How technology is transforming the insurance sector

Imagine filing an insurance claim from your phone, tracking its progress, and resolving everything within days. It might sound like a mirage, but this is already happening. The insurance industry, once known for its slow and outdated processes, is undergoing a significant transformation thanks to rapid advancements in technology and innovative tech-driven solutions.

Watch Your Health raises $5m to expand tech-driven health solutions

Watch Your Health, a pioneering health-tech startup, has successfully raised $5m in a Series A investment round.

Health insurance disruptor Sidecar Health secures $165m in Series D round

Sidecar Health, a transformative health insurance company providing major medical coverage to businesses, announced today the closure of $165m in Series D financing.

One80 Intermediaries unveils GeneBridge to mitigate financial impact of gene therapy

One80 Intermediaries, a specialty insurance broker headquartered in Boston, has launched GeneBridge in response to the escalating costs associated with gene therapy treatments.

Lumera acquires ITM to enhance UK presence

Lumera, a leading InsurTech company dedicated to the digital transformation of the European life and pensions industry, has entered into an agreement to acquire ITM, as part of its international growth strategy.

Feather bags €6m to enhance health insurance options for Europe’s expats

German InsurTech startup Feather, which aims to simplify health insurance for expatriates, has successfully raised €6m.

Balancing technology and empathy: A guide to supporting vulnerable customers

In the wake of escalating living costs, contact centres have become crucial lifelines, particularly for vulnerable customers requiring support across utilities, healthcare, and housing sectors. This enhanced reliance on contact centres underscores their pivotal role in delivering responsible and sensitive services.

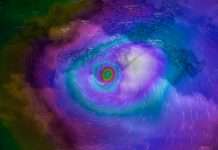

Slide Insurance raises $175m to boost hurricane preparedness and growth

Slide Insurance, an InsurTech company specialising in homeowners insurance, has secured a $175m senior credit facility.

Trinity Capital invests $40m in Gravie to reinvent health benefits

Trinity Capital, known for its diversified financial solutions for growth-oriented companies, has pledged a significant $40m debt facility to Gravie, one of America's rapidly expanding...

IEHP boosts member engagement through Ushur’s automation campaigns

Inland Empire Health Plan (IEHP) has established itself as a prominent figure in the healthcare sector, ranking among the top 10 largest Medicaid health plans in the U.S. and holding the title of the largest not-for-profit Medicare-Medicaid public health plan nationwide.