new products, services, and ways of engaging with customers, creating opportunities that were previously unimaginable.

Majesco’s role in guiding insurers through this journey is pivotal, helping them navigate both the technological and cultural shifts required.

The organisations that succeed will be those that treat AI not as a tool, but as a strategic partner in shaping the insurance enterprise of the future.