Cytora and The Warren Group bring property intelligence to underwriting

Cytora, a digital risk processing platform for commercial insurers, has entered into a strategic partnership with The Warren Group, a long-established provider of real...

The quiet failure behind most digital health platforms

A digital health app’s life rarely ends with a dramatic failure. More often, it fades quietly into the background of a user’s phone, unopened,...

The hidden CE compliance risk facing multi-state agencies

For many MGAs, CE compliance feels like a box already ticked. Courses are assigned, certificates are logged and spreadsheets show producers as “complete”. On...

InsurTech Sixfold strengthens AI leadership with Tony Rosa hire

Sixfold, an InsurTech company focused on artificial intelligence-driven underwriting, has announced the appointment of Tony Rosa as its new chief data & analytics officer,...

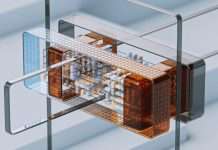

Travelers launches AI Claim Assistant powered by OpenAI technology

The Travelers Companies, a US-based multiline insurance provider, has announced the launch of a new artificial intelligence solution designed to modernise the way customers...

Insly unveils Nora to streamline insurance workflows with AI

Insly, the low-risk, enterprise-grade insurance software provider, has launched its latest AI innovation, Nora, designed to simplify and optimise administrative insurance processes.

The new product...

A practical guide to fixing MGA compliance

Buying a compliance platform is often treated as the finish line for MGAs. Demos are watched, pricing tables debated, and contracts signed, with the...

What innovations will define InsurTech in 2026?

As artificial intelligence moves from experimentation into production, insurers are rethinking how products are priced, delivered and experienced. Forecasting these industry-defining innovations is the...

Gallagher completes $1.2bn Woodruff Sawyer integration

Global insurance brokerage Gallagher has completed the integration of specialist brokerage Woodruff Sawyer, bringing the San Francisco-based firm fully under the Gallagher brand following...

Matic partners with nCino to streamline mortgage insurance

Digital insurance marketplace Matic has partnered with cloud banking software provider nCino to embed home insurance shopping directly into the digital mortgage process, allowing...