Key US InsurTech investment stats in Q3 2025:

- US InsurTech deal activity increased by 39% QoQ in Q3

- California and New York continue to dominate the US InsurTech landscape as companies based in those two states secured over 50% of all deals in the country during Q3

- Reserv, a New York-based InsurTech specialising in AI-driven claims management solutions, secured one of the biggest InsurTech deals in the third quarter with an additional $16m fresh funding

US InsurTech deal activity increased by 39% QoQ in Q3

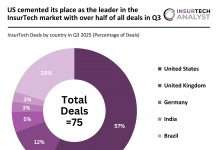

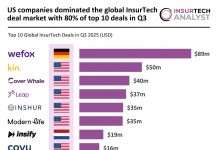

In Q3 2025, the US InsurTech market bounced backin both funding and deal activity following a subdued first half of the year.

The sector secured $559.5m across 32 deals, marking an 18% increase in funding and a 39% rise in deal activity compared to the $474.9m raised through 23 deals in Q2 2025.

However, when compared with Q3 2024, total funding fell sharply by 71% from $1.9bn, even as deal volume increased by 33% from 24 deals, suggesting smaller deal sizes and cautious investor sentiment.

It is important to note that Q3 2024 included Sedgwick’s $1bn deal, which heavily inflated overall funding for that quarter.

Excluding this transaction, underlying funding in Q3 2024 would have been $908m, meaning that funding in Q3 2025 actually declined by 38%, reflecting a continued moderation in investor appetite despite the uptick in activity levels.

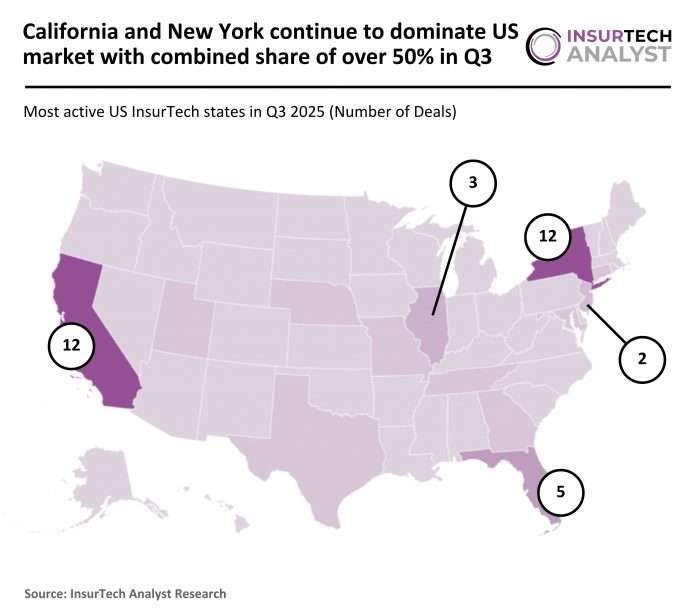

California and New York continue to dominate the US InsurTech landscape as companies based in those two states secured over 50% of all deals in the country during Q3

California and New York jointly led the US InsurTech landscape in Q3 2025, each recording 12 deals (29% share) — a notable increase from 9 deals (23% share) and 6 deals (15% share), respectively, in Q3 2024.

Florida emerged as the third most active state with 5 deals (12% share), entering the top three and replacing Massachusetts, which had also completed 6 deals (15% share) in the same quarter last year.

Despite the ongoing funding contraction, the rise in deal count across major states indicates renewed momentum in early- and mid-stage investments.

California and New York, in particular, continue to strengthen their dominance within the US InsurTech ecosystem, accounting for more than half of total deal activity during the quarter.

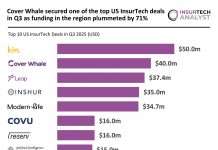

Reserv, a New York-based InsurTech specialising in AI-driven claims management solutions, secured one of the biggest InsurTech deals in the third quarter with an additional $16m fresh funding

This extended its oversubscribed Series B round to $41m.

The extension was led by QBE Ventures alongside new strategic investors, with continued backing from Bain Capital Ventures and Flourish Ventures.

Founded to modernise claims operations for insurers, managing general agents (MGAs), and self-insureds, Reserv operates as a technology-driven third-party administrator (TPA) that leverages automation, data orchestration, and AI to streamline complex claims workflows.

Its platform now serves over 100 clients globally, generates more than $75m in annual recurring revenue, and supports a workforce of over 500 employees.

The new capital will accelerate the company’s development of large-scale AI orchestration, expand adoption of its patent-pending claim rollover technology, and strengthen its US market presence through partnerships such as that with QBE.

This funding underscores the accelerating demand for advanced InsurTech solutions that enhance claims efficiency, transparency, and decision-making across the insurance value chain.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst