How Five Sigma’s Clive AI is delivering measurable results in claims handling

Five Sigma has experienced a breakout year in 2025, with considerable demand for its AI and automation solutions for claims management.

The company’s multi-agent AI...

How Majesco cuts insurance claims from an hour to four minutes

A single claim used to take an hour to process. Now it takes four minutes. In a quiet corner of the office, the hum...

When generic AI isn’t enough: why insurance needs its own brain

Insurance companies may be eager to adopt generative AI capabilities, but generic models often fail to grasp the industry’s complexities

How BexarWare is laser-focused on modernising the insurance industry

Originally founded in 2019, San Antonio-headquartered BexarWare provides end-to-end custom software services that meet complex business challenges with native, hybrid, and custom software development....

How iCover is easing life insurance challenges

When Nicole Mwesigwa lost her husband, she encountered firsthand just how challenging life insurance could be. The process felt unnecessarily cumbersome and frustrating, particularly...

Profitable growth in a soft market: How contextual AI and decision intelligence are redefining...

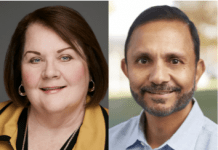

After more than five years of hard market conditions, the insurance sector is now shifting into a soft market. This shift means firms will need to change their strategies to ensure they can stay competitive and profitable. Quantexa VP Insurance Alex Johnson believes Contextual AI and Decision Intelligence is the key to achieving this.

Inside insurance’s legacy tech problem

Insurers are dreaming of AI, but many are still anchored to outdated systems. A 2024 Novidea survey found that 41% of insurance professionals admit...

How Symphony is redefining client interaction in insurance

When an insurance client sends a message, every second counts. A delayed reply can cost trust, revenue, and even long-term loyalty. Symphony is helping...

How Agentero is making life easier for agencies and carriers alike

For many small and medium agencies, winning the attention of carriers can be hard enough, but securing their business can be even tougher.

How Expert.ai is using hybrid AI to transform the insurance market

Expert.ai is an enterprise AI solutions provider specializing in hybrid AI that helps insurance organisations understand data and make better decisions across a wide...