Allica Bank partners with Westcor International to launch title indemnity insurance and cut application...

Allica Bank, a UK-based bank specialising in supporting established SMEs, has entered into a partnership with Westcor Internationa to launch their Perfect Title insurance product across its commercial mortgage range starting from 1st July 2024.

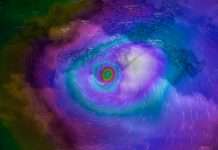

Raincoat, pioneering AI climate insurance in Puerto Rico, clinches $150k

Raincoat, a startup based in Puerto Rico, has received a significant financial boost with a $150k award from Google.

Balancing technology and empathy: A guide to supporting vulnerable customers

In the wake of escalating living costs, contact centres have become crucial lifelines, particularly for vulnerable customers requiring support across utilities, healthcare, and housing sectors. This enhanced reliance on contact centres underscores their pivotal role in delivering responsible and sensitive services.

Ushur and mortgage giant team up: A leap towards eco-friendly paperless solutions

One of America's largest mortgage servicers has been facing a significant challenge. The company, which was established in the early 1990s and operates across...

Lloyd’s launches new Canadian fixed income fund with Fiera Capital

Lloyd’s, a global leader in the insurance market, has announced the launch of its new Canadian Core Fixed Income Solution on the Lloyd’s Investment Platform.

London-based InsurTech Bondaval unveils new trade credit insurance solution

Bondaval, a leading London-based InsurTech, has announced the release of its first trade credit insurance product.

Slide Insurance raises $175m to boost hurricane preparedness and growth

Slide Insurance, an InsurTech company specialising in homeowners insurance, has secured a $175m senior credit facility.

How to balance AI and human expertise in insurance underwriting

Imagine an insurance industry where decisions are made with the speed and precision of a machine, yet imbued with the empathy and discernment of a human. This is not a futuristic dream but a present-day reality being shaped by the integration of AI in insurance underwriting. As AI takes on more significant roles, automating data-intensive tasks and improving risk assessment accuracy, the indispensable value of human expertise becomes even clearer. AI automation specialists Simplifai lifts the lid on the synergy between AI and human expertise in insurance.

Insurity and Coherent join forces to modernise P&C insurance operations

Insurity has announced a new partnership with Coherent to advance the capabilities of property and casualty (P&C) insurance organisations, enabling them to modernise their systems and streamline operations.

Supercede elevates ReinsurTech with a robust $15m Series A investment

Supercede, a London-based reinsurance technology company, has successfully completed a $15m Series A funding round.