AI insurer Harper secures $47m in seed and Series A

Harper, an AI-powered commercial insurance brokerage, has raised $47m in combined seed and Series A funding.

The round was led by Emergence Capital, with participation...

How will evolving customer expectations change InsurTech in 2026?

After years of digital transformation initiatives, 2026 is shaping up to be less about technological experimentation and more about behavioural reality. Across insurance markets...

Floodbase and Liberty Mutual launch instant flood quoting

Floodbase, a parametric flood risk insurance platform, and Liberty Mutual have announced the launch of an instant quoting application for parametric flood (re)insurance in...

General Magic raises $7.2m to speed up insurance quotes

General Magic, an AI agent platform for the insurance industry, has raised a $7.2m seed funding round, bringing its total funding to $8.4m.

The round...

Canopius taps Globex to scale marine insurance

Canopius, a global specialty and P&C re/insurer, has formed a strategic partnership with Globex Underwriting Services to strengthen the placement of local marine insurance...

The insurance cost of undetected water leaks

A water leak is rarely “just a leak”. It is one of the fastest ways to turn an ordinary week into emergency call-outs, disrupted...

Ecuador rolls out parametric cover for farmers

Ecuador has contracted its first parametric agricultural insurance policies, providing protection against extreme rainfall and drought for up to 10,000 people in smallholder rice...

FIS unveils generative AI tool for actuaries

Jacksonville-based FinTech firm FIS has launched the Insurance Risk Suite AI Assistant, a generative AI tool designed to provide actuaries with instant guidance on...

WTW appoints George Lewkowicz to lead P&C capital modelling

WTW, a global advisory, broking and solutions company, has appointed George Lewkowicz as global proposition leader for P&C capital modelling within its insurance consulting...

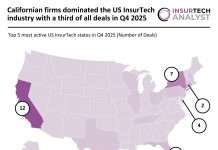

Californian firms dominated the US InsurTech industry with a third of all deals in...

Key US InsurTech investment stats in Q4 2025:

US InsurTech deal activity grew by 33% YoY in Q4 2025

Californian firms secured a third...