Flow Specialty outlines AI vision amid agnetic AI integration plans

Flow Specialty, a next-gen specialty wholesale insurance brokerage, has unveiled its vision for the future of AI as it looks to become the only brokerage with full agentic AI integration.

Qover launches AI-enabled solution to streamline insurance claims experience

Qover, a leading InsurTech, has announced the launch of its AI-enabled solution designed to streamline the claims experience.

Veteran insurance executive James Bracken joins Zurich North America as CFO

Zurich North America, a leading provider of commercial property-casualty insurance solutions and services, has appointed James Bracken as its new Chief Financial Officer (CFO).

Ushur appoints new CFO to continue growth surge

Ushur, a leader in AI-powered Customer Experience Automation™ (CXA), has announced that Anthony Smolek has joined its executive leadership team as chief financial officer (CFO).

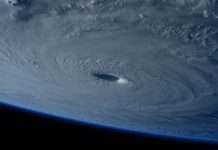

IBISA secures $3m to expand parametric climate insurance in Asia and Africa

IBISA, a global leader in the Climate InsurTech sector, has successfully raised $3m to enhance its parametric insurance offerings aimed at mitigating weather-related risks across Asia and Africa.

Healthcare AI firm Humata Health secures $25m funding round

Humata Health, a healthcare company specialising in frictionless prior authorisation payments for payers and providers through AI and automation, has successfully raised $25m.

Trawick International launches new international student insurance plans

Trawick International, the worldwide travel insurance specialist, has announced the launch of a new portfolio of international student insurance plans, effective immediately.

The evolution from AI assistants to AI agents

AI agents have been making significant headlines recently. To understand their impact, it’s useful to revisit the era of AI assistants and the advancements...

How Scanbot’s mobile barcode scanner SDK is enhancing airline efficiency

Luggage loss remains one of the most significant challenges airlines face. Many travellers have resorted to using AirTags and other smart tags to track their bags, though the issue persists, affecting airlines’ brand image and customer satisfaction. Scanbot SDK delves into how its mobile barcode scanner SDK is enhancing airline efficiency.

BCIC introduces Caribbean’s first omnichannel insurance ecosystem

British Caribbean Insurance Company has launched the Carribbean's first-ever omnichannel insurance ecosystem.