Why 2026 is the year of smarter insurance

The expectation for insurance has changed. Paper forms, manual approvals, and siloed spreadsheets now feel as archaic as dial-up phones. In their place, customers...

BIA explained: How ChainThat’s building the future of insurance finance

For insurers, brokers, and MGAs, managing complex financial flows has long been a source of inefficiency. Multi-entity structures, fragmented policy administration systems, and manual...

What is the current state of risk in the finance and insurance sector?

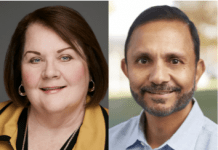

FinTech Global recently sat down for an interview with Dun & Bradstreet, a US-based provider of commercial data, analytics, and insights for businesses, to find out how financial services and insurance companies are navigating risk in an age of AI, fraud and uncertainty.

The InsurTech trends you need to watch

Almost two decades ago, the smartphone revolution saw the end of flip-phones, and technology such as touchscreens, an online app store, and 4K cameras...

The tech underpinning successful insurance operations in 2025

Insurance in 2025 is a performance of precision, agility, and empathy. Behind the customer-facing apps, slick interfaces, and instant quotes lies a backstage operation...

Can insurers really keep up as customer expectations shift?

After hours of doing battle with frustrating online forms, captcha loops, and AI chatbots, many fans finally managed to secure Oasis reunion tickets in...

How to maximise your partnership with an InsurTech provider

With insurance carriers, brokers, and managing general agencies under intense pressure to modernise their operations, partnering with an InsurTech provider is often hailed as...

How insurers can maximise value with AI

Artificial intelligence holds enormous promise for firms across insurance and financial services. But most pilot projects fail to scale, often stalled by fragmented data,...

AI is rewriting the rulebook for P&C claims — here’s how

Billions of dollars are paid out in P&C insurance claims each year, yet many firms still underinvest in claims transformation.

Kevin Reilley, CEO at Westhill...

How Majesco cuts insurance claims from an hour to four minutes

A single claim used to take an hour to process. Now it takes four minutes. In a quiet corner of the office, the hum...