Hippo is having a great 2020, having officially secured its unicorn status this summer, it has now bagged a $350m investment just as the InsurTech industry seems to be recovering from a previous slump.

The Palo Alto-based InsurTech received its new cash injection from Mitsui Sumitomo Insurance Company, which is a subsidiary of MS&AD Insurance Group Holdings.

The Californian insurance innovator will use the money to expand its offering to be able to reach 95% of the US’s homeowners within the next year, according to Crunchbase, which reported that Hippo is currently only covering 70% of the nation’s market.

Hippo achieved a $1.5bn valuation this summer, cementing its title as a unicorn, after raising $150m. The Series E round was supported by FinTLV Ventures, Ribbit Capital, Dragoneer Investment Group and Innovious Capital.

Hippo had previously raised a $100m Series D round in 2019. That round enjoyed participation from Bond, Comcast Ventures, Felicis Ventures, Fifth Wall, Hillhouse Capital, Horizons Ventures, ICONIQ Capital, Lennar Corporation, Michael Ovitz, Pipeline Capital, Propel Venture Partners, RPM Ventures, Standard Industries, and Zeev Ventures.

The company uses thermal and satellite imagery to provide homeowners with a better assessment of the risk their properties may be in.

Although, Hippo is not the only InsurTech company to have enjoyed success this year. The most notable example of that is the US-based InsurTech Lemonade that successfully went public in July.

Root Insurance followed Lemonade along the same path and went through an initial public listing in October.

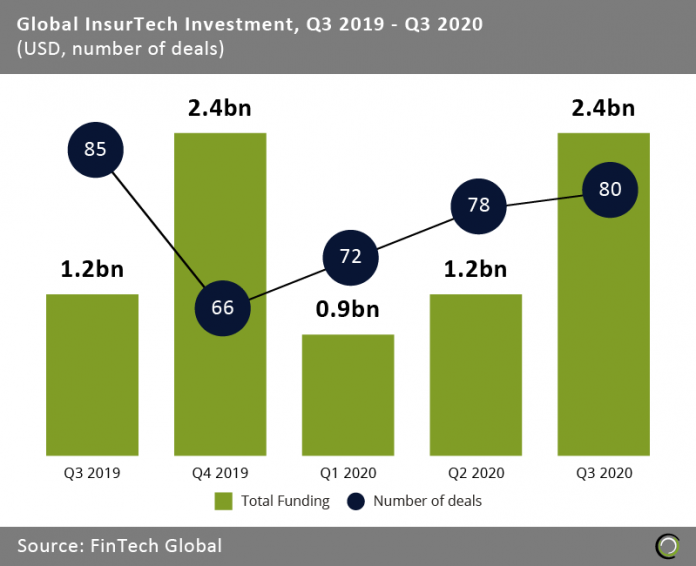

Looking at investment into the InsurTech industry as a whole, the sector had a reasonably slow start to 2020. The industry only raised about $900m between January and March, according to FinTech Global’s research.

That’s hardly surprising given the financial turmoil brought on by the coronavirus pandemic. Investors are renowned for their dislike of market uncertainty, motivating their caution in the beginning of the health crisis.

Nevertheless, investment has picked up in the last two quarters. The sector raised $1.2bn in the second quarter and a whooping $2.4bn in the third.

The strong funding levels recorded were driven by five large deals over $100m. Those five rounds were Bright Health’s $500m deal, Ki Insurance’s $500m cash injection, Next Insurance’s $250m deal and Waterboard’s $230m injection as well as the $150m round picked up by Hippo.

Some market experts are even suggesting that the InsurTech industry could prove to be one of the big winners once the smoke has settled from the coronavirus crisis.

The argument is that the pandemic has demonstrated, with almost painful clarity, how much the insurance industry is in dire need of innovation.

Given Hippo’s new raise and the overall trend in the InsurTech industry, the question is if there isn’t something to that.

Copyright © 2020 FinTech Global