Key US InsurTech investment stats in Q3 2025:

- US InsurTech investments dropped by 18% QoQ in Q3

- Average deal value fell to $17.5m as investors shifted to smaller deals due to market uncertainties

- INSHUR, a global InsurTech platform that provides AI-driven commercial insurance solutions for the on-demand mobility sector, secured one of the biggest US InsurTech deals of the quarter with a $35m funding round from Trinity Capital

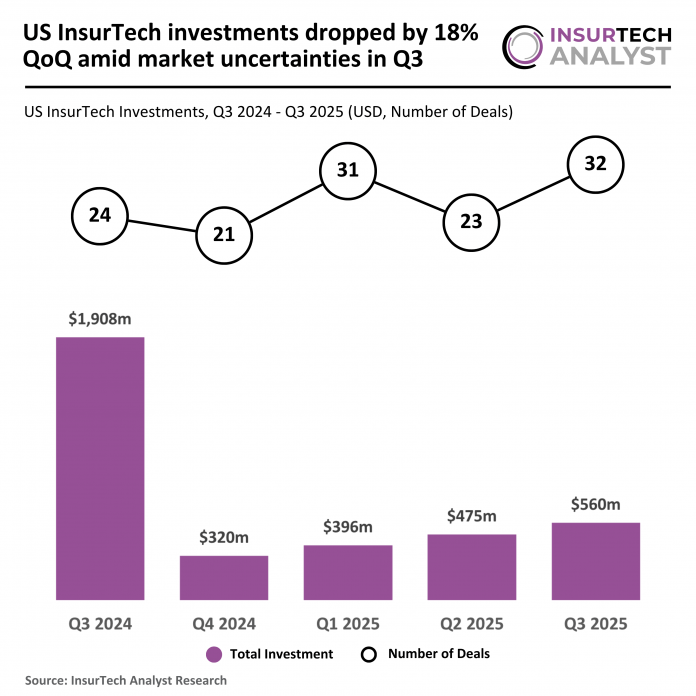

US InsurTech investments dropped by 18% QoQ in Q3

In Q3 2025, the US InsurTech market saw a notable shift in activity, with deal volume reaching its highest level in the period despite continued pressure on overall funding.

A total of 32 deals were recorded in Q3 2025, marking a 33% increase from the 24 deals completed in Q3 2024 and a 39% rise from the 23 deals seen in Q2 2025.

This rise in transactions highlights renewed investor engagement, even as capital deployment remains more selective.

Total funding in Q3 2025 reached $559.5m, representing a 71% decline from the $1.9bn raised in Q3 2024 and an 18% increase compared with the $474.9m recorded in Q2 2025.

It is important to note that Q3 2024 included the $1bn Sedgwick deal, significantly inflating that quarter’s total.

When excluding the Sedgwick transaction, Q3 2024 funding falls to $908m, making the year-on-year decline a less severe but still material 38%.

Average deal value fell to $17.5m as investors shifted to smaller deals due to market uncertainties

The average deal value in Q3 2025 was $17.5m, a steep 78% decline from the $79.5m average in Q3 2024 (driven heavily by the Sedgwick round).

Excluding Sedgwick, the Q3 2024 average drops to $37.8m, meaning Q3 2025 still reflects a significant 54% decrease.

Compared with Q2 2025, where the average deal size stood at $20.6m, Q3 2025 saw a smaller drop with a 15% change, underscoring a continued investor shift toward smaller, more measured investments amid ongoing market uncertainty and a cautious funding climate.

INSHUR, a global InsurTech platform that provides AI-driven commercial insurance solutions for the on-demand mobility sector, secured one of the biggest US InsurTech deals of the quarter with a $35m funding round from Trinity Capital

The investment will be used to enhance INSHUR’s artificial intelligence capabilities, advance R&D into autonomous vehicle (AV) insurance, and accelerate its growth across the United States.

Operating globally, INSHUR’s platform simplifies insurance for rideshare and delivery drivers, fleet operators, and mobility platforms such as Uber, and has surpassed 1 million policies sold in the UK.

The funding will support the expansion of innovative programmes, including on-demand and off-rental coverage solutions for car rental fleets, and initiatives like Uber’s ‘Bring Your Own Insurance’.

INSHUR aims to leverage advanced AI to improve underwriting precision and real-time pricing, cementing its position as a world-class leader in mobility insurance.

With consistent growth above 50% CAGR since 2023, the company is on track to surpass a $100m revenue run rate within a year while advancing profitability and shaping the future of autonomous and on-demand insurance.

Keep up with all the latest InsurTech news here

Copyright © 2025 InsurTech Analyst