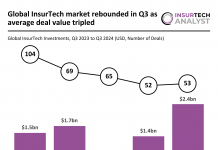

Global InsurTech market rebounded in Q3 as average deal value tripled

Key InsurTech investment stats in Q3 2024:

Global InsurTech market rebounded in Q3 as funding increased by 55% YoY

Average deal value tripled in...

Tokio Marine Kiln appoints industry veteran as head of marine for APAC

Tokio Marine Kiln (TMK), a specialist insurance provider renowned for its expertise in marine and specialty insurance, has announced the appointment of Alexandros Ampatzis as the new head of marine for the Asia-Pacific (APAC) region.

Canopius and Pivix unite to streamline commercial property insurance access for wholesale brokers

Pivix Specialty Insurance Services, a managing general agency specialising in excess and surplus lines, has partnered with Canopius US Insurance to enhance insurance offerings in the wholesale distribution market.

Prudential Hong Kong and RGA partner to launch MedScreen+ for faster digital underwriting

Prudential Hong Kong, a leading life insurance provider in Hong Kong, has launched MedScreen+, a digital underwriting tool designed in partnership with Reinsurance Group of America.

Donegal Insurance leverages ZestyAI’s Roof Age solution for enhanced property risk evaluation

ZestyAI and Donegal Insurance Group have partnered on an initiative that enhances property risk evaluation within Donegal’s Personal Lines policies through ZestyAI’s new Roof Age solution.

The collaboration...

Global commercial insurance rates experience first decline in seven years

Global commercial insurance rates shockingly experienced their first decline in seven years, according to the Global Insurance Market Index released today by Marsh.

California JPIA selects Risk Control Technologies to bolster its loss control processes

The California Joint Powers Insurance Authority has selected Risk Control Technologies (RCT) to modernise and enhance its loss control and risk management processes.

Inspectify raises $5.26m to drive innovation in property risk assessment

Inspectify, a Seattle-based property inspection and underwriting platform, has raised $5.26m in a funding round led by Munich Re Ventures.

London-based digital insurance platform Aurora raises seed funding from QBE Ventures

Aurora Insurance, a London-based digital insurance platform, has secured seed funding from QBE Ventures, as it aims to develop cutting-edge solutions within the commercial insurance sector.

Valon secures $100m in Series C to transform the mortgage industry

Valon, a trailblazer in mortgage technology, has successfully secured $100m in a Series C funding round.