Vienna Insurance Group launches new offering to mitigate cyber risks

Vienna Insurance Group (VIG), the largest insurance group in Central and Eastern Europe, has launched a new venture focused on assisting small and medium-sized enterprises (SMEs) in managing and mitigating cyber risks.

Macquarie launches rent-a-captive insurance solution to enhance client offerings

Macquarie, a global financial services provider, has expanded its client offering with the launch of a rent-a-captive insurance solution for property and casualty-related risks.

Dundee-based Broker Insights debuts Vision platform in the US

Dundee-based Broker Insights, an InsurTech firm specialising in commercial insurance, has officially launched its Vision platform in the United States.

Best Insurance introduces flexible insurance buying via WhatsApp

Best Insurance, an InsurTech provider dedicated to simplifying the insurance process, has launched an AI-driven service enabling customers to purchase and manage insurance via WhatsApp.

UK-based HealthTech firm Semble secures $15m from Mercia Ventures

London-based HealthTech company, Semble has raised $15m in a Series B funding round led by Mercia Ventures.

IQUW and mea partner to boost underwriting efficiency

IQUW, a prominent (re)insurer with a focus on digital transformation and seamless broker experiences, has entered a strategic partnership with mea in a bid to transform the underwriting process.

Bolt joins forces with Salesforce to revolutionize insurance quoting

Bolt announces a strategic partnership with Salesforce, an industry leader in customer relationship management (CRM).

CyberCube and Miller form strategic alliance to elevate cyber risk management

CyberCube, the foremost provider of cyber risk analytics, has recently forged a strategic partnership with Miller, a leading independent specialist (re)insurance broker.

HOMEE secures $12m in Series C funding to enhance AI claims management

HOMEE, an AI-driven direct repair network for the Property and Casualty (P&C) insurance industry, today announced the successful closure of its Series C funding round, amassing $12m.

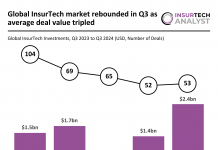

Global InsurTech market rebounded in Q3 as average deal value tripled

Key InsurTech investment stats in Q3 2024:

Global InsurTech market rebounded in Q3 as funding increased by 55% YoY

Average deal value tripled in...